<h1 class="entry-title">Category: Gold Market Discussion</h1>

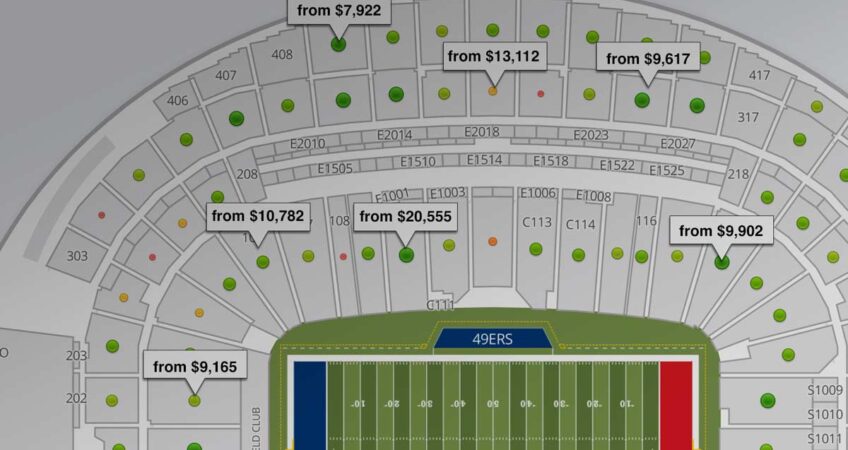

22

Jul

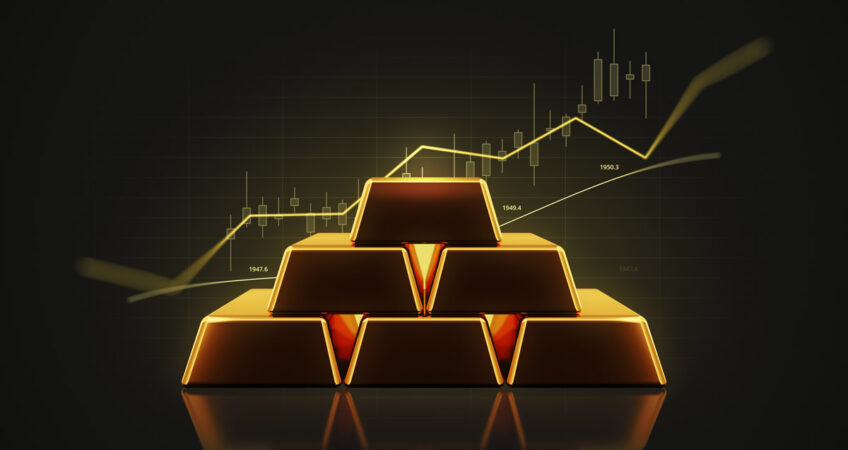

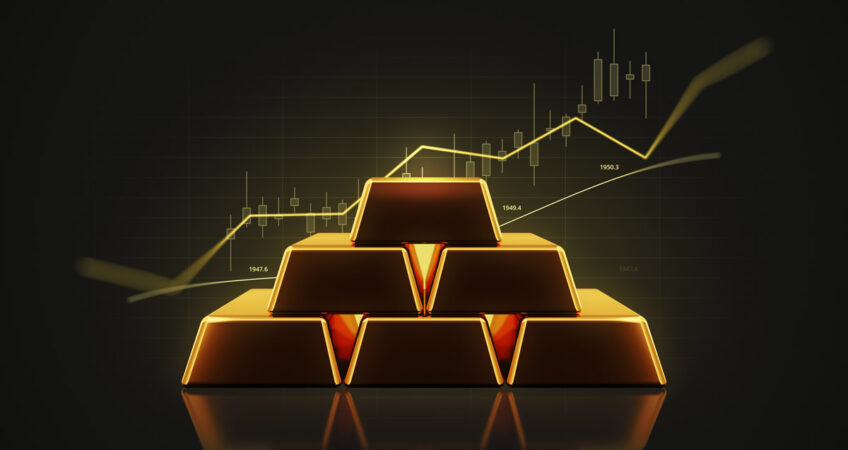

2024 has been quite a year for gold and silver. And it looks like there is more to come. Here is a one-year chart of the gold price: Please note the bullish technical indicators, with the red line indicating the 200-day moving average price and the blue line the shorter term 50-day moving average. Gold […]

22

Jul

Is the United States insolvent? By that I mean is it unable to pay its debts? The honest answer is yes. The formal answer is no. Let us explain. Better yet, let Ben Bernanke, the former Chairman of the Federal Reserve System explain: “The US government has a technology, called a printing press, that allows […]

21

Jul

The Crowstrike Outage Shows How Fragile Our Digital Infrastructure Can Be The headlines captured the story this way: It’s like Y2K, except it happened this time! “Largest IT Outage In History” Sparks Disruptions Worldwide! Unprecedented IT Outage Cripples Businesses Around the Globe! The IT shutdown impacted major banks, stock exchanges, 911 services, media, and airlines. […]

12

Jul

Is the Inflation Rate only the 3% that the Government says it is? Here’s a wake-up call! Yes, another one! The government tells us the inflation rate is currently 3.0 percent. That’s the Consumer Price Index increase for the 12 months ending in June. Between January 2020 and last May, consumer prices rose […]

