<h1 class="entry-title">Category: Gold Market Discussion</h1>

16

Jul

A Cryptocurrency Backed By Gold? Sure Makes Sense, Doesn’t It? Cryptocurrencies like bitcoin have experienced massive rallies recently as a possible, alternative safe haven investment. Are Gold and Cryptocurrency forming a New Relationship? Naturally, a cryptocurrency such as Bitcoin brings inherit fears of instability and raises questions from investors. This being mainly because the “currency” […]

09

Jul

Gold Prices Are Down Right Now – It’s a Prime Time to Buy When metals are low, it’s a perfect time to buy, and gold prices are down right now. This could be an important, new price bottom before the next rally. If you have been waiting for the right moment to get in, this […]

25

Jun

How Are Global Tensions Going to Affect Gold? Gold had some pull back at the start of the week, but closed out the week making back some gains. However, going forward, there are global tensions going to affect gold, most likely. Although lately gold has at times been fairly quiet on the volatility trade, there […]

18

Jun

Gold Retreats after Fed Raises Rates a Quarter Point This week gold retreated from its rally following the Fed announcement Wednesday that lifted rates a quarter point. Gold still looks safe long term, however, and made back some small gains Friday as the dollar index experienced some weakening. The dollar index strengthened Wednesday following the […]

11

Jun

Gold Is at 7 Week High on Weak Dollar Index, Nearly Reaches $1300 This week, gold is at 7 week high on weak dollar index (among other driving factors). Gold prices started out the weak with a rally climbing over $1,290, however it pulled back some on Thursday and Friday. The dollar index was up […]

04

Jun

Arizona Authorizes Gold as Legal Tender as Alternate to Fiat Currency This fall, Arizona authorizes gold as legal tender with Governor Doug Ducey’s signing of House Bill 2014 this past week. The bill eliminates capital gains tax on gold and silver, which encourages its use as currency. Previous version of the bill passed the state […]

28

May

China Downgrade Worrying Investors As the Country’s Financial Strength in Question Gold had another strong week, and looks like it is moving out of its recent sluggishness. With Moody’s China downgrade worrying investors this week, the dollar continuing to show weakness, and a possible rate hike, gold is looking attractive and shows signs that it will […]

21

May

Volatility Rocks the Markets and Gold is Looking Bullish After a turbulent week, gold is looking bullish, and investors are flocking back to precious metals. Volatility rocked the markets stemming from political controversy in Washington. This was the controversy surrounding the President’s dismissal of FBI director Comey and his meeting with Russian state officials. The […]

14

May

Has this Gold Market Run Out of Steam For Now? Are investors worried that this gold market has run out of steam? With gold and silver kicking off the week continuing the pull back from last week, some investors are. What are the reasons for the pull back, and what does it mean going forward? […]

07

May

Current Silver to Gold Ratio Represents Prime Buying Opportunity The current silver to gold ratio represents a prime buying opportunity. The silver to gold ratio represents the amount of ounces of silver that equates in price to an ounce of gold. It normally sits around 80 to 1, but is at 75 to 1 right […]

23

Apr

As Metals Continue to Perform, These Are the Market Rallying Events to Watch for Gold Precious metals continued their winning streak this week, and there are several market rallying events to watch for gold over the next year. Gold rose above $1,290 an ounce this week before pulling back slightly towards the end of the […]

16

Apr

Gold Posts 10% Gains, 5-month High as Geopolitics Spark Flight to Safety and Gold Developments in geopolitics spark flight to safety and gold by investors this week. Gold has posted 10% gains for the year now. It broke out Tuesday over $1,270, and by Wednesday, it had hit a 5-month high. It continued these gains […]

09

Apr

Gold Surges after Airstrikes in Syria by the U.S. Gold surges after airstrikes in Syria on Thursday night to end the week hitting the $1,270 mark on Friday. In retaliation for an alleged Syrian chemical attack on civilians last week near Idlib, the U.S. fired 59 Tomahawk cruise missiles at Shayrat Air Base late Thursday […]

02

Apr

3 Things That Will Fuel Gold Rally There are 3 things that will fuel gold rally that are abundantly transparent in the markets already. This week, gold continued its upward climb touching above $1,250. Take a look at what’s driving this rally. 1. Inflation Some analysts are predicting gold to soar to $1,500 soon as […]

