Is the Establishment Starting to Panic About U.S. Debt?

First the NY Times! Now Chase Bank?

If you aren’t panicking about the US debt picture, you may not be paying attention!

Now even the most establishment of establishment figures are starting to show signs of panic. Including the most establishment banker of America’s most establishment bank.

Jamie Dimon is the chairman and chief executive officer of JPMorgan Chase, the largest bank in the US. They like him a lot. He’s been in that role since 2005, a job that has made him a billionaire.

Maybe Dimon isn’t panicked, but he sure as heck is worried that we are at the brink. “It is a cliff. We see the cliff. It’s about 10 years out.”

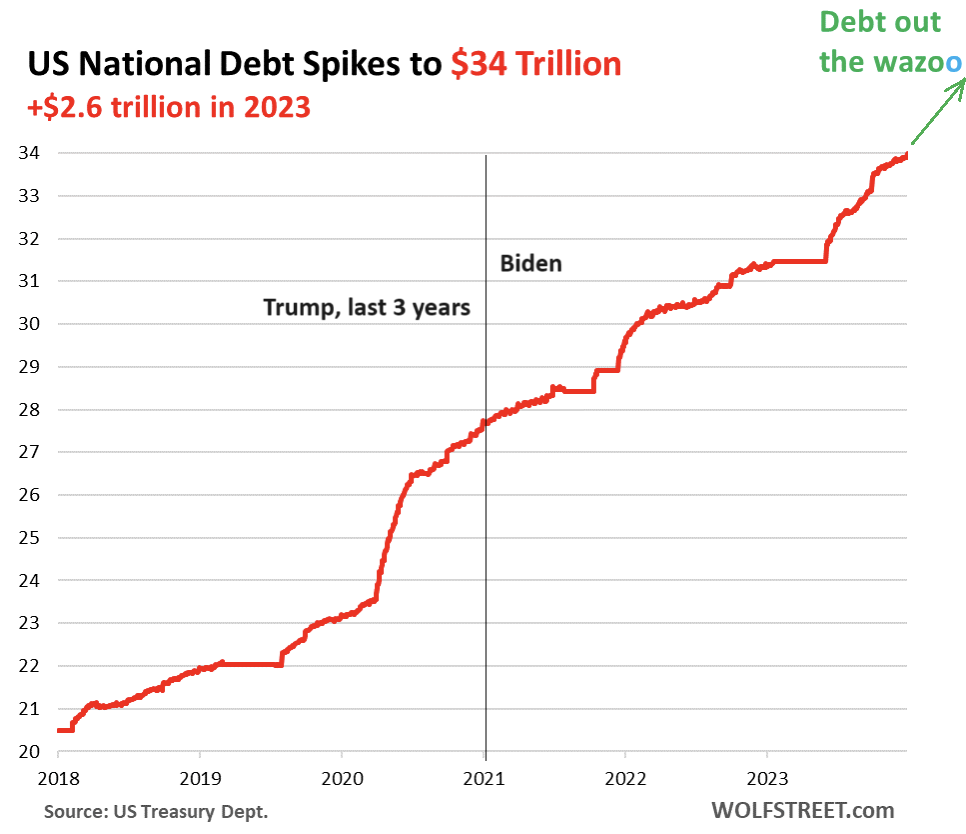

The US national debt is currently more than $34 trillion. Throughout its history, US debt has averaged 30 percent of total US economic output. Today, it is 123 percent, more than four times the average. It is more than the entire annual productivity of China, Japan, Germany, the United Kingdom, France, and Italy combined.

Dimon says the US is going to face “a rebellion” around the world when our debt trajectory turns straight up.

Dimon underestimates the debt-to-GDP ratio at 100 percent. It is 123% of GDP which means the cliff is much closer than he says. And while everyone is trying to act like there is no panic, the panic is beginning to spread even at central banks around the world.

Dimon is not the only establishment voice to express concern about uncontrollable US debt. As we reported recently, even some at the reliably big government, big spending New York Times are getting religion. And that tells us that the crisis is about to boil over.

From the lead of a recent Times piece: “For years, many economists believed the country’s debt was not a problem. Interest rates were low, which held down debt payments. Inflation was also low, which suggested the debt wasn’t hampering the economy.

“But times have changed, and federal deficits now look scarier.”

We prefer “unpayable,” but “scary” is a good word for the debt as well. After all, the national debt amounts to $102,400 per person. How can retirees, fast-food workers, and the American middle class manage that kind of debt burden? They can’t.

Here’s the “Debt out the Wazoo” chart from WolfStreet.com:

Call our debt spiral a death spiral. That’s what Nassim Taleb calls it. We don’t accuse Taleb, the author of The Black Swan, of being an establishment today. Far from it.

Here’s his take:

So long as you have Congress keep extending the debt limit and doing deals because they’re afraid of the consequences of doing the right thing, that’s the political structure of the political system, eventually you’re going to have a debt spiral.

A debt spiral is like a death spiral.

Nassim Taleb

What do you do when the issuer of your currency is in a death spiral? You protect yourself with gold and silver as people around the world have learned to do for thousands of years.