12

Jul

We have shared our view that the Federal Reserve is anxious to cut interest rates before long to help elect Democrats in November. (See our January post THE FED TILTS THE SCALES! TO THE LEFT, OF COURSE!) It’s not too complicated. The very existence of a central bank is a left-wing dream come true. It […]

12

Jul

Your Essential Financial Survival Briefing! The American Gold Story! Reviewers praise Real Money for Free People! Rich Dad Poor Dad’s Robert Kiyosaki says Jim Clark’s book is “essential reading for anyone who values their financial freedom.” New York Times bestselling author Charles Goyette says Jim Clark’s book “explains in easy-to-understand terms what the Founders knew, […]

05

Jul

Want to see something really bullish? With this post, we hope to show you how seriously the rest of the world takes gold in this new era of de-dollarization. The following bullet points are taken from an article by Sergei Glazyev, Commissioner for Integration and Macroeconomics within the Eurasian Economic Commission and a close Putin […]

05

Jul

They’re even wrong about being wrong about inflation! What a bunch we have running fiscal policy in our country. Treasury Secretary Janet Yellen has distinguished herself for being wrong about inflation and virtually everything else. And President Biden, well there’s no need to describe his abject confusion anymore. Since everyone except a few shameless toadies […]

05

Jul

What are the major forces driving gold prices up? We spotlight four of them: WAR It is our view that the mainstream media ignores or underplays the significance of all of the forces destroying our currency and prosperity. But it seems most clueless about the way war destroys both. However, our hands-on experience goes back […]

25

Jun

If it is so strong, why does it buy less and less? Headline, the Wall Street Journal, June 4, 2024: The Dollar Is at Its Strongest Since the 1980s. Can It Last? Sorry, but it’s flapdoodle. Gobbledygook. Gibberish. Bafflegab. Or to put it in more serious terms, it’s Newspeak. George Orwell coined that term […]

25

Jun

Here is just a short list of the major – some might say existential – threats we Americans are facing. They all have the same cause. It’s not hard to figure out. It‘s not because of the alignment of Jupiter and Mars. It’s not because of subversion by space aliens. They are all […]

10

Jun

It’s a purchasing power calamity! Brace yourself! Another huge wave of inflation is approaching! The purchasing power of your savings is about to get swamped once again. So far the purchasing power of the US dollar has lost about 20 percent of its value during the Biden presidency. But the Biden presidency is not […]

10

Jun

Suppose a hundred years ago some far-sighted benefactor, someone a few generations back, wanted to leave some wealth for their descendants – including you. Would you be better off if they left you $10,000 cash in bills or $10,000 in gold? A hundred years ago American money was gold. Americans commonly carried and conducted commerce […]

10

Jun

To us, the real estate bubble was blindingly obvious. That is why we tend to keep an eye on those who also saw it coming. Ron Paul is a case in point. Not only did he see it coming, he famously explained in Congress and in detail exactly how it would unfold. And so it […]

28

May

We don’t want any of our friends and clients to miss out! Everywhere you look, commodities are screaming higher and higher. Gold, coffee, chocolate, uranium, copper, nickel. And silver! But nowhere in the commodity complex is the opportunity greater than in silver! Try taking delivery of investible quantities of chocolate and storing it […]

28

May

The headline on Yahoo! Finance reads, “Living on Edge: Nearly 90% of Retirees Worried Inflation Will Eat Away Savings.” The story reports that a third of retired Americans are worried that they haven’t saved enough. No surprise there. 89 percent describe themselves as deeply concerned about the erosion of their purchasing power by inflation. As […]

28

May

It’s not something that people generally want to talk about – widespread civil chaos, lawlessness, and social collapse. But it goes hand in hand with the failure of the monetary system. And it doesn’t take a Nostradamus to see the sign of something like that on the horizon. Just the other day we noticed […]

23

May

They are saying “Buy More Gold!” It’s not good when you get three stories like this all lined up in a row, all at once on a major new site. It’s like getting three cherries in a row on a Las Vegas slot. Except that it’s not a jackpot. Quite the opposite. Still, bells and […]

23

May

Sorry, too late. You just can’t turn a $24 trillion economy over to someone a clueless as Joe Biden and expect things to go well. How many examples do you need? It was just last week the President claimed that inflation was 9 percent when he took office, but he got it on the run. […]

22

May

Ron Paul says, “Massive public unrest… violence… authoritarianism!” Make sure you have plenty of gold and silver, because it’s not going to be pretty! No one has a better track record than former Congressman and presidential candidate Ron Paul when it comes to foreseeing the results of government interventions. Whether it is foreign policy like […]

14

May

U.S Representative Re-Introduces a Bill that Could Remove Taxes from Coins and Bullion It is the most audacious flim-flam, for the government to make the nation’s legal tender so unreliable that people have to protect themselves from its devaluation, and then tax them punitively for successfully protecting themselves from it. It’s like installing a clock […]

14

May

Something is beginning to bubble in the silver market! The year isn’t even half over and silver is already up more than 15 percent. And yet it is still unbelievably inexpensive! But first, there is more going on in the silver market than just the insanity of Bidenomics. More than Washington’s unpayable $34.6 trillion […]

