The Rush to Gold When Banks Start Crashing

It was not quite a year ago that banks started tumbling down. You remember the names: Silicon Valley Bank, Signature Bank, and First Republic, all American banks. But it wasn’t just an American problem as the presence of Swiss banking giant Credit Suisse and Deutsche Bank on the troubled list attested.

Rising interest rates were tanking the banks’ holdings of US Treasury debt instruments and mortgage-backed securities. Many Americans – although not most – made withdrawals from their banks. It was only prudent. Why keep your money parked in troubled institutions? It’s your money. Protect it!

Even though the Fed’s balance sheet is upside down (that’s another story!), the central bank rode to the rescue with another Big Bank Bailout Bonanza. Don’t be surprised. The Fed was created by the Big Banks in the first place to do Bailout Bonanza whenever Big Banks needed them.

The Fed said, “Even though as a matter of law, accounts at Big Banks are only insured to $250,000, we will create a new program known by the acronym BTFP to create the impression that the Fed will bail out all the banks – or at least the Big Banks that are in on the Bailout Bonanza!”

So, bank depositors started moving money to Big Banks that would be the beneficiaries of the Bonanza Bailout. That was not good for small banks, but they didn’t create the Fed, so tough!

None of this fixed anything. It was just designed to forestall the en masse withdrawals of deposits from banks (and into gold, by the way).

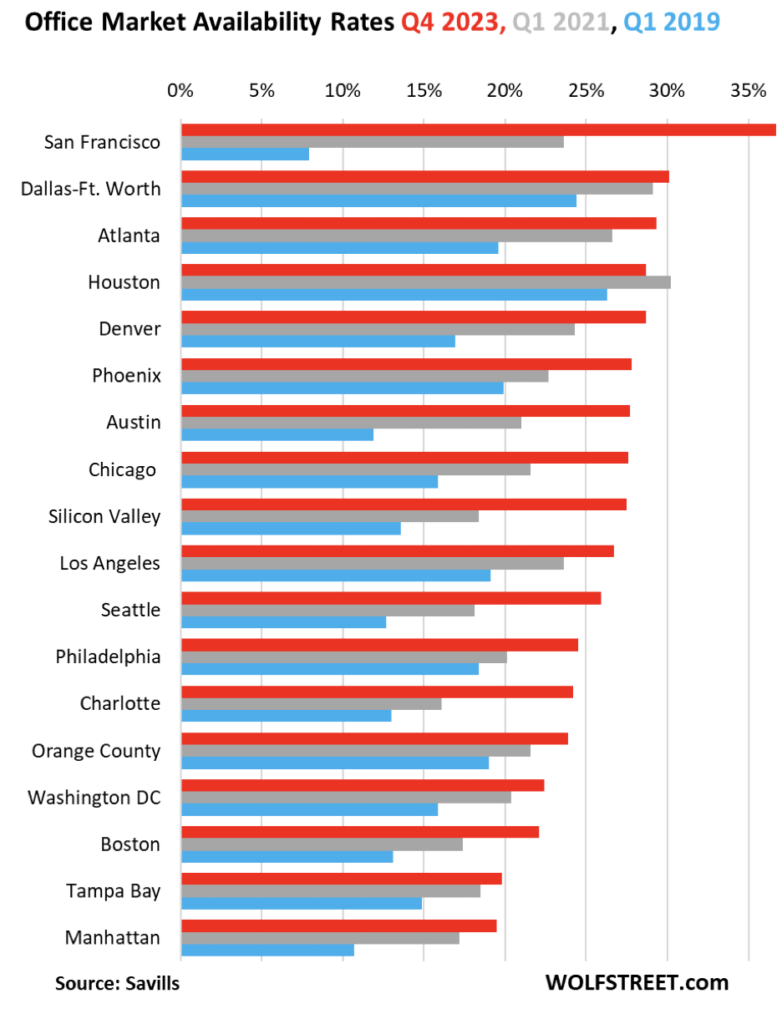

Now the other shoe is dropping, one we have been warning about: Commercial Real Estate. The delinquency rate on office building mortgages is climbing at a fast clip, putting the screws to private leaders and banks alike.

New York Community Bancorp is in such bad shape that its picture belongs on the back of milk cartons.

A lot of these CRE loans are coming due this year and next year, and need to be refinanced, or extended, but interest rates have jumped, and many of these office properties are dealing with the structural collapse of demand for office space, so refinancing is going to be tough, and extending-and-pretending is going to be tough, and banks are going to have to deal with losses.

The problem is structural and won’t just vanish when the mood changes or rates drop.

Appearing on CBS 60 Minutes recently, Fed Chairman Powell said there will be losses, but he thinks they are manageable (of course he does!):

You know, we’re working with them. This is something we’ve been aware of for, you know, a long time, and we’re working with them to make sure that they have the resources and a plan to work their way through the expected losses.

Right. Where do the resources come from to manage their losses?

They come from you. It’s not magic. They devalue the people’s money. It is what they have always done. That’s how the Big Bank Bailout Bonanza works!

Last year, people wanting to move assets out of banks and into gold and silver were waiting for us when we opened the doors in the mornings. Our lobby was crowded from early to late.

This year we think you would be wise to beat the rush! Speak with a Republic Monetary Exchange specialist today.