Will Powell Save the Dollar?

Don’t bet on it!

It doesn’t take long to ruin a currency. A little run of double-digit inflation soon has people looking for a better store of wealth.

Like gold and silver.

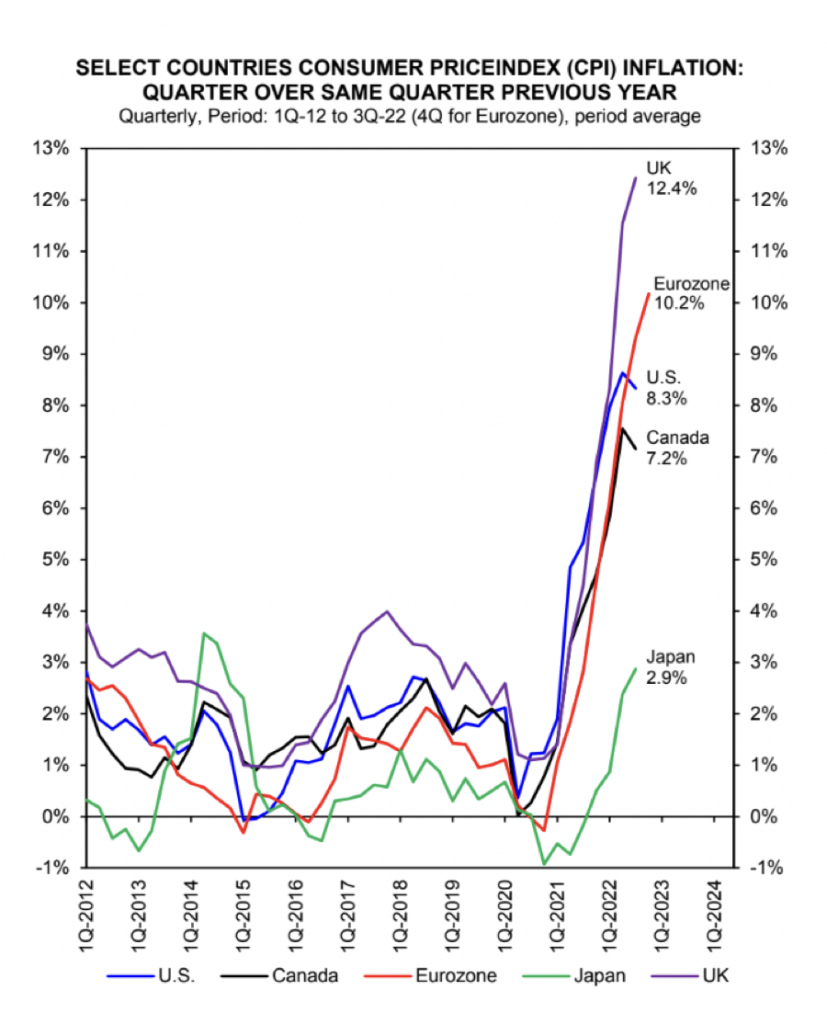

Look no further than at the other central banks of the world. They know the money-printing game as well as Federal Reserve officials in the US do. They run the exact same scam on their own citizen. Take a look at inflation rates in a few other countries:

And those aren’t even the banana republics. Those are what are thought of as the Western bloc nations (yes, including Japan). The inflation rate in Turkey is 83 percent. That’s the highest among the G20 nations. We can’t even be bothered to keep up with the inflation rate in Venezuela. It was somewhere around 120,000 percent, but last year it issued a new currency after knocking six zeros off the old one. So now it may have an inflation rate of 120 percent. But who knows?

It is because central bankers everywhere from Argentina to Zimbabwe know the money printing game so well – they run the scam on their own people all the time – it is because they know the game themselves that they don’t want to be victimized by us running it on them.

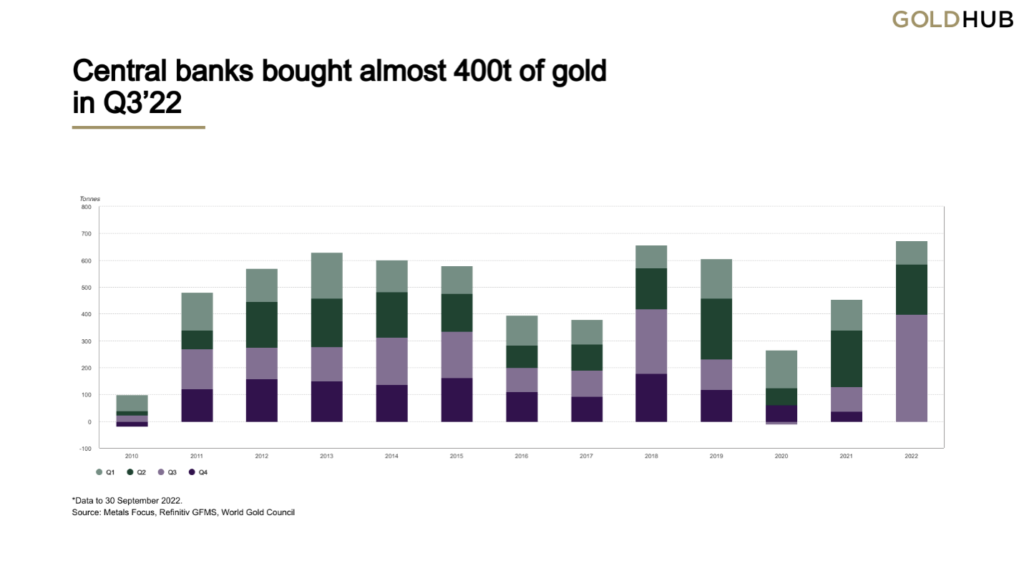

Which is why there is an international movement away from the US dollar. Central banks bought 399 tons of gold in the third quarter this year according to the World Gold Council. That’s almost double the previous record gold purchases.

But isn’t Powell serious this time about wringing inflation out of our monetary system? Well, first of all, he has no intention of ending the practice. He simply wants to destroy the dollar’s purchasing power at a fixed and sustained rate. (By the way, we don’t mind predicting here that the Fed’s target rate for inflation will probably be raised from 2 percent annually to somewhere around 4 percent annually. That will help devalue the otherwise unpayable US national debt.)

Think about it this way. It has been eight months since the Fed saw the light and realized that inflation wasn’t transitory. It’s been eight months since the Fed began raising interest rates. And it has been eight months of Hamlet-like soliloquies and halfway measures from Powell. But inflation rages, nonetheless.

Indeed, Powell’s record of money-printing puts all the prior Fed chairmen to shame, as David Stockman describes:

When Powell was sworn in as Fed Chairman in January 2018, the Fed’s balance sheet stood at $4.439 trillion, the work of 15 chairmen over 104 years.

When he finally blinked in March 2022 and began to reluctantly raise rates from the zero-bound where they had been hideously impaled, the balance sheet stood at $8.937 trillion.

So the math of it speaks a thousand words. The gain during Powell’s first 50-months was $4.298 trillion, a figure larger than the money-printing total of all of his predecessors combined!

It makes no more sense to think that the chairman who oversaw a lightning-like doubling of the Fed’s balance sheet will now get it all under control than it does to believe that the wolf who has been raiding the henhouse has suddenly become a vegetarian.

It doesn’t take long to ruin a currency. That is why central banks are selling dollars at today’s highs to buy gold at today’s bargain prices.

We recommend you do likewise. To learn more, speak with a Republic Monetary Exchange gold and silver professional today.