13

May

So now the Federal Reserve has had to backpedal on its presumed interest rate cut this year. That’s due to “a lack of further progress” on inflation says the new policy announcement. The Deep State Money Manipulators are in one hell of a fix! Again. If they cut rates and loosen money, prices will keep […]

03

May

We Know what government promises are worth! Gross Domestic Product is weak. Inflation is strong. That’s the latest from the government numbers. But all those numbers are misleading. They can be crunched, re-crunched, and inevitably revised. The statistical components are changed at the drop of a hat to serve political interests. And their assumptions are, […]

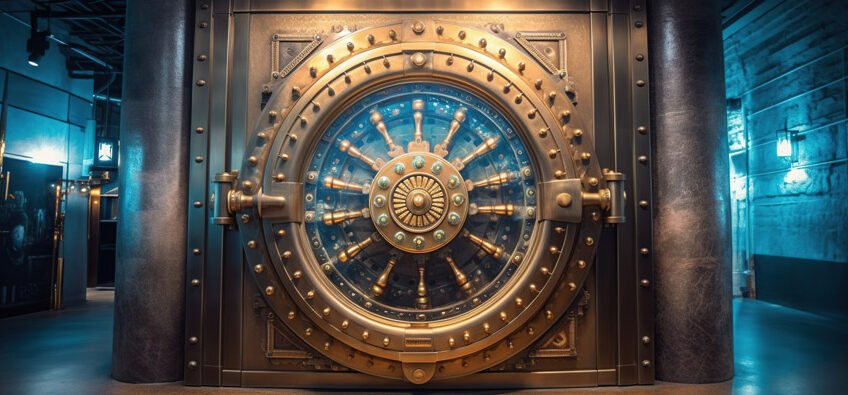

02

May

A Former Treasury Official Says You Already Don’t! In YOU WILL OWN NOTHING, Part I, we shared a video of a Canadian man trying to withdraw a few thousand dollars from his bank account. The bank wanted a document of some sort to show what he was going to do with his money. There is […]

02

May

The only money you own is gold and silver in your personal possession! You better watch this video. Especially if you think you own what is in your bank account. Ownership is the ability to call upon and dispose of assets as you desire or as agreed upon. When you deposit your money into your […]

22

Apr

The World Bank is not even trying to hide it. Why are global central banks beating a pathway to the gold market? Why are central banks an important force in driving the gold price to new all-time highs? We have called central bank de-dollarization and gold-buying one of the most important megatrends of […]

22

Apr

Gold is going through the roof because the already unpayable US debt is, too! After all, if there is no hope for US debt at $34 trillion today, how about when it reaches $141 trillion in 2054? And that is where the Congressional Budget Office says we are headed! $141 trillion is a lot of […]

22

Apr

Here’s a story we have told before, but with gold hitting so many all-time highs lately, it is one that deserves to be told again. It begins with a serious economic crisis that is fast approaching. Here’s a snippet from Fred Hickey (The High Tech Strategist) on April 2 that highlights just how fast things […]

12

Apr

Why is gold setting new records? It’s a gold and silver bull market for all the reasons we’ve been saying. As we write this, spot gold is about $2,400, while Spot silver is closing in on $29.00 per ounce. Why are precious metals so strong, especially in a rising interest rate environment? Because other […]

12

Apr

Washington is squirting red ink out from every pore. The budget year is half over, finishing with a deficit of more than a trillion dollars. This will end badly. We have been sounding an alarm in these posts about US debt and the fear that it would get away from us. A few recent […]

12

Apr

Lew Rockwell Explains it All! “The power to create money is the most ominous power ever bestowed on any human being. This power is rightly criminalized when it is exercised by private individuals, and even today, everyone knows why counterfeiting is wrong and knavish. Far fewer are aware of the role of the federal government, […]

26

Mar

The price of gold has continued climbing to one new all-time high after another Is Powell playing politics? See the gold and silver charts! First Gold… …and Silver The latest moves have come in response to the Federal Reserve and its broad hints that Powell is playing election-year politics. While inflation surprised officials on […]

26

Mar

As Zimbabwe’s latest attempt at a currency collapses – this would be the sixth one since 2008 – the country’s leaders are watching it fall and hinting that the next Zimbabwe dollar will be gold-backed. Riiiight! Of course it will!!!! Bloomberg News: The country’s local dollar has weakened against the US dollar every day in […]

26

Mar

It’s time again to update our friends and clients on the financial situation of the US government. We are neither surprised nor pleased with what we have to report. While no one likes to be the bearer of bad news, despite what the lapdog press tells you the situation is growing grim. We have […]

18

Mar

$15,000? Here’s Why! Gold expert and best-selling author James Rickards says that gold will skyrocket, reaching $15,000 an ounce by 2026 or sooner. Now, with its recent surge to all-time highs, gold is attracting new attention from analysts eager to get in front of the parade with higher gold price forecasts. But Rickards forecast is […]

18

Mar

Some are leaving the dollar. You might want to think about it, too! Charles de Gaulle, the former Premier of France, called the global dollar system America’s “exorbitant privilege.” Or maybe he didn’t. Maybe with was a French finance minister. But if de Gaulle hadn’t said it himself, he could have because he understood that […]

15

Mar

“You know the Founders wrote the Constitution “to bind down the government from mischief,” said Jefferson. Then they added the Bill of Rights, and you know what those ten amendments say: The government shall not… shall not… shall not… shall not… all the way up to the marvelous Tenth Amendment that said if we forgot […]

