Uncle Sam’s Credit Score Keeps Falling

US pays higher rates to borrow than Vietnam, Morocco, Bulgaria…That’s not good news for the world’s biggest debtor or for the dollar!

With its credit rating falling, the US government has to pay higher interest rates than Third World countries to borrow money.

Being the world’s biggest debtor is starting to catch up with Uncle Sam.

From Business Insider:

In a surprising development that upends some of the bond world’s time-honored conventions, the US government’s borrowing costs have surged past those of developing nations with much poorer debt ratings such as Vietnam, Morocco, and Bulgaria…

US 10-year yields [which reached 5% last month] are now also higher than those in emerging markets such as Morocco and Bulgaria. Similar rates are at just 3.8% in Greece, the economy at the center of Europe’s sovereign debt crisis a decade ago, and needed multiple European Union bailouts in the following years.

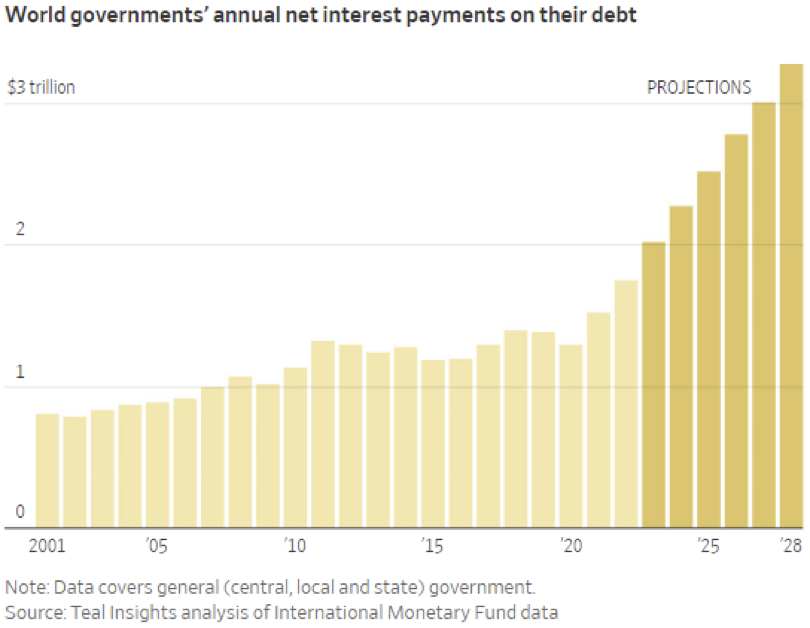

The high US yields also reflect investor concerns about America’s deteriorating public finances. US total debt has more than doubled in the past decade to $33.7 trillion – or 25% more than the nation’s GDP.

Nobody keeps a FICO credit score on Uncle Sam as they do on you and other borrowers and credit card users. But if they did, it would be falling. When that happens to ordinary people, it becomes more costly or harder to get loans.

Now, Uncle Sam’s credit standing has been dialed down. Again.

Moody’s, one of the major credit rating agencies, has just lowered its outlook for the safety of US government debt from “stable” to “negative.” This is not a full-frontal downgrade, but it is a warning that there may be more rating humiliation in Uncle Sam’s future.

The likelihood of defaults, along with debt ceilings, uncontrolled spending, deficits off the reservation, and debt up the wazoo are all considerations in the rating outlook. Of course, higher interest rates make borrowing more costly, as well.

In August another major ratings agency, Fitch, downgraded its US credit rating from AAA to AA+, citing an erosion of confidence in the nation’s fiscal management. Treasury Secretary Janet Yellen uttered a feeble protest over the downgrade, calling it “arbitrary.” Like she – she who told us two and a half years ago that inflation was transitory; she more recently insisted that the US can afford wars on two fronts – as she would know.

But the governing classes never seem to know.

When Moody’s put the US Treasury on a negative watch list in 2010, then-Treasury secretary Tim Geithner responded with a hasty appearance the following Sunday morning on ABC’s This Week to insist there was no risk of the U.S. losing its AAA bond rating. “Absolutely not,” he vowed. “And that will never happen to this country.”

Nobody laughed at Geithner. But they should have.

It seems that by the time the ratings agencies figure it out, we’re way out of risk territory. When Geithner told students at Beijing University in 2009 that Chinese dollar holdings were “very safe,” his assurance drew loud laughter.

Downgrades soon followed. In fact, the US lost its AAA credit rating for the first time ever when S&P lowered its rating in 2011. Moody’s and Fitch lowered their outlook on US debt shortly after.

Uncle Sam, already the world’s biggest debtor, is looking at having to borrow a lot more money, beginning immediately. But with a sketchier credit rating, that debt cannot be considered (if you’ll pardon the expression) “good as gold.”

Gold and silver are the only monetary assets that are not someone else’s liability. They are not dependent on someone else’s solvency, promises to perform, or honesty. Their value does not depend on the endorsement, propriety, or honesty of any State or institution. They are not like empty government promises. They have no counterparty risk, no risk of rule changes, nonpayment, default, or bankruptcy by individuals, companies, financial exchanges, institutions, and banks—quite apart from being insulated from the risks of the Fed’s fiat dollar as well.

It is a wonderful thing for people’s promises to be reliable, and for institutions to be vigorous fiduciaries of their clients’ interests. The modern world with all its miracles is built on the assurance that people will meet their obligations, fulfill their contracts, and respect others’ property.

When this environment of trust begins to fray, sophisticated civilization itself is at risk.

And that is where we are today. Everything is at risk. Except gold and silver, because no one can ever print gold and silver.