Government Price Controls Won’t Fix Inflation

Despite what some people may think, the cure is worse than the disease!

In one of the 1980 presidential debates between Ronald Reagan and Jimmy Carter, when the Carter administration’s inflation was the undoing of countless American’s prosperity, the candidates were asked about the wisdom of government price controls.

Price controls never work, said Reagan, as the Roman emperor Diocletian demonstrated nearly 2000 years ago.

“I guess I am one of the few persons old enough to remember that,” he said.

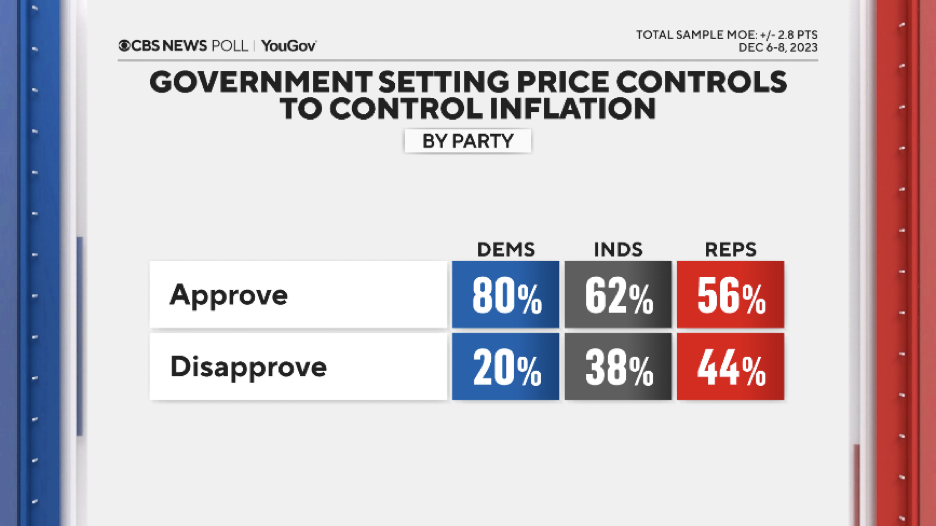

Even fewer people today understand the inevitable failure of price controls. Today majorities of Republicans, Democrats, and Independents alike approve of the use of government price fixing to control inflation.

Here’s the bad news in response to a new CBS News poll to the question, “To try to control inflation, would you approve or disapprove of government price controls – that is, laws that limit the amount that companies can raise prices or charge for products and services?”

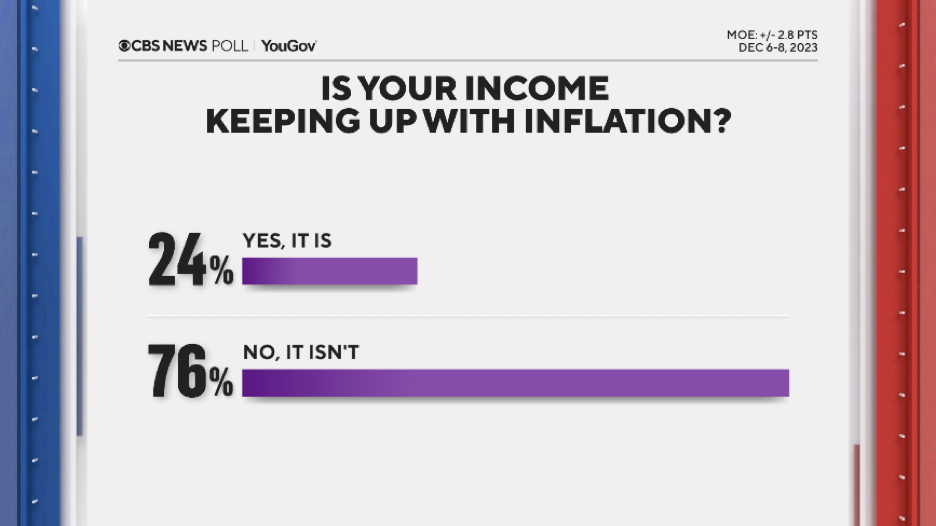

Unfortunately, when people feel that they are falling further and further behind financially, they are most susceptible to snake-oil solutions like government price fixing. And people today are certainly feeling that they are slipping backward financially.

When people ask the government to “do something” about inflation, they seem to forget that the government already did do something about inflation: it created inflation in the first place!

Price controls aren’t about controlling prices. Prices have no volition of their own. Instead, price controls are about controlling people. They forbid free people from engaging in noncoercive commercial activities. Instead, politicians institute price controls to wreak their economic toll by creating either surpluses or shortages.

Government bureaucrats and bureaucrats have no special knowledge of the ever-changing conditions of supply and demand at any given moment. So, when they set prices artificially, prices that aren’t free to move on their own, they are bound to be either too high or too low. If they set prices too high surpluses result. That is because producers attracted by the inordinately high prices produce more, while the inordinately high prices drive buyers to alternatives.

If they set prices too low, shortages result. Producers who can’t make a profit cut back on production, while buyers buy more at artificially low prices.

Shortages or surpluses. Empty store shelves touting nice, low prices, or government warehouses with mountains of surplus government cheese. Take your pick.

What does all this have to do with owning gold? Everything. We live in a world in which Fed bureaucrats believe they can set the price of money. That is what interest rates are, the price of renting or borrowing money. If the bureaucrats set interest rates artificially low, bubbles result. Bubbles in home prices, bubbles in bonds, bubbles in stocks. If they set interest rates too high, the bubbles they create pop, leaving behind unemployment, recessions, and depressions.

If they print a lot of money, inflation results. If the money supply dwindles, deflation becomes a risk. Either way, instead of relying on real conditions of supply and demand and letting prices move organically, smoothing out distortions by reacting to change, our money exists at the whims and caprices of monetary bureaucrats who have not distinguished themselves from being right about anything. Instead of a gold standard, James Grant says, we are living on a Ph.D. standard.

Instead of the reliable money of the centuries, we are relying on fiat money, the unreliable money of the centuries. And that is no place to be in volatile times.