Can the Fed Declare Victory? Is the Inflation War Over?

We say be prepared for an inflation resurgence!

Some sectors of the markets along with some analysts believe that the Federal Reserve has declared victory over inflation.

That would be like General Custer encountering one lone Sioux on his way to Little Big Horn and patting himself on the back.

Still, stocks roared higher the day after Powell’s latest press conference. The Dow was up 564 points; the S&P rose 80 points; the Nasdaq index took off, climbing 232 points.

So is their verdict correct? Has the inflation bogeyman been vanquished? Did Custer vanquish the Sioux?

Not hardly.

Of course, the Fed doesn’t want to raise rates. It doesn’t want to be blamed for a collapsing housing market, bond market, and stock market. But it should have thought of that when it prints the last few trillion dollars. No, with the Fed it is never forethought. It is always an afterthought.

So, it doesn’t want to raise rates. However, it did not want to raise them when it began raising rates in 2022. Consumer anger over rising prices forced their hand.

So that’s two meetings in a row that the Fed has punted, leaving rates unchanged. And it gave no indication that another rate hike would be forthcoming at its December meeting. “The stance of policy is restrictive,” said Powell, “meaning that tight policy is putting downward pressure on economic activity and inflation, and the full effects of our tightening have yet to be felt.”

And that was enough for some participants to conclude that the Fed’s bias is to hold rates where they are. Until something else happens.

Something about this is uncannily familiar. Other central banks, who know the inflation racket better than anyone since they are the inflation racker, keep buying gold.

Central bank gold demand so far this year is 14 percent ahead of the same period last year. But it also reminds us of when the Fed prematurely assumed inflation was under control in the 1970s.

It wasn’t.

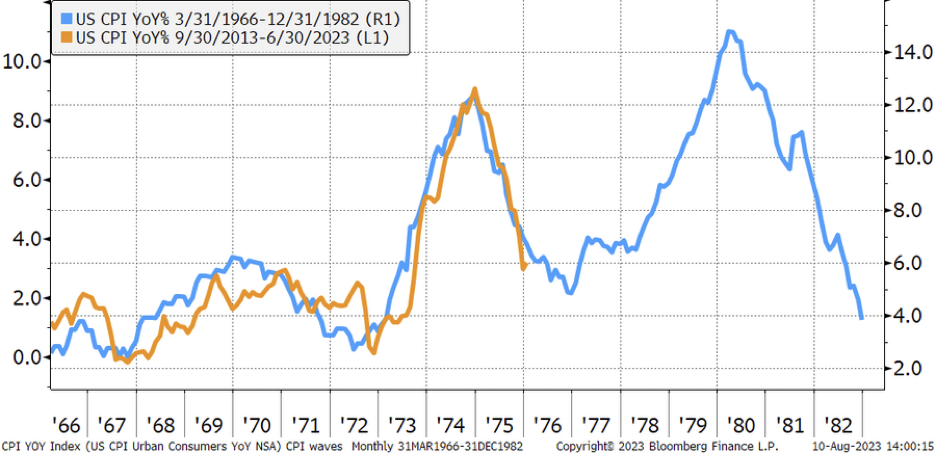

Here’s a chart from Jeffrey Kleintop, Jeffrey Kleintop, Chief Global Investment Strategist at Charles Schwab that we ran during the summer.

The chart shows the CPI from 1966 to 1982 in blue. That includes the inflation decade of the 1970s. Clearly inflation roared up in 1973 – 74, eased off, and took off again in 1978 – 79.

The yellow line overlaying it is the CPI from 2013 until now. It is almost uncanny how closely the patterns align. Most economists today understand that the Federal Reserve concluded it had won the war on inflation in the mid-70s. But they declared victory too soon and price inflation roared back even stronger than before.

Kleintop says, “It’s funny how history rhymes!”

It is funny. Remember that four other members of his own family were killed along with General Custer at the Battle of Little Big Horn: his 18-year-old nephew, his brother-in-law, and two younger brothers.

Protect your family and your wealth. Take advantage of today’s gold and silver prices and be ready for inflation’s resurgence. Speak with your Republic Monetary Exchange precious metals professional today.