Large Banks are Bleeding Deposits!

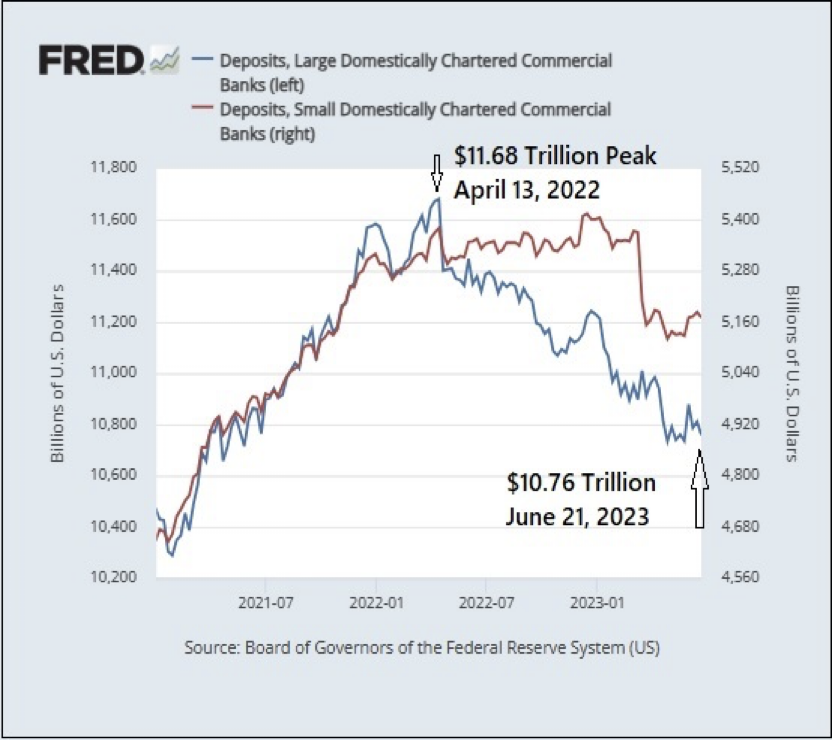

The largest 25 US banks have lost a whopping 7.88 percent of their deposits since April 2022.

More than $920 billion has left the big banks in a little over a year.

Wall Street on Parade reports that the flight from US banks is not quite what has been described by much of the national press:

You may recall reading a burst of headlines during the banking crisis in March of this year about depositors fleeing small banks for the perceived comfort of the largest banks. Unfortunately, those headlines were never put in context or updated to reflect a broader picture….

Deposits at the smaller banks didn’t peak until December 14, 2022, reaching $5,413,667,700,000. The most current reading on June 21 was $5,170,296,000,000, a decline of 4.5 percent from the peak versus the 7.88 percent decline at the 25 largest banks. In actual dollar terms, those 4,071 banks shed just $243.37 billion versus the $920.78 billion at the 25 largest banks.

The exodus of depositors is just one crisis for the banking system. Rising interest rates exacerbate the problem of the sinking value of the banks’ bond portfolios, as well. And then there is the problem with their commercial real estate portfolios.

Wolf Streetwrites, “The delinquency rate of Commercial Mortgage-Backed Securities (CMBS) backed by office properties jumped to 4.5% by loan balance in June, up from 1.6% just six months ago in December 2022.”

Here’s a close look at the unfolding crisis from Wolf Street:

Giant landlords such as private equity firm Blackstone and private equity firm Brookfield – have defaulted on the mortgages and then walked away from the property. They lose the equity in the property, and the lenders then have to sell the office tower for whatever they can get.

But whatever they can get for older office towers is a lot lot less than anyone had imagined a few years ago when the CMBS were issued. The losses on the mortgages for CMBS holders are huge, such as 88% and 82% by two Class-A office towers in Houston, or even a total loss, with the proceeds of the foreclosure sale just paying for fees and expenses, which happened with the vacant 46-story former One AT&T Center in downtown St. Louis. Two class-A office towers in San Francisco sold at 70% off the pre-pandemic price estimates, though they didn’t involve mortgages. Other office towers were sold with 40% to 50% in losses.

So these older office towers create some serious investor-bloodletting.

In short, there is big trouble brewing in the banking sector, all of it driven by the Federal Reserve’s unhinged interest rate manipulations. Never did any of the Fed authorities from Greenspan to Bernanke, from Yellen to Powell, ever give a substantial warning of the market distortions they were building into the system of falsified interest rates. They operated as though they could distort rates and power endless malinvestments in the economy for a generation or more without consequences. And so, year after year, the dislocations and false signals about the price of money continued.

Now the problem is much bigger than anything the FDIC can backstop. A maturing bank crisis can only be addressed in the current fiat money structure by massive money creation by the Federal Reserve. But it will require money printing on a scale most people can barely imagine, one that will leave the US dollar a quivering, empty husk.

The handwriting is on the wall. A national tragedy is in the making. You must prepare for it by owning physical gold and silver.

Better a day early than a day late.