Central Banks Keep Buying Gold!

Central Banks all over the world are buying gold. Are you?

Because central banks around the world sold so much gold in the post-WWII era – to hold US dollars in their currency reserves instead – we believe the reversal of that practice represents the biggest monetary megatrend of our time.

In other words, these days central banks are buying gold. They are de-dollarizing.

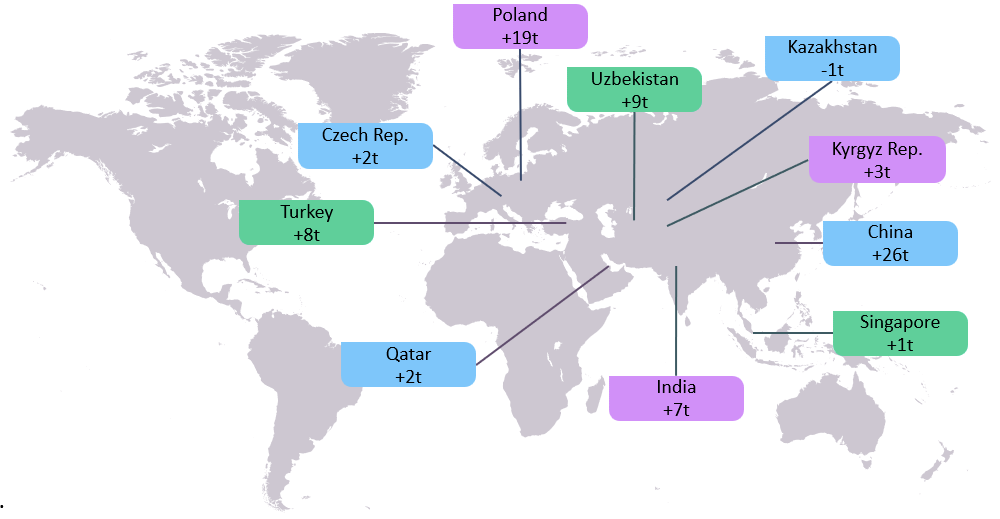

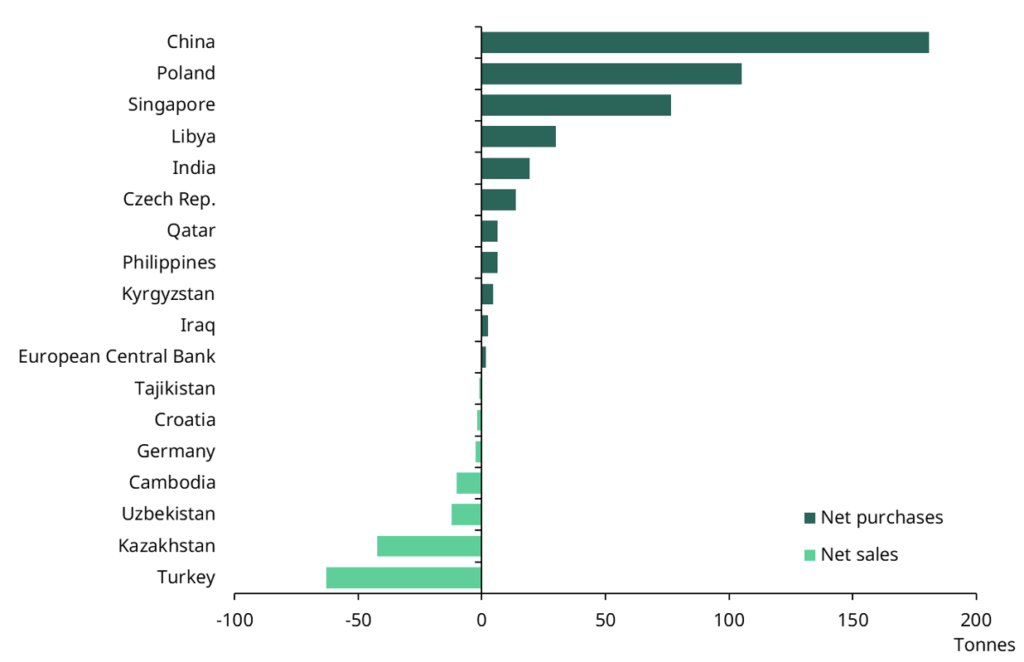

The World Gold Council reports that in September global central banks were net purchasers of 77 tons of gold!

Leading the way in gold acquisitions is the People’s Bank of China.

Asia’s hunger for gold is manifesting in other ways. Of course, China has distinguished itself as the world’s leading gold producer. Now Asia is emerging as a powerful and growing hub for old trading and commerce. Russia, the world’s second largest gold producer, has recently moved its gold trading from Dubai to Hong Kong. According to Bloomberg News, “Hong Kong imported 68 tons of Russian gold this year, four times as much as the whole of 2022.”