26

Mar

Gold Rally Continues from Last Week’s Jump Last week’s gold rally continues this week with gold toying with the $1,250 mark. Gold is now up 8.5% this year. On Tuesday, the Dow had its worst day yet in 2017. It experienced some shakiness after the Fed announcement last week, and volatility rocked stocks this week. […]

19

Mar

Gold Reacted to the Fed Announcement on Interest Rates with Rally On Wednesday, gold reacted to the Fed announcement with a rally that broke over the $1220 mark by Friday. Janet Yellen announced – in a rather positive communiqué – that rates would go up a quarter point, and that we could anticipate a couple […]

12

Mar

Gold Lower on Upcoming Rate Hike and Animal Spirits, but is the Fed Behind the Curve? Gold prices were weighed down heavily this week mostly due to the upcoming rate hike.. The dollar is maintaining its strength right now, which is pushing down gold prices. Moreover, strong indications that the Federal Reserve will hike rates […]

05

Mar

The U.S. is on the Brink of a Major Debt Crisis With a $20 trillion national debt, it sure appears the U.S. is approaching a debt crisis. This past week President Trump addressed Congress with a pro-jobs and growth message that prompted a stock market rally the next day. As a result, gold saw some […]

26

Feb

11 Straight Record Closes, But This Market is Overvalued Despite 11 straight record closes, investors are starting to worry the market is overvalued. Investor pessimism is rising as they start to fear a correction is coming. Friday marked the first record 11-day win streak for the Dow Jones since 1987. In 1987, the Dow Jones […]

19

Feb

Rising Inflation Will Boost Gold and Silver The current economic outlook is anticipating inflation in the not-so-distant future, and rising inflation will boost gold and silver prices. Consumer prices are up 0.6% in January and 2.5% over the last year. Price seem to be rising at the fastest pace in about six years. Rising inflation is to […]

13

Feb

Increasing European Political Uncertainty and Populism Will Fuel Safe Haven Demand Plummeting levels of confidence in national governments (and even more so in the EU) is leading to increasing European political uncertainty. This is true in the U.S. as well. Donald Trump’s election and the Brexit vote are indicators of rising populism and uncertainty. Other […]

05

Feb

President Trump Repeals Dodd Frank Regulations Triggering Stock Market Rally The Dow closed 187 points up on Friday settling just over 20,000. Investor confidence got a boost as President Trump repeals Dodd Frank regulations. Goldman Sachs and other banking institutions were once again the big winners (unsurprisingly). The boost came Friday afternoon after President Trump signed […]

