Why Do They Want to Destroy the Currency and Economy?

Here are a Few Answers!

Someone asked us, “Why does the Federal Reserve destroy our money with inflation? Don’t they realize what they are doing to this country?”

No answer we give will be complete. There are too many things going on and too many different interests at work for an all-encompassing response. But we’ll provide a couple of the leading components in our response.

Let us answer the second part of the question first. Some of the people inside the Fed do realize what they are doing to this country. And they keep doing it because what it is doing to the country is what they want done. You might think of them as believers in George Soros’s new world order: They don’t like America and they want it changed. They want to level the world into a uniform socialist mediocrity (with a special class of rulers, to be sure: themselves!) These are members of the Davos crowd who want you to eat bugs and own nothing.

Others don’t know any better. Although she seems to have a foot in both camps, both among those who intend what they are doing, as well as a leading figure among those hopelessly without a clue how things work, we give you Janet Yellen.

Why does the Fed do it? It destroys our money for a number of reasons. It serves the governing classes, giving them “free” paper or digitally printed money) for vote-buying giveaways, and to win elections. The central bank’s power to create and destroy money is the power to boom and bust the economy at will. It is the power to support and sustain the banks and the crony classes that created the Fed in the first place.

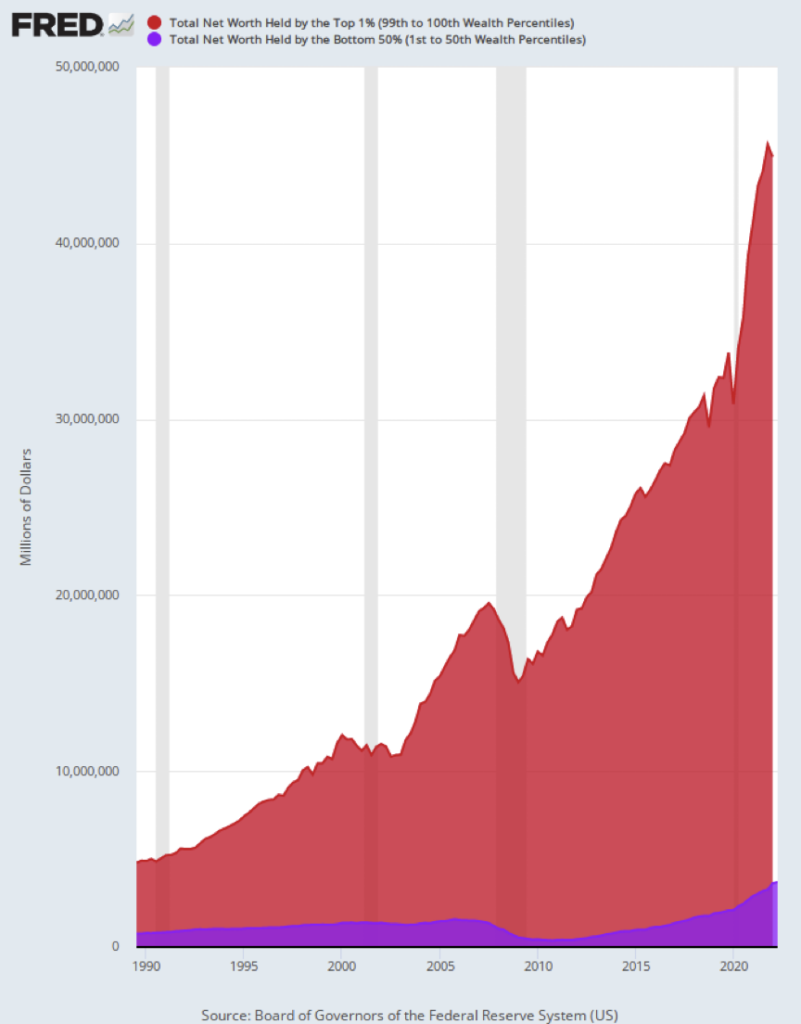

There can be no doubt that the orgy of “galloping central bankism” that we have seen over the last generation or so has profited the crony classes enormously. Just take a look at the following chart. It depicts an explosion in the net worth of the wealthy, the top one percent versus the entire 50 percent of the population at the bottom.

That chart is provided and explained by David Stockman in his newsletter Contra Corner. He writes:

On the eve of the Greenspan money-pumping era in Q4 1989, the net worth of the top 1% was about $5 trillion, while the bottom 50% held about $800 billion of net worth. But thereafter came the great Greenspanian bubble, perpetuated with even added gusto by his successors.

Accordingly, during the last three decades the top 1% have gained an additional $40 trillion of net worth, while the bottom 50% have picked up just $2.9 trillion. So the math of central bank fueled asset bubbles is impossible to deny: To wit, the wealth of the top 1% was 6X that of the bottom 50% in 1989, representing reasonably honest capitalism at work. But since then that figure had soared to 12X— owing to the Fed’s relentless flooding of Wall Street with easy money and repeated bailouts.

Of course, the founders of this country knew that given the power over the creation of money, that power would be used to profit the few at the expense of the many. That is why they intended to create a gold and silver-based monetary system, prohibiting the “creation” of money out of thin air.

Too bad we didn’t follow the founders. But you can still get off the paper money and digital printing trains before they arrive at their destination: a place called The Crack-Up Boom!

That’s when everyone realizes at once that the paper and digital money are going bad, and they all try to get off the train at once. That’s usually too late. Better to own gold and silver, especially at today’s preferred prices.