Expect Higher Gold Prices

We grow very wary when it appears almost everyone is thinking the same thing. It often means there is not a lot of real thinking going on. The view that Chairman Powell and the Fed are going to be able to drive interest rates lower in the New Year is nearing unanimity.

But no one is bigger than the markets. Even the Fed. And the markets may produce quite a different outcome.

Consider: The Fed can diddle with short-term rates, but its rate manipulations cannot control long-term rates. And even its artificial distortions of short-term rates are ephemeral. We are living today through the reckoning for years of the Fed’s interventions. Stated otherwise, there ain’t no such thing as a free lunch. Milton Friedman used that phrase repeatedly to make clear that a price would be exacted for the government’s manipulations, cronyism, and giveaways.

That is why we have inflation. The Fed makes up money to give to some entity or to pretend it can control interest rates. But the money it prints takes on value to the degree that the rest of the money in the economy – your money – loses value. Having inflated the supply of money and credit to buy down interest rates, bail out banks, or “stimulate” the economy, prices everywhere else go up.

It is also why we have recessions. Washington and the Fed create malinvestment with made-up money, booming some recipients or sectors with liquidity only to have financial reality and monetary reality eventually assert themselves. Remember the housing boom and bust?

Having created 8 trillion dollars in the years after the housing bubble, the Fed has fraudulently distorted the economy with years of this legalized counterfeiting. The most massive monetary distortion in US history has yet to be assimilated. It is bound to cheapen the dollar’s value much more than the bothersome inflation we have already experienced over the last two years.

And don’t even ask us about the money printing that is needed now to manage the otherwise unpayable US debt.

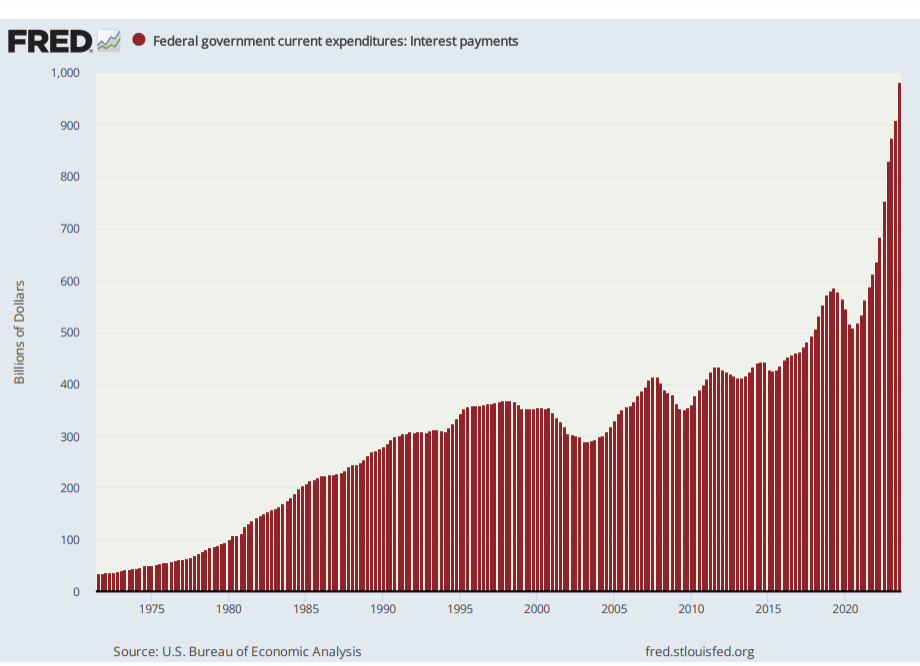

Oh well, go ahead and ask. We happen to have a chart that tells the story.

Interest on the national debt has climbed to a trillion dollars a year. It was less than half that just a couple of years ago. As older government bonds bearing lower rates come due, the Treasury will have to roll that debt over into higher interest rate issues. And in the face of furious money printing to pay for that interest, rates will climb to offset the accompanying inflation. At least market rates will climb.

As Rep. Thomas Massie told Tucker Carlson recently, the Fed was sold to us on the basis that it would be the economy’s firefighter; instead, it is the arsonist!

So, whatever plans that Powell and the Board have for interest rates, all the money printing that has gone before will have its say. And people tend to abandon made-up currencies in times of crisis, preferring gold.

Wouldn’t it be wise to expect much higher gold prices with all that money printing headed our way?