29

Jan

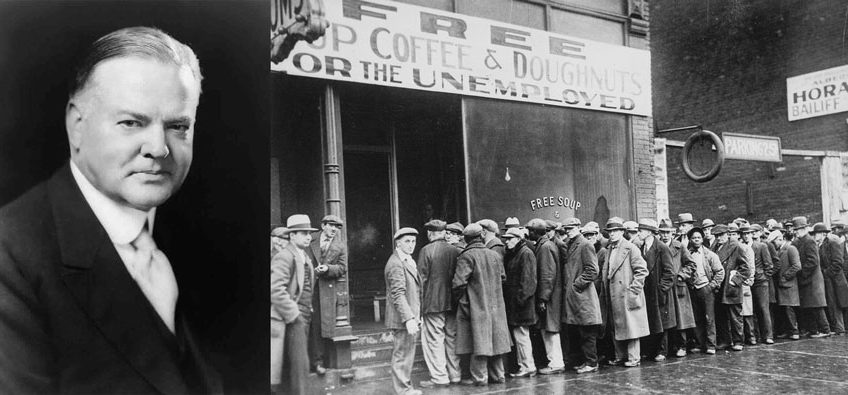

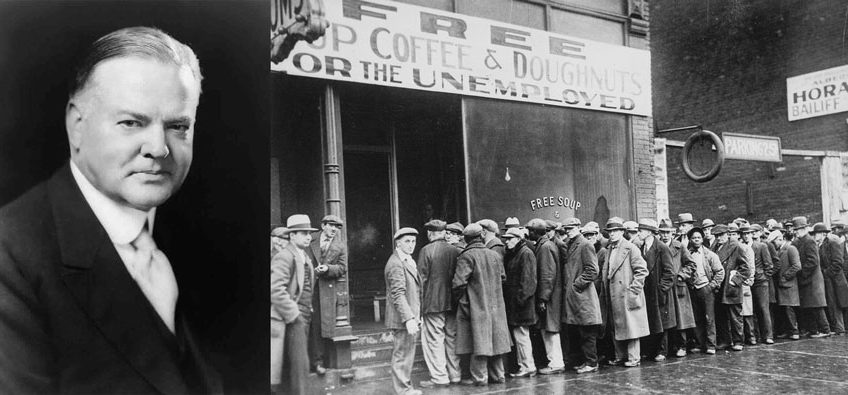

Lessons from Hoover on Trade Policy: The Smoot-Hawley Tariff Act As the Trump administration starts enacting new policy, history can illuminate some valuable lessons from Hoover on trade policy and its implications. These implications could have especially relevant repercussions today. Trade has been an cornerstone of Trump’s campaign. This week he signed an executive order canceling the […]

22

Jan

Why Populism Will Be Biggest Driver of Markets According to the Largest Hedge Fund’s Manager Ray Dalio, founder of Bridgewater Associates (considered the world’s largest hedge fund), believes that populism will be biggest driver of markets and money in the future. Populism will be even more influential than monetary policy from the Federal Reserve and […]

15

Jan

Gold Has Hit the Low for 2017 and Is Set to Climb In December 2015, RME called the gold price bottom, and 2016 followed with a rally in metals. Once again, we are calling that gold has hit the low for 2017 already. In 2015 the price bottomed at $1,055. On January 3rd this year, gold […]

08

Jan

This week we will take a look back over the 5 biggest stories for gold and the markets in 2016 and how they impacted investors. Donald Trump Wins the Election The election of Donald Trump was, of course, the pivotal story of 2016. His shock win took most of the world by surprise and contradicted […]

18

Dec

DOLLAR REACHES 14-YEAR HIGH AND FED RAISES RATES Gold was hit hard this week as the dollar hit 14-year highs and the Federal Reserve raised interest rates a quarter point. Janet Yellen – Chair of the Fed – also announced that we can expect one more hike in the first half of 2017 and three […]

11

Dec

Gold Continues to Pull Back, but Has Positive Long Term Prospects Gold prices continued to show retreat this week. The stock market has been hitting “lifetime highs” for the past couple weeks with the Dow at nearly 20,000. The stock market experienced a sharp upswing after the election and has been hitting new highs every […]

04

Dec

RE-THINKING GOLD BUYING OPPORTUNITIES & TAKING ADVANTAGE OF CURRENT PRICE DIP Gold prices have been falling since Donald Trump’s election win, and as price dips, it is an optimal time for strategically re-thinking gold buying opportunities of the wealth preserving asset. Most analysts predicted that a Trump win would be positive for gold due to […]

20

Nov

DOES THE VIX STILL ACCURATELY MEASURE FEAR? OR IS IT NOW THE DOLLAR? The VIX does not seem to accurately measure fear anymore. The VIX – or volatility index – shows the markets’ 30-day forecast for volatility. It describes implied volatilities, is constructed partly from both calls and puts, is forward-looking, and referred to as […]

13

Nov

Stock Market Rally in Aftermath of Stunning Trump Win Donald Trump’s win Tuesday is seen as a victory over the political establishment and a return to conservatism. The news also triggered a triggered a massive stock market rally. In the long run though, the Trump win will likely mean inflation and debt down the road. As […]

06

Nov

Is the Correction Over? Gold Breaks $1300 This Week Gold prices broke through to $1300 this week for the first time in nearly a month signaling that the correction of the last few weeks could be over. It closed the week at a four week high after starting the current rally the previous week. The […]

30

Oct

Gold Set to Continue Gains in 2017 Precious metals have made tremendous moves this year, and gold is set to continue its gains in 2017. Even if the Federal Reserve decides to hike rates in December, the conditions are set to be favorable to gold. Gold prices have rallied over 19% this year. Global economic slowdown, […]

