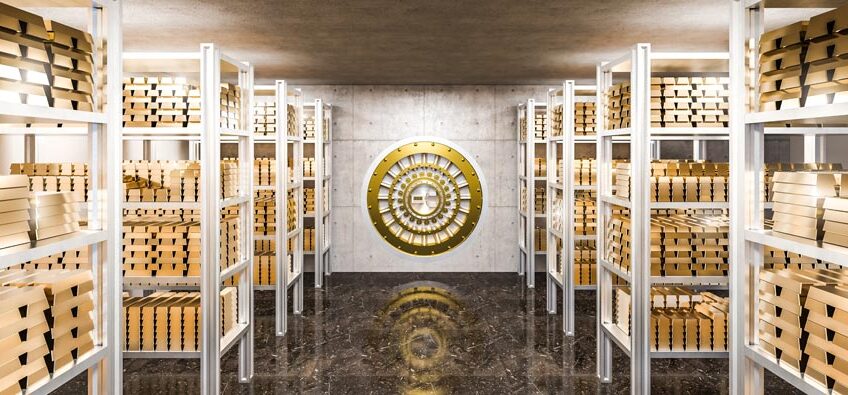

Nations Bring Home Their Gold

Trust in Global Financial Order Continues to Erode

With the specter of the Cold War hanging over Europe, countries like Germany that might have been caught in the crossfire choose to leave their national gold reserves in safer places like the Bank of England in London and the US with the Federal Reserve in New York.

That was then. This is now.

Slowly those nations have now begun repatriating their gold. Slowly is the operative word because for inexplicable reasons some of those who have asked for their gold back have had to wait for some time. Wait without clear explanations for the holdup.

These days nations are increasingly uncomfortable with their gold being held by the US. They are taking their gold into their own possession. They are afraid of being victimized by US geopolitical dominance.

There has been an explosion of US financial heavy-handedness around the world. It consists of sanctions, penalties, and asset seizures: foreign banks have been slapped with billions of dollars in fines. Entire nations have seen their foreign assets frozen for what they believe are arbitrary US sanctions.

The obvious corollary for gold investors is that owning gold you don’t have in a tangible form and in your possession is not a preferred strategy. That is why at Republic Monetary Exchange, our business is providing real, actual gold and silver to our clients. Not paper. Not promises to pay. Not claims or presumed title to gold held elsewhere.

Here is an excerpt from a must-see Reuters report on the annual Invesco Global Sovereign Asset Management Study survey about central bank and sovereign wealth fund gold repatriation:

Last year’s freezing of almost half of Russia’s $640 billion of gold and forex reserves by the West in response to the invasion of Ukraine also appears to have triggered a shift.

The survey showed a “substantial share” of central banks were concerned by the precedent that had been set. Almost 60% of respondents said it had made gold more attractive, while 68% were keeping reserves at home compared to 50% in 2020.

One central bank, quoted anonymously, said: “We did have it (gold) held in London… but now we’ve transferred it back to own country to hold as a safe haven asset and to keep it safe.”

Rod Ringrow, Invesco’s head of official institutions, who oversaw the report, said that is a broadly-held view.

“‘If it’s my gold then I want it in my country’ (has) been the mantra we have seen in the last year or so,” he said.

Invesco’s survey also found that more than 85 percent of the institutions surveyed by Invesco expect higher inflation in the coming decade.

Isn’t it time to see to it that you have real wealth – gold and silver – in your possession, instead of relying on a global monetary system that is breaking down?