Gold is the Answer to Global Debt

Global debt is soaring! Up $15 trillion last year!

Uh oh! Unpayable debt leads to money printing. That’s just the government playbook.

The Institute of International Finance, a global association of financial institutions, tracks and analyzes global capital flows and debt trends. It reports that “over $15 trillion of additional debt was added to the global debt mountain just last year. That brings total global debt to a new record high of $313 trillion.”

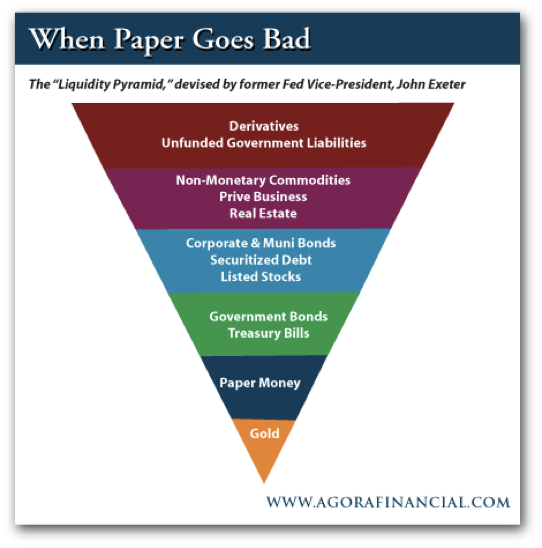

Let us remember J.P. Morgan’s words, that gold is money. Everything else is credit.

All of this debt, not to mention other undisclosed leverage like derivatives that can come topping down in a crisis, represents a lot of precarious credit resting on a tiny amount of real liquidity, gold.

Economist Daniel Lacalle calls this a “ticking time bomb for the global economy.” He writes:

Bloated public debt is a burden on the economy, making productivity stall, raising taxes, and crowding out financing for the private sector. With each passing year, the global debt figure climbs higher, the burdens grow heavier, and the risks loom larger…

Citizens are led to believe that lower growth, declining real wages, and persistent inflation are external factors that have nothing to do with governments, but this is incorrect. Deficit spending is printing money, and it erodes the purchasing power of the currency while destroying the opportunities for the private sector to invest. The entire burden of higher taxes and inflation falls on the middle class and small businesses.

Lacalle concludes, “The end of the United States dollar will not come from external threats but from the irresponsible actions of its own government. Cheap debt is always exceedingly expensive.”

At the risk of repeating ourselves, they can’t print gold.