23

Oct

Why the Gold Bull Market Has Room to Run Yet The gold bull market is not over yet. It still has some room to run. Gold price climbed slowly, but steadily this week after pulling back last week. Gold and silver both have been keeping rather quiet the past two weeks, but this week they […]

16

Oct

Economic Slowdown in Asia Signals More Gold Buying Gold demand in the Asian markets is picking up after a slowdown last week when Chinese markets closed for a week of holidays. Markets are indicating that now may be the perfect time to buy gold. Demand for gold in Asia is on the rise, which will […]

09

Oct

$1.4 Trillion Dollar Deficit That No One Is Talking about In the 2016 fiscal year, the U.S. hit a 1.4 trillion dollar budget deficit, and no one is talking about it. October marked the start of a new fiscal year, and 2016 closed with a deficit three times larger than the previous year. It is […]

02

Oct

Deutsche Bank Strikes Fears of Lehman Brothers Repeat Deutsche Bank sent liquidity fears through the markets on Thursday reminiscent of the lead-up to the 2008 crash. The bank’s stock fell to all-time lows on Thursday on liquidity concerns as large funds began to withdraw excess cash and positions at Deutsche Bank. The bank, which is […]

25

Sep

Gold Has Shining Week After Fed Decision Not to Hike Rates Gold and silver both ended the week on highs after the Fed announced its decision not to raise interest rates. The metals had their greatest weekly advance since July. Stocks and bonds initially rallied after the Thursday announcement as well, before they experienced pull […]

18

Sep

Boris Johnson: Brexit Negotiations Could Begin Early 2017 Boris Johnson says Britain will begin Brexit talks soon. Johnson, the British Foreign Secretary and staunch “Leave” vote advocate told the Italian prime minister this week that Brexit talks could begin as soon as early 2017. Boris Johnson, the former mayor of London, campaigned heavily for Great […]

11

Sep

Massive Stock and Bond Sell Off Shake Markets on Interest Rate Prospect On Friday, the Dow and Nasdaq had their worst day since Brexit. The Dow was down nearly 400 points and had its third worst week overall year to date. An unexpected announcement from the Federal Reserve that hinted at an imminent interest rate hikes […]

04

Sep

Why is the Deutsche Bank Backing out on Promised Delivery of Gold? Is Gold Approaching a Short Squeeze? This week German gold buyers discovered that they could not receive delivery of the metals they had paid for. The bank in question – Deutsche Bank – is the chief bank of Germany. Investors had bought through the […]

27

Aug

The Markets’ Take on a Trump Presidency Presidential elections in the U.S. have significant impact on market movements. Even the anticipation of (before the candidate is even elected) what a candidate might do is impactful. According to some hedge fund managers, there is a correlation right now happening between investors wanting to hedge against a […]

21

Aug

Just Over 45 Years Ago the U.S. Left the Gold Standard – What Has Happened Since? We just passed the 45-year anniversary of fiat currency replacing gold. 45 years ago – August 15, 1971 – President Nixon declared the end of the United States’s decades long, gold backed monetary system and replaced it with the current […]

14

Aug

Ben Bernanke Predicts Fed Won’t Raise Rates For months now investors have been expecting the Federal Reserve to raise interest rates. Events such as the May jobs report data, the June Brexit vote, and a lack of economic growth in Q2 have forced the Fed to continue to delay hiking rates. There is much […]

07

Aug

What the Gold Market Is Saying about Global Risk, Bank of England Rate Cuts, Japanese Stimulus Michael Preiss of Taurus Wealth Advisors believes the global economic outlook is recession and stagnation. In his analysis on CNBC he stated that the gold market can reveal much about the state of the economy. He points out that […]

04

Aug

Watch: Bill Gross Doesn’t Like Stocks or Bonds! Trouble viewing video? Click here. Bond King Bill Gross “Doesn’t Like” Stocks or BONDS. Bonds! This is the former head of Pimco, where he managed the largest Bond fund to the tune of oh… $270 billion. After all, the man’s nickname literally is “The Bond King”. So what […]

31

Jul

Gold Prices End the Week High on U.S. Economy Growth Concerns and European Bank Stress Test Results Gold closed out July hitting two-week highs and seeing gains through Thursday and Friday to settle at $1350 by Friday close. The metal has entered a new bull market and is now up 26% for the year. There […]