04

Mar

Inflation, for sure! Well surprise, surprise! Last week even the New York Times has provided details about that “a C.I.A.-supported network of spy bases constructed in the past eight years that includes 12 secret locations along the Russian border.” That’s the sort of thing that has been generally denied for a long time. And whatever […]

04

Mar

Global debt is soaring! Up $15 trillion last year! Uh oh! Unpayable debt leads to money printing. That’s just the government playbook. The Institute of International Finance, a global association of financial institutions, tracks and analyzes global capital flows and debt trends. It reports that “over $15 trillion of additional debt was added to the […]

04

Mar

The following graphic is from Visual Capitalist. It displays the top 11 countries by gold reserves as of September 2023, based on data from Central Banks, the Federal Reserve Bank of St. Louis, the International Monetary Fund, the World Bank, and the World Gold Council. It says, “In 2023, amid uncertainty about US interest rates and continued […]

27

Feb

Our currency is losing its dominance! Get ready! Get gold! “Our country is going to hell and we’re not going to be the big boy,” Trump said. Well, he got that right. It reminds us of the old expression that he who has the gold makes the rules. The US Treasury says we have a […]

27

Feb

And then stake out a long-term gold and silver position! “Any way you look at it, interest costs on the national debt will soon be at an all-time high!” So says the Peter G. Peterson Foundation, a nonpartisan organization dedicated to addressing America’s long-term fiscal challenges. They provide the following illustrations of the problem Washington […]

27

Feb

PICK ONE: Central bank purchases, stagflation, or a deep global recession! You could see gold surge by 50 percent according to Aakash Doshi, Citi’s North America head of commodities research. He and other Citi analysts wrote in a recent note to clients that among the pathways to $3,000, gold would be a ramp-up in de-dollarization […]

12

Feb

Surging industrial demand for silver has driven estimates for 2024 total demand to the second-highest level ever. The latest forecast from the Silver Institute, a trade association, calls for global silver demand this year to total 1.2 billion ounces. That would rival 2022’s chart-topping demand of 1.242 billion ounces and represents an overall increase in […]

12

Feb

It was not quite a year ago that banks started tumbling down. You remember the names: Silicon Valley Bank, Signature Bank, and First Republic, all American banks. But it wasn’t just an American problem as the presence of Swiss banking giant Credit Suisse and Deutsche Bank on the troubled list attested. Rising interest rates were […]

12

Feb

Their financial situation is worse than alarming! “Twitching like a fingerOn the trigger of a gun.” -Paul Simon Uh oh! China is making things feel twitchy! We are always on the alert for the most likely trigger of the coming economic calamity. The thing that ends the made-up, manipulated money system and remonetizes honest money. […]

05

Feb

First the NY Times! Now Chase Bank? If you aren’t panicking about the US debt picture, you may not be paying attention! Now even the most establishment of establishment figures are starting to show signs of panic. Including the most establishment banker of America’s most establishment bank. Jamie Dimon is the chairman and chief executive […]

05

Feb

…and what it could mean for us. China is a hot mess. We have only addressed China’s rickety economic conditions occasionally and not written much about them, but you should know how vulnerable things are in that centrally-planned economy. Youth unemployment in China is running at about 15 percent. Property prices in December fell at […]

05

Feb

Forget what the Fed chairman says. Forget the Consumer Price Index and the Producer Price Index. Pay no attention to core inflation and the Personal Consumption Expenditures (PCE) price index. Pay no attention to any of Washington’s price indices. Instead, trust your own living experience. Is your cost of living going up or down? […]

29

Jan

Despite what some people may think, the cure is worse than the disease! In one of the 1980 presidential debates between Ronald Reagan and Jimmy Carter, when the Carter administration’s inflation was the undoing of countless American’s prosperity, the candidates were asked about the wisdom of government price controls. Price controls never work, said Reagan, […]

29

Jan

See for yourself, it’s US against them! Having ignored the Constitution and subverted our once good-as-gold dollar, the American elites hope to complete their betrayal with Soviet-style policies (for you, not for themselves, of course). That includes eliminating freedoms (yours that is), gas stoves (yours that is), air travel (yours that is), parental rights […]

29

Jan

Once again Republic Monetary Exchange’s Jim Clark joins Robert Kiyosaki’s panel of experts to complete the four-part series that Robert calls “the most important show ever!” The Rich Dad Poor Dad radio show panelists – all veteran gold professionals – have been called together to explore the significance of gold as a timeless form of […]

15

Jan

The world’s best-informed buyers are central banks. They know the made-up, unbacked, paper, and digital money ruse best. And they keep buying gold. How many Americans could explain how the entire Federal Reserve monetary system works, how they create money out of nothing at all? One in ten? One in a hundred? Probably […]

12

Jan

In our effort to make sure our friends and clients are always well-informed, we work our way through mountains of information. We were surprised and happy a few days ago to see that The Market Oracle was quoting our friend and colleague Charles Goyette from his New York Times bestseller The Dollar Meltdown: The Market […]

12

Jan

Rich Dad Poor Dad author Robert Kiyosaki presents a four-part program that he calls “the most important” show ever. Today we present Part 1, The Good News and Bad News about Money. It features Jim Clark on a panel with other veteran precious metals experts including RME associate Charles Goyette. The discussion addresses the historical […]

