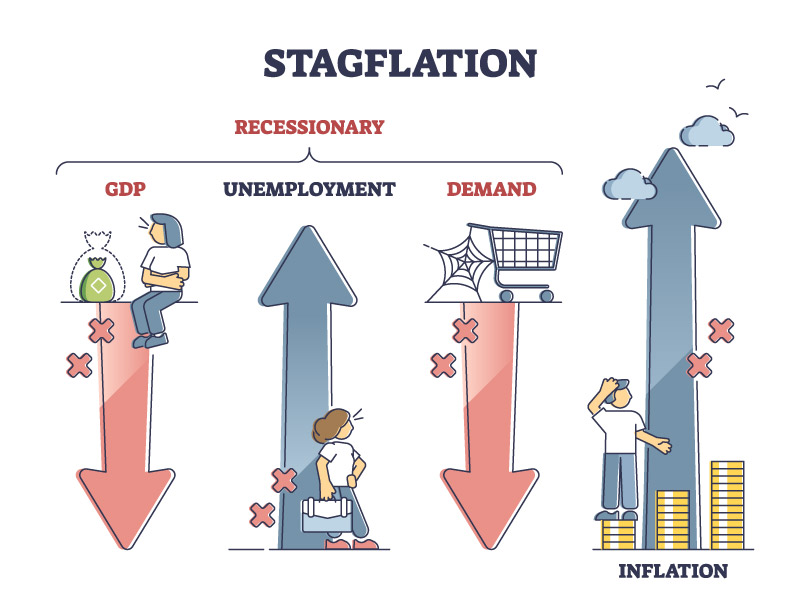

Echoes of Stagflation

Here We Go Again!

It’s been a while since we last wrote about the Stagflation Decade, the 1970s, but some of the parallels are so eerie that even one of the world’s biggest banks has started to notice!

The 1970s era was characterized by oil price shocks, the Soviet war in Afghanistan, and high inflation.

Deutsche Bank, a leading multinational investment bank, is now pointing to those and other ominous parallels.

Deutsche analysts Henry Allen and Cassidy Ainsworth-Grace write:

Inflation remains above target across the major economies; we have witnessed severe spikes in energy prices over recent years; and there’s been growing industrial unrest.

Over the weekend, the attacks on Israel showed how geopolitical risk can return unexpectedly. And we are also seeing an El Niño event this year, which echoes a similar event in the early 1970s that put upward pressure on food prices.

It’s not time for complacency they warn:

Inflation is still above target in every G7 country, and the 1970s showed how unexpected shocks could rapidly send inflation higher once again. History also suggests that the last phase of returning inflation to target is the hardest.

And given inflation has already been above target for the last two years, a fresh inflationary spike could well lead expectations to become unanchored.

The costs of the Vietnam War played a huge role in the stagflation that plagued the American people in the 70s. So far, the Biden gang has thrown $100 billion in taxpayer money into Ukraine. Never forget that war leads to larger fiscal deficits, more debt monetization, and higher inflation on a persistent basis!

All the numbers are much bigger now, the amount of spending and debt, the prices of oil, and the costs of war. A brand-new stagflation decade will mean a gold and silver bull market that will be much bigger than the one your grandparents remember. Speak with your Republic Monetary Exchange professional advisor about stagflation. Prepare yourself now without delay.