U.S. Debt Finally Got Away From Us

Washington is squirting red ink out from every pore. The budget year is half over, finishing with a deficit of more than a trillion dollars.

This will end badly.

We have been sounding an alarm in these posts about US debt and the fear that it would get away from us. A few recent examples:

Another Ominous U.S. Financial Update

Time to Take a Look at the U.S. Fiscal Situation!

Uncle Sam’s Credit Score Keeps Falling

We believe the price of gold is confirming that Washington’s debt is every bit as bad as we have said.

Our opinions don’t have the force of law, but to us the US national debt is a matter of criminal negligence. Washington has been indifferent to the debt as it grew, and now it is too late: the national debt has gotten away from us!

From the Wall Street Journal:

The Congressional Budget Office reported Monday that the federal budget deficit for the first six months of fiscal 2024, ending in March, was $1.064 trillion. Enjoy it, because you’ll eventually pay for it in higher taxes.

The problem isn’t a shortage of tax revenue, which rose 7% from a year earlier to $2.19 trillion. Individual income-tax and payroll-tax revenue both rose 6%, while corporate income taxes rose 35%. Is a 7% increase what President Biden would call a “fair share” increase? Probably not, because he wants to raise taxes even higher if he’s re-elected.

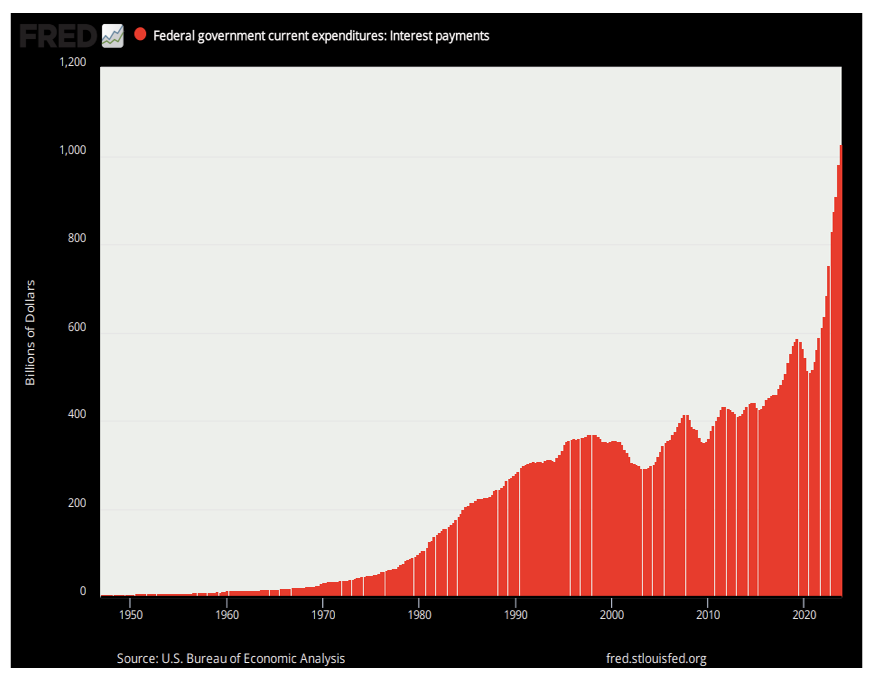

Interest on the national debt is now a trillion dollars a year. That will go up as older debt, money borrowed at lower rates, matures and is refinanced at today’s and tomorrow’s higher rates.

If Washington has to borrow more and more and more to keep itself afloat, it will have to attract borrowers at much higher interest rates, especially now with the world already beginning to express skepticism about the US dollar. Jaime Dimon at JPMorgan Chase is talking about rates rising to 8 percent. That’s nothing, but financing today’s US debt at 8 percent would cost $2.75 trillion a year,

There is no solution to the debt overhang. Except legal counterfeiting. The debt can only be paid by printing money.

It is a critical situation, one best met by owning gold and silver. A US debt crisis and the soaring interest rates that will accompany it will crash banks, financial markets, real estate, small businesses, and consumers around the world.

As we wrote about the worsening debt situation last year, “Gold and silver are the only monetary assets that are not someone else’s liability. They are not dependent on someone else’s solvency, promises to perform, or honesty. Their value does not depend on the endorsement, propriety, or honesty of any State or institution. They are not like empty government promises. They have no counterparty risk, no risk of rule changes, nonpayment, default, or bankruptcy by individuals, companies, financial exchanges, institutions, and banks—quite apart from being insulated from the risks of the Fed’s fiat dollar as well.”