08

Jan

Surprise! The New York Times Gets Something Right! “The federal debt starts the new year at a level that is hard to grasp: $34 trillion. That is 1.2 times the U.S.’s annual economic output. At the end of World War II, the ratio was only about 1.1.” Count us thunderstruck! The preceding paragraph is something […]

08

Jan

Harry Dent Warns about the Stock Market: Since 2009, this has been 100 percent artificial, unprecedented money printing and deficits: $27 trillion over 15 years, to be exact. This is off the charts, 100 percent artificial, which means we’re in a dangerous state. I think 2024 is going to be the biggest single crash year […]

08

Jan

One really easy lesson… here’s what’s going to happen to your money! The current inflation rate (CPI) is 3.1 percent. What does that mean for your money? Jim Rickards at the Daily Reckoning sums it all up in just a few words: How damaging is 3.1% inflation? That rate will cut the value of the […]

26

Dec

It’s an easy story, the future of the US dollar. So easy in fact, that we think we can tell it in three simple pictures. First of all, the US is the biggest debtor in the world, the biggest of all time. Take a look at the first picture from Visual Capitalist: The US […]

11

Dec

More victims of US Dollar Inflation! Food or medicine? Those are bad choices to have to make, just like having to drain the last of your retirement savings to heat your home in the winter. But Americans’ retirement plans are cracking up on the reefs of Washington’s monetary policies. Its elective destruction of the […]

11

Dec

We grow very wary when it appears almost everyone is thinking the same thing. It often means there is not a lot of real thinking going on. The view that Chairman Powell and the Fed are going to be able to drive interest rates lower in the New Year is nearing unanimity. But […]

08

Dec

You Haven’t Seen Anything Yet! Gold is on a hair trigger! Or to put it another way, Biden’s governance has now stretched everything to the breaking point. Spot gold had a previous record high of $2,063, but on Friday, 12/1, it closed at a new all-time high of $2,071. Then fresh war rumors on […]

04

Dec

Now is the time to buy gold according to Marc Faber, a leading French bank, and others! When is the right time to buy gold? If you don’t have enough for what’s coming, right now is the best time to buy gold… whenever right now happens to be. Who has enough gold? We’ve never met […]

04

Dec

Who are you going to believe? The Swamp media or your lying eyes? With less than a year before the presidential election, a Swamp public relations agent named Taylor Lorenz, who poses as a reporter at the Washington Post, is hard at work on the newspaper’s relentless mission to explain that prices, inflation, and the […]

01

Dec

Wonder Why? “America is Broke,” Says Robert Kiyosaki “Buy gold and silver. Save gold and silver,” said the author of the biggest-selling investment book of all time! That turned out to be a timely recommendation. Gold closed at a new all-time high on Friday (12/1/23) only a day after Robert Kiyosaki warned a national […]

27

Nov

Once They Get Started, They Can’t Seem to Stop! Once the money printers get started – whether by actual paper or more modern digital money printing – it usually ends in catastrophe. As our present monetary crisis of unrestrained Washinton spending and unpayable US debt continues to unfold, we think it is instructive to […]

27

Nov

All Eyes are on Argentina! It’s an upset! Javier Milei’s landslide win in Argentina has toppled – at least for now – the country’s inflationary Peronista left-wing rule. “Freedom goes forward! Hail freedom, dammit!” shouted Milei. Milei will be sworn in as president in December. He has promised to end central banking and the […]

24

Nov

RME’s Jim and Charles join friend Robert Kiyosaki to Talk Precious Metals, the Economy, and the Hunt Brothers This past week, RME’s Jim Clark and Charles Goyette were guests on friend Robert Kiyosaki’s Rich Dad Radio Show. Below you can watch the entire interview. In addition to the topics of the U.S. going bankrupt, precious […]

20

Nov

US pays higher rates to borrow than Vietnam, Morocco, Bulgaria…That’s not good news for the world’s biggest debtor or for the dollar! With its credit rating falling, the US government has to pay higher interest rates than Third World countries to borrow money. Being the world’s biggest debtor is starting to catch up with Uncle […]

20

Nov

Central Banks all over the world are buying gold. Are you? Because central banks around the world sold so much gold in the post-WWII era – to hold US dollars in their currency reserves instead – we believe the reversal of that practice represents the biggest monetary megatrend of our time. In other words, these […]

20

Nov

End users of industrial silver will experience surging output totaling 46 percent between now and 2033. The surge is expected to be especially rapid in the electrical and electronics industries which are forecasted to grow by 55 percent over the decade. That is the finding of a new study by Oxford Economics, a leading global […]

10

Nov

Some quotes from Colonel Douglas Macgregor: “I don’t think we’ll ever get to the 2024 election! I think things are going to implode in Washington before then.”“I think our economic financial condition is fragile. It’s going to come home to roost in ugly ways.” We have a great deal of respect for Colonel Douglas Macgregor. […]

10

Nov

Newsweek reports that China is gobbling up gold on the international market. China is already the world’s largest gold producer, but it’s buying more gold hand-over-fist. And it has been doing so every single month for almost a year. For thirteen years central banks have been socking away gold. The Financial Times headlines its account […]

