Another Ominous U.S. Financial Update

It’s time again to update our friends and clients on the financial situation of the US government.

We are neither surprised nor pleased with what we have to report. While no one likes to be the bearer of bad news, despite what the lapdog press tells you the situation is growing grim.

We have already shared the headline story with you, that US debt is growing by a trillion dollars every one hundred days.

The deficit, just for February alone, was $298 billion, up $36 billion, or 14 percent over February 2023.

Meanwhile, as we write, a $1.2 trillion 1,012-page omnibus spending bill covering an estimated 70% of discretionary government spending, is before the House of Representatives.

Michael Shedlock, MishTalk, calls it a Republican humiliation:

- Republicans said no more omnibus massive bills: Failure

- Republicans demanded budget cutbacks: Failure

- Republicans said they would restore order: Failure

- Republicans said they would pass bills without Democrats: Failure

- Republicans said no more continuing resolutions: 3 Failures

It is a legislative horror story, loaded with leftist pork, woke spending, and transfers overseas of wealth from the American people. It is simply impossible to describe in a short space what an outrage it is. Here are a few details reported by Jesse Waters:

- $850k for a gay senior home

- $15 million to pay college tuition for Egyptians.

- $400k for a gay activist group to teach elementary kids about being trans

- $500k for a DEI zoo

- $400k for a group to give clothes to teens to help them hide their gender. That includes giving 13-year-old children chest binders, tuck equipment, and “counseling” without parental consent.

Go here to see some additional details.

As if that is not enough, the new fiscal year, FY2025, is only about six months away, with a White House budget proposal that increases federal spending to $7.3 trillion, a jump for 4.7 percent over the current year.

Q. Does Washington think money grows on trees?

A. Yes.

The Congressional Budget Office projections that the debt will reach $50 trillion by 2033 and $60 trillion in 2034. Former Reagan budget Director David Stockman is more realistic. He expects the Washington UniParty to drive the debt to $100 trillion in the early 2040s.

Other indicators:

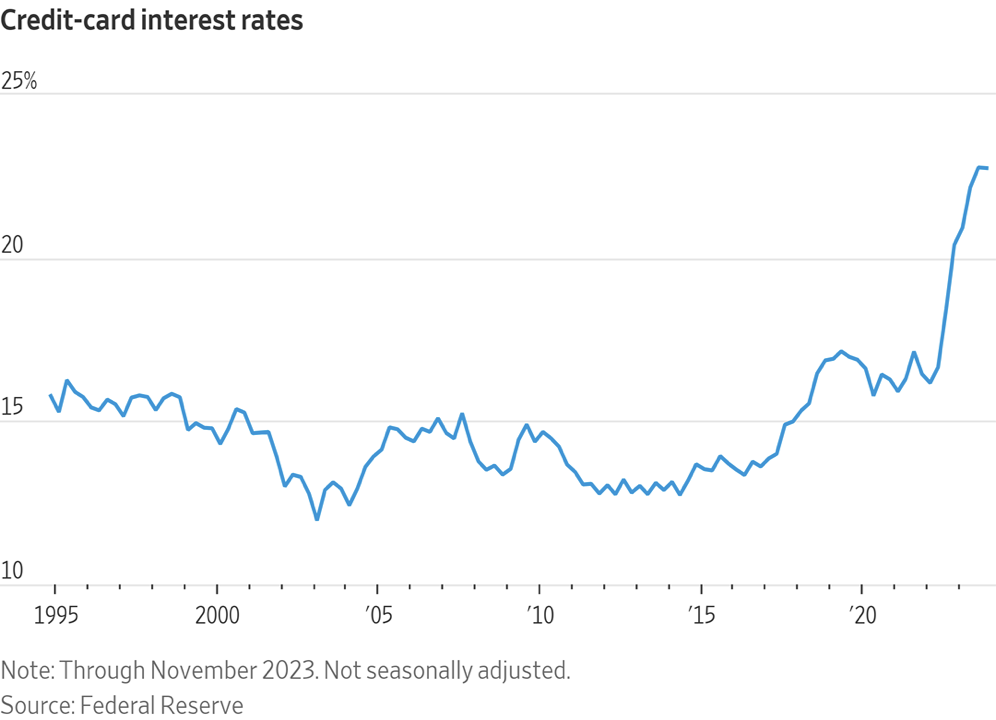

The cost of auto insurance is skyrocketing, up 21 percent last year. The Wall Street Journal reports that credit card interest rates are near record highs. Delinquencies are rising.

At the same time, home affordability has collapsed to the lowest level on record.

One other dirty little secret is the situation at the Federal Reserve. After the private chefs and limousines, the palatial offices and private jet travel, an incredibly bloated staff of bureaucrats, and the money it throws at the economics profession to keep them all endorsing its fiat monetary fraud, the Fed is supposed to send to the Treasury the money it makes in its monetary operations. How is it doing on that front? Not well. As economist Judy Shelton wrote recently, it is actually helping to widen the deficit:

The Fed’s main tool for raising its target interest range is to increase the “administered rates” it pays to commercial banks and money-market mutual funds on the roughly $4 trillion they hold in cash accounts at the Fed. Last year the Fed’s interest expense amounted to an unprecedented $281 billion—exceeding its $164 billion in interest income—with the difference paid out of funds that would otherwise be remitted to the U.S. Treasury.

To appreciate the fiscal effect of the Fed’s operating losses: The Biden administration’s budget for fiscal 2023 projected $516 billion in Federal Reserve “earnings” to be included as receipts for the 2023-32 period.

How America’s financial situation has been allowed to deteriorate so fast is a story for future historians. But the story for today is how can so few people see how fast it is falling apart.

For now, buy gold and silver. And hold your breath. Things are moving very fast.