The Dollar in Three Easy Pictures

It’s an easy story, the future of the US dollar. So easy in fact, that we think we can tell it in three simple pictures.

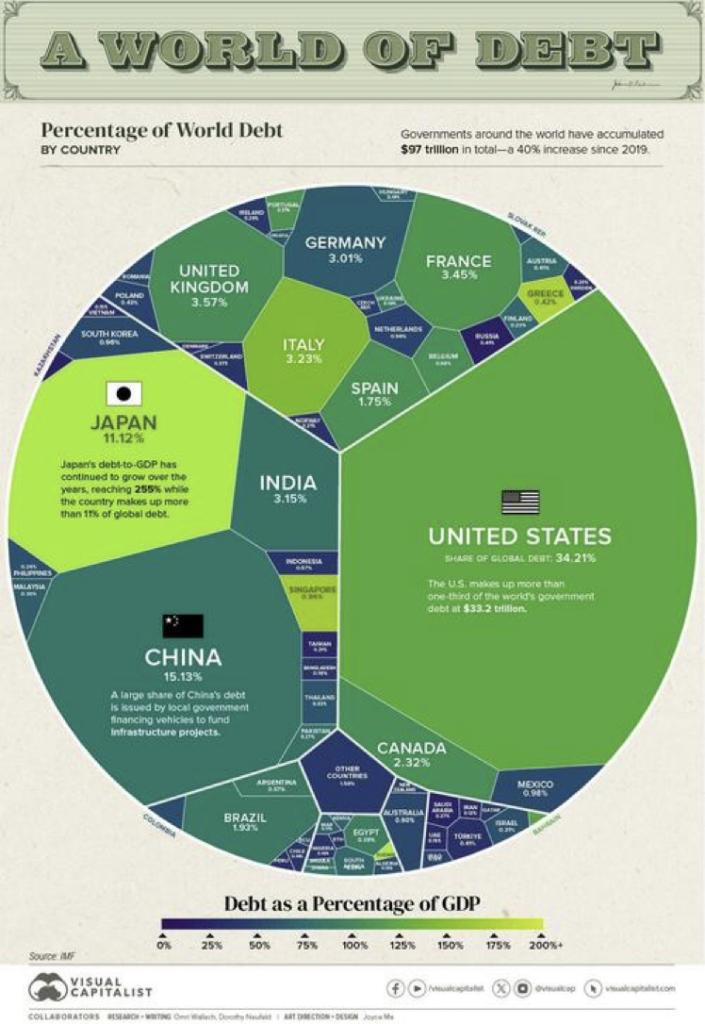

First of all, the US is the biggest debtor in the world, the biggest of all time. Take a look at the first picture from Visual Capitalist:

The US is the world’s biggest debt by far, responsible for more than a third of the world’s $97 trillion national government debt. It can’t pay this debt back in an honest, reputable way.

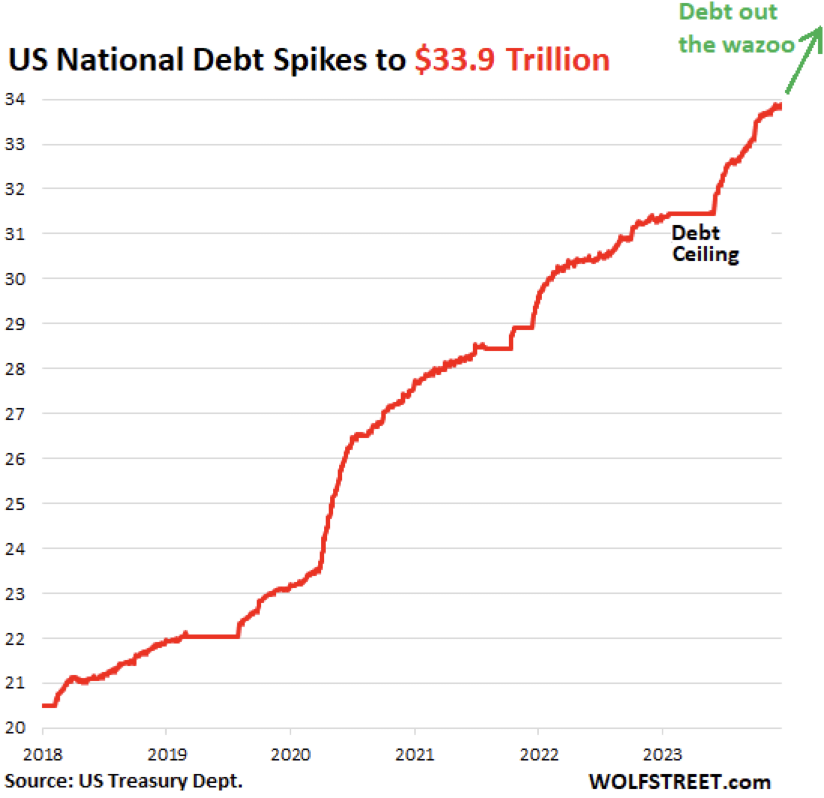

Now the second chart, this one from Wolf Street. It calls this chart Debt out the Wazoo! That couldn’t be more accurate:

It depicts how fast US debt has been growing, especially since 2020. And it is not slowing down. Washington ran the biggest monthly deficit in history in November, $317 billion in a single month. How come so much red ink? Was there a massive shortfall in tax revenue? No. Revenue was up 9 percent. The problem is spending, which was up 18 percent. That is the kind of unmoored financial management that goes on in banana republics.

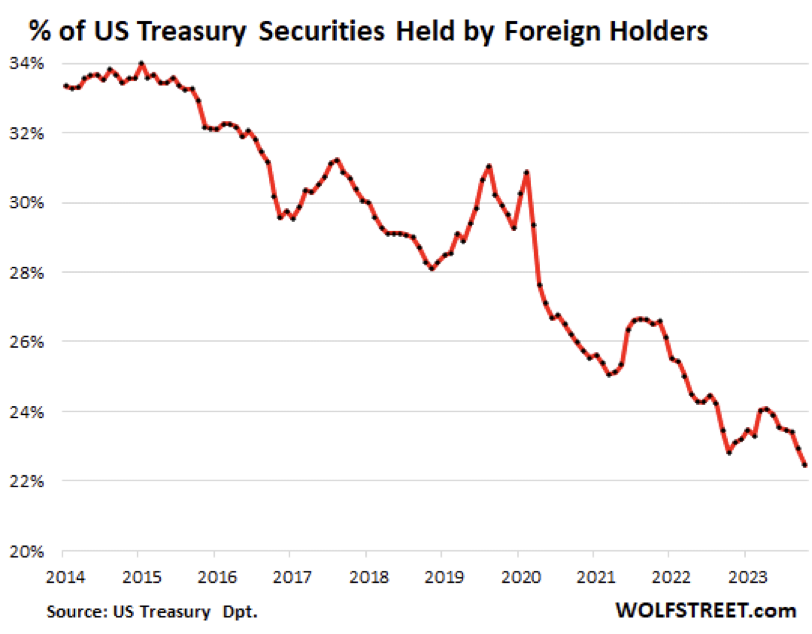

And our third chart, also from Wolf Street. It shows that foreigners are losing their appetite for US government debt. Why? In part because they know that when the US bonds they buy mature, they will be paid back in dollars of sharply reduced purchasing power.

And that is the story in three easy pictures, a story that answers the question of dollars or gold?

Any other questions? Call (602) 633-8315 to speak with a Republic Monetary Exchange gold and silver specialist to get your questions answered!