Look What We Found While Reading the Financial News…

In our effort to make sure our friends and clients are always well-informed, we work our way through mountains of information. We were surprised and happy a few days ago to see that The Market Oracle was quoting our friend and colleague Charles Goyette from his New York Times bestseller The Dollar Meltdown:

The Market Oracle: Consider that fifteen years ago Charles Goyette author of “The Dollar Meltdown” (2009, Penguin Group) came to a conclusion with respect to the repayment of our national debt when, by comparison, it was only $11.9 trillion. He states then: “The gross federal debt is 80 per cent of GDP. That’s the highest it’s been since the 1950s. But that percentage of debt was much more manageable then because fifty years ago America was a creditor nation, now America is a debtor nation. Fifty years ago, it maintained a trade surplus, now our trade deficit, having grown for a generation, is immense. Fifty years ago, America was the world’s manufacturing hegemon, now America’s manufacturing base is being lost to the world. Fifty years ago, Americans were savers. Now the Chinese have shown us what it means to defer consumption and save.”

He continues: “America’s debt at any level – $12 trillion, $59 trillion, or $99.3 trillion – won’t be paid. They will simply be rolled over again and again until America’s creditors are unwilling to loan any longer. To recapitulate, inflation in the United States is a result of the Federal Reserve turning government debt into money. The Federal Reserve is central to America’s most devastating bubbles and is responsible for almost a hundred years of criminal-scale dollar destruction. By debt monetization, government acquires money to spend without debate, legislation, or vote, by commensurately devaluing the currency held by the people. No wonder critics say, this amounts to nothing less than taxation without representation. In truth, the nature of the U.S. debt is so enormously understated that it amounts to accounting fraud.

Today, the US debt remains an accounting fraud. The only difference is that today the numbers are so much bigger, and that time is running out on the US government’s fiat money Ponzi scheme.

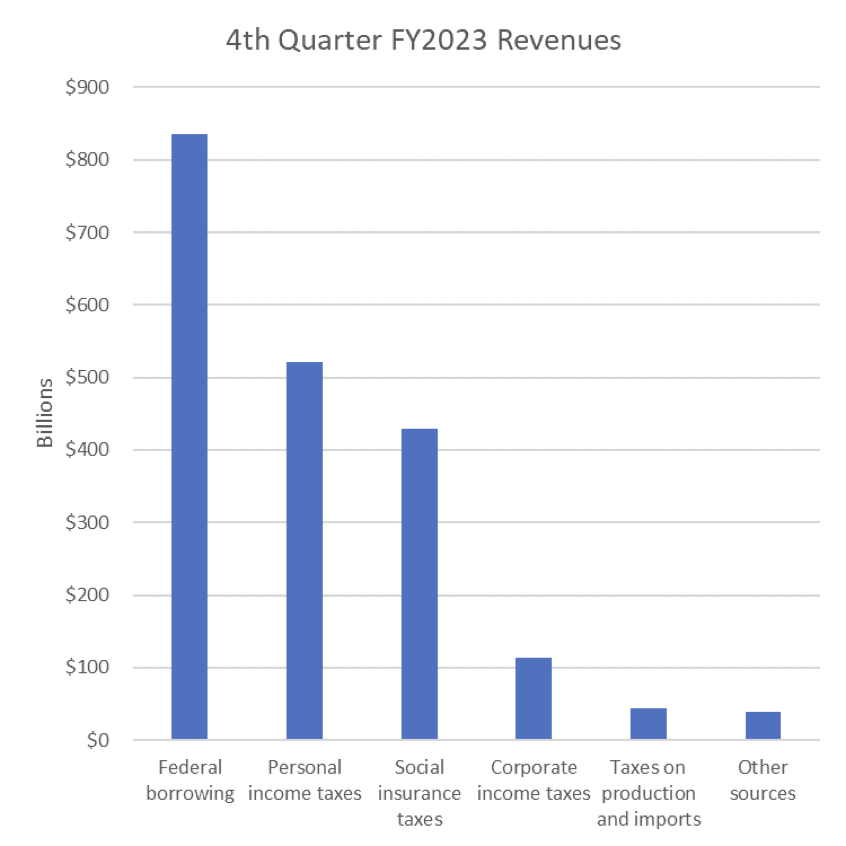

The following chart for the fourth quarter of the last fiscal year makes our point, illustrating that the federal took in more money from borrowing than from any other revenue source.

If you believe Washington can borrow America’s way to prosperity, then there is nothing to worry about. If you are not that naïve, you will want to own gold and silver. Speak with a Republic Monetary Exchange precious metals specialist today to create a sensible plan to protect yourself from Washington’s mounting and unpayable debt.