Looking for a Place to Hide?

May We Suggest…

A Drudge Report headline the other day read, “Wary Investors Struggling to Find Places to Hide…”

That’s because stocks have been taking a pounding.

It linked to a Wall Street Journal piece titled, “Wary Investors Struggle to Evade Market Tumult”:

“The S&P 500 has fallen 25% this year, with all three major U.S. stock indexes heading toward their worst annual performances since 2008. Bonds haven’t provided a ballast to portfolios—the Bloomberg U.S. Aggregate bond index is on pace for its worst year on record going back to 1976, down 16%.”

Altogether, the markets are “leaving nervous investors questioning where to hide from further pain.”

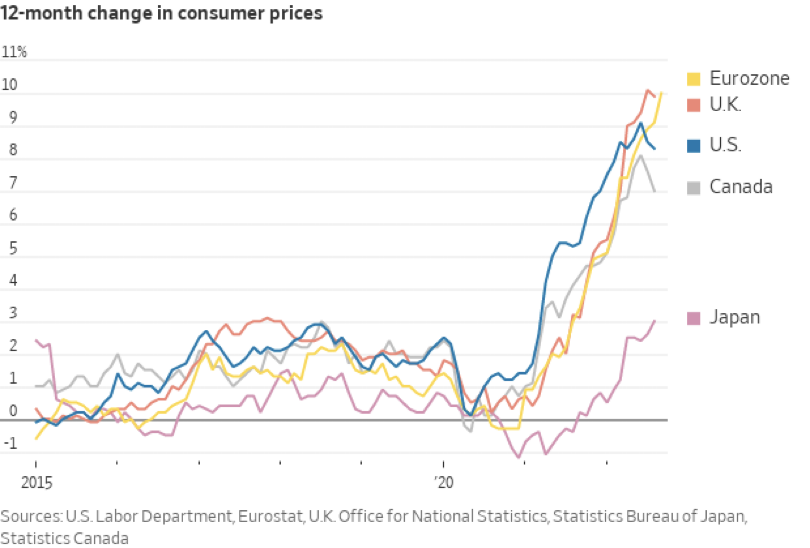

Well, we feel their pain. But it can’t be helped. The Fed has raised interest rates five times this year to increase the cost of borrowing money. It is trying to put the inflation genie back in the bottle. So far, it hasn’t accomplished much other than spewing all that red ink around the stock and bond markets.

The higher rates have driven the dollar up and have driven yield-hungry Wall Street speculators and hedge funds to liquidate gold mutual funds and ETFs for 12 consecutive weeks.

But while they are leaving paper gold instruments, real people are buying real gold and silver. They are concerned about the continued viability of the dollar and Biden-nomics.

As we have explained (Market Condition Alert! Gold and Silver Shortages!), the price of “paper” gold and silver has completely diverged from the price of real gold and silver. High premiums on gold and silver bullion and coins mean that the real price of physical gold and silver is not taking the pounding that stocks and bonds are taking.

So, for those seeking refuge from the Wall Street carnage, we say come to us and we will give you shelter from the storm! Speak with a Republic Monetary Exchange gold and silver specialist today.