Silver’s Monetary Role

The extreme divergence in the world markets between “paper” precious metals and real physical gold and silver continues. “Paper” precious metals are nothing more than the purported paper title to gold and silver that promise to deliver at some future date.

The high premiums on physical silver suggest that in our present economic circumstance of high inflation the world is once again awakening to silver’s role as a monetary commodity. Often, especially in normal times of growth and economic resiliency, the industrial demand for silver dominates its dual role as money as well. Silver has actually been used as money in more times and places throughout history than gold itself.

See our recent post Market Condition Alert! Gold and Silver Shortages!

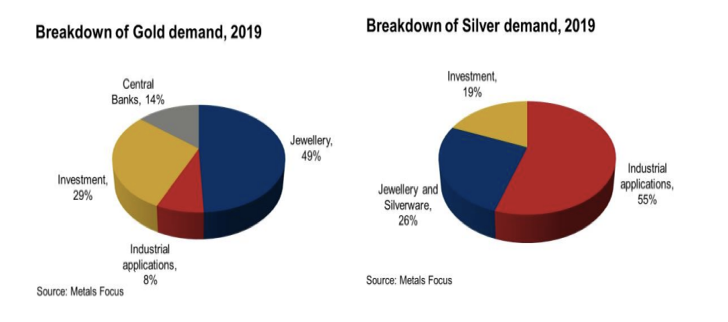

The graph of gold and silver demand from pre-pandemic 2019 shows investment accounts for 19 percent of silver demand. But during times of economic distress, silver’s monetary role grows more prominent.

And that is exactly what the divergence in paper silver prices and real physical silver prices suggest, that investors want silver for protection from state currency mismanagement and fraud. And they are willing to pay for it.

Meanwhile, a new report designed to examine its long-run benefits ratifies the view that silver belongs in one’s investment portfolio. From a news release by the Silver Institute, an international non-profit trade association:

OPTIMAL INVESTMENT PORTFOLIO SHOULD INCLUDE 4-6 PERCENT SILVER ACCORDING TO NEW REPORT

Silver Can Be a Strategic Asset Within Efficient Multi-Asset Portfolios

(Washington, D.C. – September 29, 2022) – Silver as a distinct asset class should be considered as a strategic investment allocation within a global multi-asset portfolio, according to new research by Oxford Economics, a leading independent economic advisory firm. The firm finds that investors would benefit from an average 4-6 percent silver allocation within their portfolio, significantly higher than current holdings of silver by most institutional and individual investors.

The entire report can be read HERE.

Silver’s volatility is storied. Many remember how dramatically it outpaced gold during the last stagflation decade. When the world turns to silver for monetary protection, its performance can be stellar.