10

Nov

Here are a Few Answers! Someone asked us, “Why does the Federal Reserve destroy our money with inflation? Don’t they realize what they are doing to this country?” No answer we give will be complete. There are too many things going on and too many different interests at work for an all-encompassing response. But […]

06

Nov

We say be prepared for an inflation resurgence! Some sectors of the markets along with some analysts believe that the Federal Reserve has declared victory over inflation. That would be like General Custer encountering one lone Sioux on his way to Little Big Horn and patting himself on the back. Still, stocks roared higher the […]

06

Nov

Read ‘Em and Weep! Or Buy Gold and Laugh! At least we’re not the only ones writing about the US Treasury’s debt crisis now. The story is starting to play far and wide now. That’s because it is becoming impossible to ignore! Here are three consecutive headlines from the Drudge Report on Wednesday, 11/1. The […]

06

Nov

A sign that the American monetary system won’t last…. and why you must own gold and silver! The governing classes and the people in Washington are stealing everything that isn’t nailed down. It sounds like hyperbole to say that it is the end of times. We don’t exactly say that, but we do say that […]

30

Oct

Biden is Burning Down the House! “The first panacea for a mismanaged nation is inflation of the currency; the second is war. Both bring a temporary prosperity; both bring a permanent ruin. But both are the refuge of political and economic opportunists.” – Ernest Hemingway By now you probably know that that Biden is burning down […]

30

Oct

Gold’s next stop is $3,700! Silver to $68! It’s time now to wake up! And to tell your friends! Rich Dad Poor Dad author Robert Kiyosaki doesn’t issue a wake-up call like that very often. When he does, he means it! We follow our friend Robert closely. And since he says we should […]

30

Oct

The gold picture is coming into view, and it is very bullish according to one of our favorite commentators, Michael “Mish” Shedlock from MishTalk.com. We’ve known “Mish” for a very long time, dating all the way back to when he was a small, still voice warning about the housing bubble. Gold Massive Cup and Handle […]

23

Oct

Time for Maximum Safety… Gold and Silver! It’s time to head for the maximum safety zone. Multi-front wars that can escalate at any second without warning. Energy in the cross hairs. Debt through the roof. And Treasury Secretary Janet Yellen says America can afford two wars at the same time. It is time to […]

23

Oct

Gold is Much More Than Just a Metal! Paul Tudor Jones is one of those billionaire hedge fund managers. We caught him on CNBC the other day and wanted to share a few of his observations. Put simply, Jones says, “I believe gold’s value will continue to rise as more people recognize its importance in […]

23

Oct

We’ve Been Talking About ‘Shrinkflation’, But This is Ridiculous! We’ve written many times about the Federal Reserve’s destruction of the US dollar’s purchasing power. We’ve written about shrinkflation, businesses concealing price increases with smaller package sizes. (See HERE and HERE.) And we have even joked about what we call “The Incredible Shrinking Candy Bar.” […]

15

Oct

“The hurrier you go, the behinder you get!” If you think you are falling behind in the dollar economy, you are right. The plain truth is that if you weren’t targeted to fall farther and farther behind, there would be no reason at all for inflation. In a moment of irony, Washington released the “official” […]

15

Oct

Here We Go Again! It’s been a while since we last wrote about the Stagflation Decade, the 1970s, but some of the parallels are so eerie that even one of the world’s biggest banks has started to notice! The 1970s era was characterized by oil price shocks, the Soviet war in Afghanistan, and high inflation. […]

13

Oct

“We Need Strong Fighters Like Kari” Trump Endorses Kari Lake for Senate. And So Do I! Great News! It’s official! Kari Lake is running for the US Senate. She kicked off her campaign on Tuesday, 10/10, with a blockbuster personal endorsement from President Trump. Some of President Trump’s remarks: “A Republican must win and we […]

09

Oct

…and then the Fed Cranks up the Printing Presses! A Bloomberg Survey discovers widespread expectations of a major commercial real estate crash! We’re looking at nine months of brutal price declines, according to respondents. Details from Bloomberg’s latest Markets Live Pulse survey: About two-thirds of the 919 respondents surveyed by Bloomberg believe that the US […]

09

Oct

Robert Kiyosaki warns! We’re not alone in pointing to cracks in the US banks! We’ve been running around like our hair is on fire warning about trouble ahead. But if anything, we might be accused of understating the case. Wait until you hear what Rich Dad Poor Dad author Robert Kiyosaki says! Here is his […]

06

Oct

Those of us who follow these things carefully (a minority enthusiasm for sure!) are so totally mesmerized by the rickety position of the banks and the government, that we might be accused of ignoring a story as big, if not bigger. So let us assure you that the prospects of war are not going unnoticed. […]

02

Oct

Looks like the government and corrupt officials both want gold, gold, gold! “We are devaluing American money so rapidly that in America today, you can’t even bribe Democrat senators with cash alone. You need to bring gold bars to get the job done just so the bribes hold value.” Rep. Matt Gaetz He’s always looked […]

02

Oct

Where Does the U.S. Rank Among Other Nations? Most of the gold that has been produced throughout history remains in human hands. As much as 86 percent of it has been produced in the last 200 years. Our thanks to Visual Capitalist for the below chart illustrating the history of gold production. The World Gold […]

