China’s Coming Collapse?

…and what it could mean for us.

China is a hot mess.

We have only addressed China’s rickety economic conditions occasionally and not written much about them, but you should know how vulnerable things are in that centrally-planned economy.

Youth unemployment in China is running at about 15 percent. Property prices in December fell at the fastest rate since 2015, not comforting to a middle-class heavily invested in real estate. A restive population makes for a nervous ruling class!

Here’s a chart of China’s Hang Seng index of stocks traded on the Hong Kong exchange. It has fallen in half in the last three years.

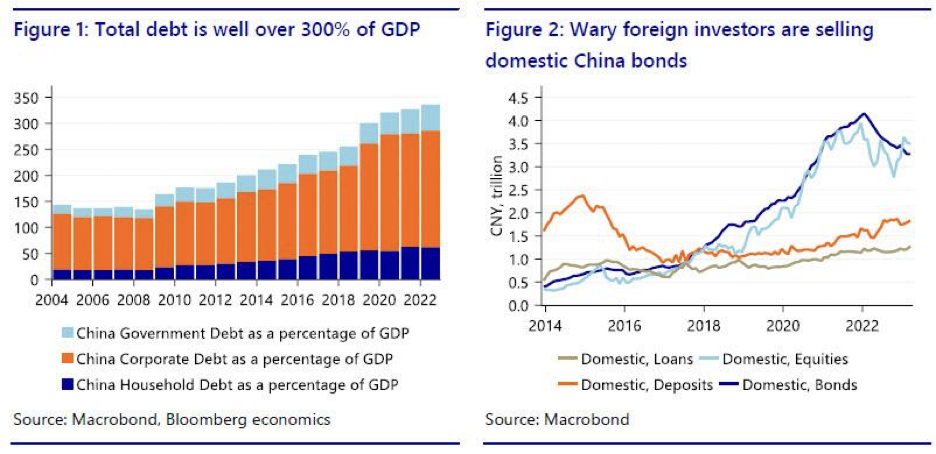

Government debt is a huge problem. It’s bad enough that Moody’s has lowered its rating on China’s sovereign debt from stable to negative.

Kyle Bass of Bass of Hayman Capital Management says China is experiencing “a full banking system collapse.” To put a fine point on it, Bass says local governments in China have amassed $4 trillion in real estate losses and $13 trillion in debt, 90 percent of which is in default.

A few snippets:

China is trying to defuse a financial time bomb that could severely damage its banking system. Cities and provinces have accumulated a massive amount of hidden debt following years of unchecked borrowing and spending. The International Monetary Fund and Wall Street banks estimate that the total outstanding off-balance-sheet government debt is around $7 trillion to $11 trillion.,,, No one knows what the actual total is, but it has become abundantly clear over the past year that local governments’ debt levels have become unsustainable.”

The Wall Street Journal, 12/6/23

Defaults by Chinese borrowers have surged to a record high since the outbreak of the coronavirus pandemic, highlighting the depth of the country’s economic downturn and the obstacles to a full recovery. A total of 8.54mn people, most of them between the ages of 18 and 59, are officially blacklisted by authorities after missing payments on everything from home mortgages to business loans.

The Finaincial Times, 12/4/23

China’s offshore corporate-bond defaults have increased to $51.9 billion so far this year.

Bloomberg, 12/4/23

The fallout from China’s collapse will be widely felt, and mean a big hit to global GDP. It is, as they say, a global economy. Global creditors will suffer huge losses. As productivity declines, tax revenue slows as well.

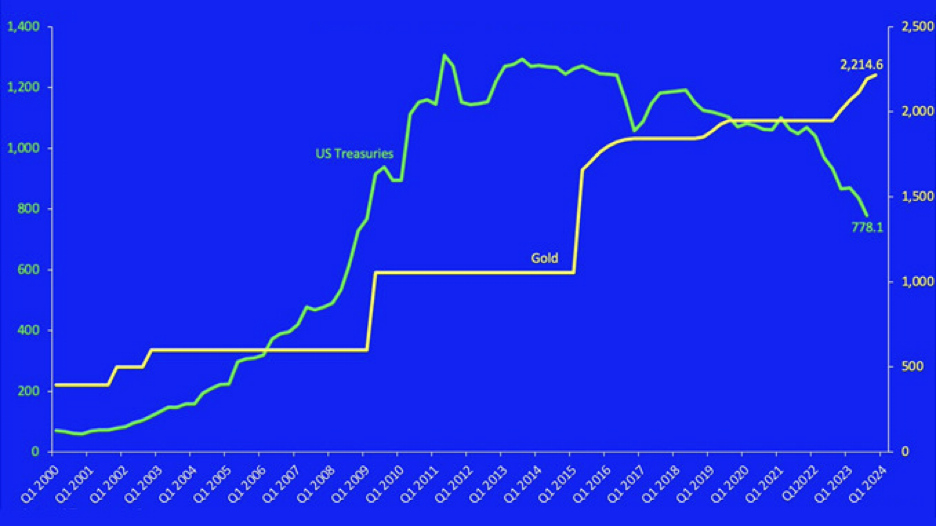

But for the United States, there is more. One must look at the contribution China has made to funding the US national debt. Not many years ago China held $1.3 trillion in US debt instruments. Today it is off 40 percent, down to less than $78o billion. In other words, China is loaning less money to the US even as Uncle Sam’s borrowing appetite is growing massively. With China’s internal debt issues reaching a crisis stage, it is in no position to keep funding the US.

Indeed, as its holding of US debt instruments declines, its gold holdings continue to rise.

As state enterprises go bankrupt, deficit-financed governments fail, and the debt-based monetary system implodes, China knows that it can depend on its gold holdings – which it has now increased 13 months in a row – to cushion the collapse.

That strikes us as an important strategy for individuals as well. The teetering banks can fail and the currency can collapse, but the people who own gold and silver will have a cushion against the fall.

These global downturns can last for years, the pain almost indescribable. But only people who have studied history realize that. That’s why they buy gold.