The Money Boom

Here is an illustration from a Wall Street Journal opinion piece by John Greenwood and Steve H. Hanke (2/21/21) called “The Money Boom Is Already Here.”

It shows Washington pumping a lot of money into the canyons of Wall Street. The sub-headline reads, “Since February 2020, the M2 supply has increased 26%—the largest one-year jump since 1943.”

We are glad the nation’s largest financial paper finally took notice of the money bubble. We have been writing about the growth of the money supply pretty much continuously, including:

A GIFT TO INVESTORS 2021-2-20

GOLD ALWAYS WINS IN THE END! 2021-2-9

23.6 PERCENT OF ALL US DOLLARS WERE CREATED IN THE LAST YEAR! 2020-10-18

THE NEW STAGFLATION DECADE! 2020-9-13

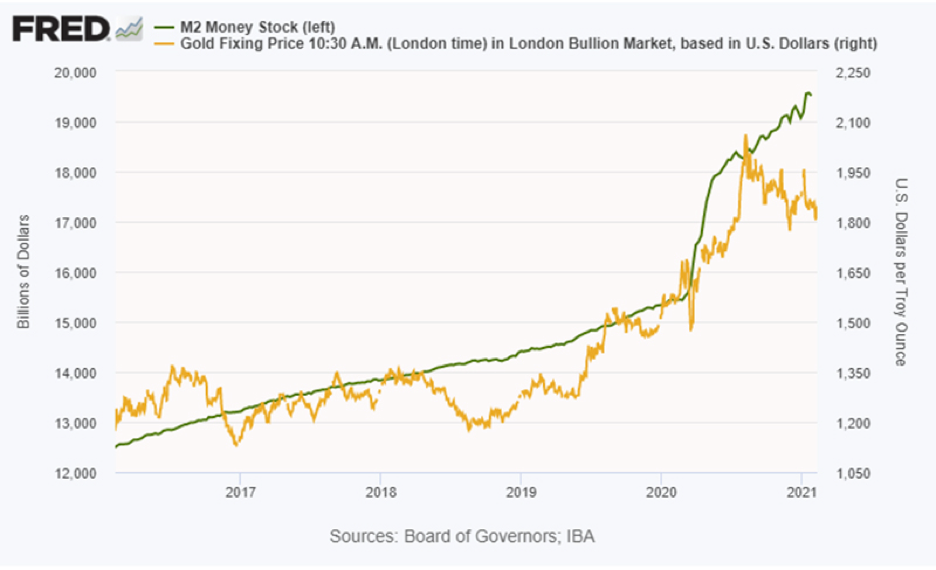

There have been many others. Here is a chart we published earlier this month showing the way gold tracks the increasing money supply.

We commented, “If appears now that gold has some catching up to do.”

Greenwood and Hanke write, “Speculative manias are in the air, as evidenced by the recent price surges for bitcoin, a digital asset with a fundamental value of zero, and GameStop, a declining retailer. Along with the other economic trends—a strong recovery, surging commodity prices and an uptick in inflation—those asset bubbles have a clear cause: the massive expansion of money and credit.

“Yet America’s fiscal and monetary masters are turning a blind eye…

“The looming danger for the economy isn’t only that the monetary printing presses have been in overdrive since the pandemic began, but also that they are already set for the same in 2021. A monetary surge for this year is locked in…

So we already know that the money supply will likely increase by at least another $2.3 trillion over the current year. In other words, even without any new lending or further purchases of securities by banks, the M2 money supply will grow by nearly 12% this year. That’s twice as fast as its average growth rate from 2000-19. It’s a rate that spells trouble—inflation trouble.”

The great economist Ludwig von Mises had an evocative name for the end stages of what Greenwood and Hanke call “the money boom.”

He called it ‘The Crack-Up Boom.”

“But then finally the masses wake up. They become suddenly aware of the fact that inflation is a deliberate policy and will go on endlessly. A breakdown occurs. The crack-up boom appears. Everybody is anxious to swap his money against ‘real’ goods, no matter whether he needs them or not, no matter how much money he has to pay for them. Within a very short time, within a few weeks or even days, the things which were used as money are no longer used as media of exchange. They become scrap paper. Nobody wants to give away anything against them.

“It was this that happened with the Continental currency in America in 1781, with the French mandats territoriaux in 1796, and with the German Mark in 1923. It will happen again whenever the same conditions appear. If a thing has to be used as a medium of exchange, public opinion must not believe that the quantity of this thing will increase beyond all bounds. Inflation is a policy that cannot last.”

Do not wait for the Crack-Up Boom to appear to start buying gold and silver. Take steps to protect yourself and your hard-earned wealth today before it is too late.