02

Oct

Get Gold Before They Hit! No one knows exactly how close we came to a US bank holiday last spring, but it was too close for comfort. None of the problems banks faced then have been solved. In fact, both have gotten worse. Here’s what’s in the mix. The banks are up to their eyeballs […]

25

Sep

Sign of Things to Come! Unbeknownst to most Americans, the price of gold is hitting new highs in foreign currencies. Author and gold expert John Rubino writes in his latest newsletter that “gold is doing great – in other currencies.” Rubino says that Japan and Australia are giving Americans “a glimpse of the future.” From […]

25

Sep

$33 Trillion Federal Debt! How did that happen? US Federal debt has now roared above $33 trillion. It has rocketed up by $2.16 trillion in just the past year. This is an increase of an unthinkable $1.58 trillion just since the debt ceiling was lifted in June! How did this happen? A new Heritage […]

25

Sep

(…For Unpayable US Debt!) Joe Biden is proving himself a master participant of one of the world’s oldest disastrous routines. It’s always the same cycle. Governments spend money they don’t have. They then have to resort to borrowing or printing or a combination of the two. The more they borrow and the more they print, […]

18

Sep

We’re talking about the breakdown of American prosperity! We do things no normal person would want to do, all as part of our pledge to keep you up to speed on the dollar, the Fed, the economy, gold, and silver. We follow money supply and Fed asset numbers closely and listen carefully to Fed officials […]

18

Sep

Own gold and silver in times of governmental failure! Looks like we’re headed for another government shutdown. Congress has until September 30, which is the end of the 2023 fiscal year, to agree on a budget and avoid another shutdown. Nine out of 10 Americans, according to a Peterson Foundation survey, want Congress to […]

18

Sep

None of our clients or friends will be surprised to learn that price inflation in August took its biggest jump in over a year. The Wall Street Journal: We warned that inflation was about to tick up, writing last month: Gasoline prices have been climbing in August. That will show up in the next […]

10

Sep

But of course, by the time Washington notices, it’s waaaaay too late! This one took us by surprise. Not the fact that we’re headed to a crisis, but that The Wahington Post, the house organ of the Deep State, noticed that the deficit is exploding! How could they say such a thing? After […]

10

Sep

It’s bad. Very bad. When it hits the fan, gold will be there, as it always has! We know what happened to a handful of big banks earlier this year. Banks like Signature and Silicon Valley suddenly were forced to realize their unrealized losses. And that was the end of the road for them. As […]

10

Sep

Buy gold before the next gusher of Fed funny money! The US government deficit has exploded! What’s up? The Wall Street Journal cites a deadly conjunction of two things at once: “: a steep drop in tax revenue related to capital gains” and at the same time “an increase in interest payments on old debt.” […]

01

Sep

(They Just Haven’t Started Yet 🤷♂️) ‘Yeah, I think the Fed’s record on these things is wonderful. It’s almost guaranteed to be wrong.’ Jeremy Grantham, Co-Founder, GMO Let’s start with this CNBC headline: 61% OF AMERICANS ARE LIVING PAYCHECK TO PAYCHECK — INFLATION IS STILL SQUEEZING BUDGETS After cluelessly denying the severity of inflation as […]

01

Sep

Take a look at this! You’ll want to own more gold! Larry Summers, Former Director of the National Economic Council, tweeted (or X’ed) this chart the other day, noting the similarity between price inflation’s rise and slowdown and rise again in the 1970s and today’s chart. “It is sobering,” he says, “to recall that the […]

01

Sep

Why they’ll have to crank up the money printing! The mountain of debt is not just big. It is ridiculously large! Unpayably huge! It is unpayable unless the authorities inflate the currency to near worthlessness. Unfortunately, that seems to be the preferred alternative for central banks that find themselves in a debt squeeze like […]

28

Aug

“Unprecedented” deficits!; “Crisis-size deficits!” Here’s the lead of an August 24 Bloomberg News story: US Budget Deficits Are Exploding Like Never Before The outlook for the federal budget right now is essentially unprecedented—crisis-size deficits as far as the eye can see, even though the economy appears to be in good health. That prospect is making […]

28

Aug

And that should be driving you to gold and silver! The world isn’t looking skeptically at the US dollar because it doesn’t like green. That would not be enough to drive de-dollarization. Nobody cares what color the money is as long as it functions adequately. Nor is de-dollarization driven merely because the world is eager […]

28

Aug

Gee, you don’t suppose it would be a good idea to take money out of the bank and put it into gold? Banks aren’t getting any safer! More are getting creditworthiness downgrades; more are being put on troubled bank watch lists. It was only a couple of weeks ago that we shared the news that […]

21

Aug

In Stocks? Watch Out Below! They’re lining up to warn you about the stock market! Here’s a quick rundown: Jeremy Grantham is as close to a bubble expert as there is on Wall Street. His bubble calls are the stuff of legend. And he says the US stock market is about to pop just like […]

21

Aug

Just a reminder to own gold and silver in times like these! The sign in the bank window reads, “Due to emergency conditions and to accommodate all customers, today’s daily cash withdrawal limit is $1,000.00” Here’s a similar sign from a British bank. It is notifying depositors that it may want to know why they […]

19

Aug

Rich Dad Poor Dad author: “America is broke!” You don’t have to spend much time with Robert Kiyosaki, the author of the bestselling financial advice book of all time, Rich Dad Poor Dad, to be convinced that you should own gold and silver. Now Kiyosaki’s warnings are growing louder! “Brace for a crash landing,” […]

