Gold Will Always Win in the End

The Labor Department reported Wednesday (2/10) that in the 12 months through January the Consumer Price Index rose 1.4 percent. For the month of January, the CPI was up 0.3 percent.

The mainstream media, whose personnel do not really know much about these things, chose to report this as news that inflation was “benign.” We know from long experience that lawmakers and policymakers view it the same way:

“Inflation means rising consumer prices. If consumer prices aren’t rising, there is no inflation.”

It is too bad they think this way. Their thinking is a source of confusion and policy error.

The economists of an earlier age were not so easily fooled. The defined inflation as an increase in the supply of money and credit. If money and credit were expanding, it was called inflation; if money and credit were contracting, it was called deflation.

Individual prices rise and fall for many reasons, as they understood. They knew that a rising price is not inflation. It is simply a rising price.

If the price of oranges goes up because of a freeze in Florida, that is not inflation.

If recent technological advances make new electronic miracles, like flat-screen HDTVs, more affordable, that is not deflation. It is a drop in prices in one sector.

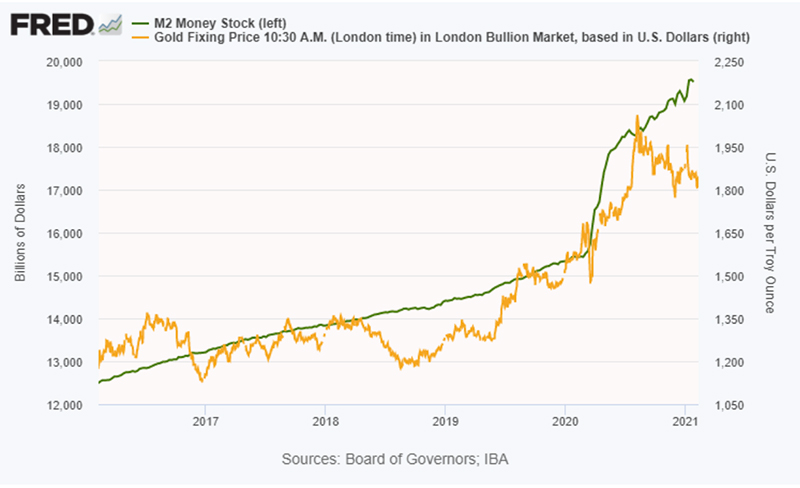

This chart should be an eye-opener. It shows M2, a widely used measure of the US money supply over the last five years (the green line). As you can see it has exploded to the upside. M2 has increase 26 percent over the last 12 months.

Nothing about that is “benign.”

In the words of market commentator John Rubino, “All that extra money has to go somewhere.” If the monetary authorities increase the supply of money and credit, prices will rise somewhere. Exactly where it shows up first depends on many factors. The inflation could show up in dot-com stocks (the late 90s); it could show up in housing prices (in the first decade of the 2000s); it could show up in financial assets like the stock and bond markets (now).

We have included the price of gold in this chart. Because gold is a monetary commodity and reflects the destruction of the dollar’s purchasing power, over time growth in the money supply pulls gold along with it. If appears now that gold has some catching up to do.

But just because the price of bread is not going through the roof today, don’t let the mainstream media or politicians tell you that there is no inflation or that the currency isn’t suffering devaluation. That is because sustained price increases in any of those other places throughout the economy reflect state meddling or corruption of the supply of money and credit.

Governments engage in these practices for several reasons. They may wish to spend more and hide the increased taxation of the people by simply printing the money. They may wish to devalue unpayable government debt by devaluing the unit of account of that debt and pay it down with cheaper money. Or they may wish to subsidize powerful financial interests and cronies with an inside line on monetary interventions.

Sometimes they may wish to do all those things at once. But eventually the debauching of the money will show up in the price of bread… and in the price of everything else.

This discussion explains why governments hate gold. They cannot print more gold or wave a policy wand and double the amount of gold in government warehouses. Gold provides financial discipline on states and politicians.

In a showdown between corruptible government money and gold, gold always wins.