24

Jul

The Dollar and Gold in a Complicated Relationship Traditionally gold and the dollar have an inverse relationship. When the dollar is strong, gold is weaker. Alternatively, gold rises on a weak dollar. However, we are currently seeing a dollar enjoying relative strength while gold prices are simultaneously over 25% into the green for the year. […]

17

Jul

The Post-Brexit Stock Rebound: The Market Rally Has a Lurking Problem In the Brexit aftermath, the stock market plunged so low that it lost all of its 2016 gains. However within a few weeks it has been hitting some historic highs to the confusion of many. There is a darker side to the stocks rally […]

10

Jul

Why Gold and Silver Will Be the Most Secure Currencies Many eminent investors consider gold and silver as currencies. Peter Boockvar considers precious metals an “anti-fiat money” currency. Because gold is a tangible, finite resource, its value cannot be as easily manipulated or created electronically through central banking monetary policy as fiat currencies can. Central […]

03

Jul

Silver Hits 21 Month High This Week As Gold Lifts Silver prices soared along with gold through the week. By Thursday silver was at $18.76 hitting its highest mark in almost two years. During the last half of the week, the stock market recovered some of its losses. Both global stocks and U.S. stock indexes […]

26

Jun

What the Brexit Vote Means for Gold, Stocks, Currencies, and Banks On Thursday, Britain voted by 51.9% majority to leave the European Union. By Friday morning, the global markets – mostly poised for a “Remain” vote – were in chaos as the Brexit spurred a massive sell-off. This is a monumental event of which the […]

19

Jun

3 Reasons Why Gold Prices Have Bright Outlook The “Brexit” The Federal Reserve’s decision on interest rates German and Japanese negative interest rates Right now, the potential Brexit and the Federal Reserve’s interest rate decision (see next section below) are two of the key drivers for gold’s rising price. A third, more long-term driver continues […]

12

Jun

Gold and Silver Prices Strong This Week, Stocks Vulnerable Gold and silver prices continued rise this week following its strong close the previous Friday. Ominous signs about the stability of the U.S. economy started to become apparent after a much weaker than expected jobs data report last week. A few days prior, Janet Yellen, chair […]

05

Jun

Bleak Economic Jobs Data: U.S. Labor Force Adds Fewest Workers in Six Years The jobs data was more negative than even the most pessimistic growth projections, according to Bloomberg analysts. Average estimates put the number of jobs added to the U.S. labor force for May at 150,000. The reality was shockingly short at only 38,000 […]

29

May

[VIDEO] Leading Wall Street Analyst: Gold Will Hit $1900; Get In Now Market Analyst Peter Boockvar was interviewed on CNBC this week saying that gold is in the beginning of a new bull market. He believes many are reading the market wrong and that gold and silver still have a ways to climb. Boockvar said […]

20

May

The “Brexit” Politics and Their Impact on the Markets A few weeks ago we touched on the possibility of Great Britain voting to leave the European Union and what the impact of this move would be on gold and the markets. The referendum for the British exit – known most commonly as the “Brexit” – […]

15

May

Gold Enters a Bull Market, According to JP Morgan One of Wall Street’s largest institutions, JP Morgan Private Bank, is betting on the gold rally to continue. Solita Marcelli, the bank’s head of fixed incomes, commodities and currencies, holds the view that gold could hit at least $1400 per ounce by the end of the year. […]

08

May

Gold Price Hits $1,300 On Monday, gold spot price passed the $1300 mark for the first time in over a year. Gold is up now 22 percent for the year and is crushing stocks, bonds, and most other asset classes. Gold’s performance this year has been driven by a few different factors. The first was […]

01

May

Gold and Silver Prices Hit Highs Vs. Weak Dollar Gold hit a 15-month high on Friday as the dollar got crushed. Gold opened with its fourth consecutive day of gains and climbed as high as $1,292 per ounce. The shiny yellow metal is now up 20% since the first trading session in January and silver is […]

23

Apr

Gold Price Rises as Oil Price Falls after Doha Oil Negotiations Derail on Iranian-Saudi Tension The oil market endured a tense week as OPEC countries met for negotiations in Doha that ultimately broke down, causing oil prices to plummet. Rising tensions between regional rivals Saudi Arabia and Iran over output levels led to the demise […]