07

Aug

On a collision course with fiscal reality! We’ve taken the title of today’s commentary, Somethings Got to Give!, from David Stockman’s recent newsletter. Stockman, director of the US budget under President Reagan, concludes that “Washington is asking for a thundering collision.” We couldn’t agree more. Most of the letter is about the Biden team depleting […]

07

Aug

Robert Kiyosaki says Mom and Pop are in trouble! Our friend Robert Kiyosaki warned about it, and now US sovereign debt has been downgraded by another one of the big three credit rating agencies. In a major development, Fitch cut the US AAA credit rating last week. And this is just the first shoe […]

03

Aug

Bad news for the U.S., good news for gold In a major reassessment of US creditworthiness, Fitch, one of the leading credit rating agencies has downgraded the U.S. credit rating from AAA to AA+. Fitch based its downgrade on “expected fiscal deterioration over the next three years, and a high and growing general government debt […]

31

Jul

We are frequently asked by our clients where they should store their gold and silver. It should go without saying that you will want to store your precious metals where you can get your hands on them in a crisis. Imagine that you have been wise enough to invest in precious metals before a banking […]

30

Jul

This is an excerpt from Jim Clark’s important book REAL MONEY FOR FREE PEOPLE… This selection is especially relevant for these times, with recent bank failures and ongoing solvency concerns. Because the book describes the entire American gold story in a clear and easy-to-understand way, and because it is information you need for the challenging […]

29

Jul

Shrinkflation is everywhere these days. That’s when retailers try to disguise price inflation by shrinking the package sizes instead of hiking the price. One of our friends mentioned that his toothpaste tube used to be 8.2 ounces. Now it is 5.2 ounces instead. Of course, the new smaller tube brags that it is new and […]

16

Jul

Trust in Global Financial Order Continues to Erode With the specter of the Cold War hanging over Europe, countries like Germany that might have been caught in the crossfire choose to leave their national gold reserves in safer places like the Bank of England in London and the US with the Federal Reserve in New […]

15

Jul

Civil War Era Stash Includes Rare $20 Gold Liberties! They are calling it “The Great Kentucky Hoard!” A Kentucky man whose name has not yet been revealed is suddenly very rich, thanks to the discovery of a lifetime. While digging in his cornfield, he uncovered a stash of Civil War-era gold coins. The stash consisted […]

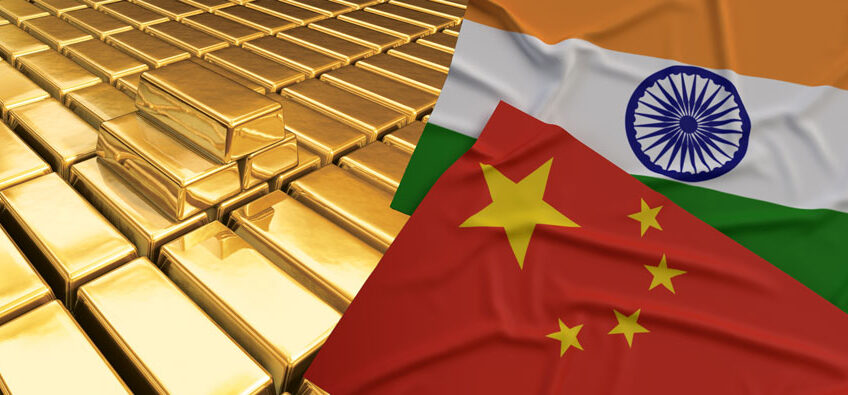

15

Jul

The Two Countries Make Up Nearly Half of the World’s Gold Demand! The gold rush is on. If you don’t see it, it is because it is taking place in Asia. India and China together are gobbling up the world’s gold. The two nations are responsible for half of the world’s total gold […]

10

Jul

The largest 25 US banks have lost a whopping 7.88 percent of their deposits since April 2022. More than $920 billion has left the big banks in a little over a year. Wall Street on Parade reports that the flight from US banks is not quite what has been described by much of the national […]

10

Jul

With big banks tumbling last March – First Republic Bank, Silicon Valley Bank, Signature Bank, and Credit Suisse – people were lining up to get their money out of banks. Many of them, foreseeing more financial and monetary stress ahead – turned to gold and silver. It turns out, as they suspected, that like a […]

10

Jul

Are we headed to “a very dark place?” Be ready! “It is clear as day that Xi Jinping is planning to move militaristically over Taiwan. We’re hoping it doesn’t happen. History is rhyming right now. I think we’re heading to a very dark place,” said Kyle Bass just days ago on CNBC. Bass is the […]

03

Jul

Powerful bullish fundamentals taking shape! “Changes to solar panel technology are accelerating demand for silver,” reports Bloomberg News. The result is an increasing deficit in silver while the outlook for additional new mine production is thin. The Silver Institute, an industry association, reports that as recently as 2014 solar technology accounted for only about 5 […]

01

Jul

But the record says differently! President Joe Biden recently tweeted that America is not a deadbeat nation. “We pay our bills,” Biden said in a related press conference. “America has never defaulted on its debt. And we never will.” Well. The President should be expected to know better. He was so very wrong that […]