A Gift for Investors

Gold on sale, just as inflation returns!

It is like a gift from the gods, a smile and a nod from the fates, or maybe just a fortunate coincidence. Whatever you call it, gold is on sale at the least likely time – just when inflation is starting to rear its ugly head.

Let us start with inflation.

The evidence in coming in from far and wide that price inflation is beginning to leak out into the consumer economy. It probably did not come as a big surprise to whoever does the grocery shopping in your household, but food prices rose 3.9 percent last year, close to twice the Federal Reserve’s targeted inflation rate.

But we are just getting started.

On Wednesday, the Bureau of Labor Statistics reported that the Producer Price Index jumped 1.3 percent for the month of January. (Try annualizing that!)

It was the biggest monthly increase since December 2009, with the hike led by its wholesale energy component in which prices surged 5.1 percent. Americans working from home may be driving less, but everything they buy depends on transportation, so rising energy prices soon show up elsewhere.

By the way, the consensus of economist for the PPI was that it would show an increase of only 0.4 percent, less than a third of the final number.

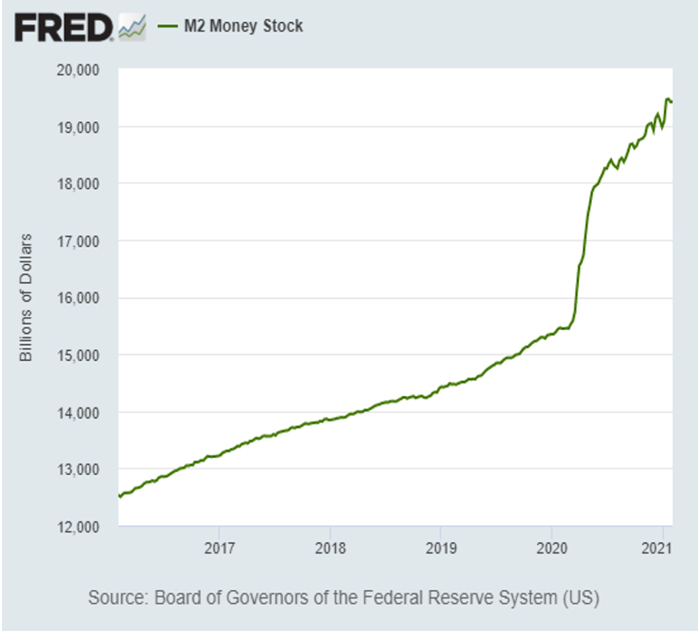

Meanwhile we cannot resist showing you the explosive rise in the US Money Supply once again.

M2 has risen by more than 25 percent over the last 12 months! As someone said, “All that money has to go somewhere!”

And it appears that it is about to go everywhere!

Vehicles, homes, even interest rates are rising to reflect the diminishing value of the dollar. While there is ample additional evidence of prices beginning to rise rapidly, one of the most historically sensitive indicators of rising price inflation is copper. Copper has almost doubled since its March low.

When prices rise across the economy it is an indication that the currency is failing as a store of value. That should be no surprise. It is the Federal Reserve’s explicit policy intent for the dollar to fail as a store of value. When the rate of its failure suddenly increases or rises above a threshold that is considered a nuisance, people begin to trade their dollars for a superior store of value.

Gold!

That is why we are grateful that the market has conspired to give us a break in gold prices – short-lived though it may be – just as prices across the consumer economy are beginning to rise. Or as we have said, as inflation begins to rear its ugly head.

Here is a chart of the gold bull market that began by some estimations two and a half years ago, in August 2018.

As you can see the bull market has paused several times along its powerful climb to catch its breath, including in both the spring and fall of 2019; with the COVID panic in the spring of 2020; and again, now when generalized price inflation is returning.

Because reversing the fundamentals of rising debt and reckless money printing is not even a subject of conversation in Washington or at the Fed, we think this juncture presents gold buyers an attractive acquisition opportunity.

For more information, contact your Republic Monetary Exchange gold and silver professional.