When the Government Stole the People’s Gold!

How the U.S. ended the Gold Standard!

April 5 was the 90th anniversary of a day that this present generation of Americans should remember: the day the government stole the people’s gold.

Here’s a description of the event from Jim Clark’s important book REAL MONEY FOR FREE PEOPLE: The American Gold Story.

Franklin Roosevelt was elected president in a landslide on November 8, 1932. He was inaugurated on March 4, 1933.

On March 6, the new president ordered a nationwide “bank holiday.” During the closure, banks were forbidden to pay out any gold or engage in foreign exchange. Four days later, on March 10, Roosevelt issued another order extending the gold and foreign exchange prohibitions, except for those who had obtained a special government license.

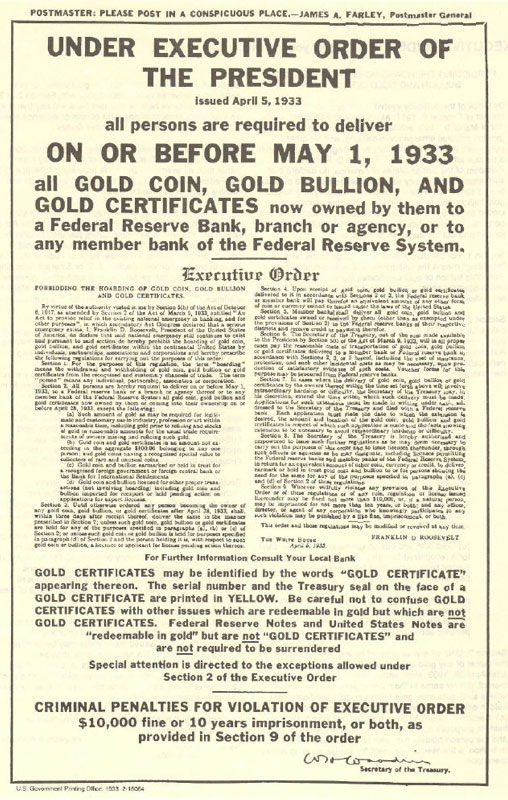

On April 5, the President issued yet another decree, this one outlawing “hoarding,” and confiscating the American people’s gold. Among the limited exceptions to Executive Order 6102 was gold for industrial purposes, art, and rare-coin collections. Otherwise, the American people were mostly forbidden to own monetary gold. They were ordered to surrender gold coins, gold bullion, and gold certificates to the Federal Reserve at the prevailing price of $20.67 an ounce (where it had been for a century) “under penalty of $10,000 fine or ten years’ imprisonment or both.”

The order began by invoking authority under law, including the Trading with the Enemy Act of 1917. America was not at war at the time, so there was no enemy as defined by the Constitution (Article 1, Section gives Congress the sole power to declare war, America’s last eighty years of undeclared wars notwithstanding; there is no means other than a war declaration for the designation of an enemy. That is an important protection of the people, as it prohibits politicians from unilaterally and promiscuously declaring “enemies.”) Because the Trading with the Enemies Act only empowered the president to restrict trade with its enemies in times of war, the administration had already had Congress extend that authority to peacetime with its Emergency Banking Act, which was passed a few days after Roosevelt’s inauguration.

The executive order then proclaimed a national emergency:

… I, Franklin D. Roosevelt, President of the United States of America, do declare that said national emergency still continues to exist and pursuant to said section do hereby prohibit the hoarding of gold coin, gold bullion, and gold certificates within the continental United States by individuals, partnerships, associations and corporations.

It concluded by prescribing penalties:

Whoever willfully violates any provision of this Executive Order or of these regulations or of any rule, regulation or license issued thereunder may be fined not more than $10,000, or, if a natural person, may be imprisoned for not more than ten years, or both; and any officer, director, or agent of any corporation who knowingly participates in any such violation may be punished by a like fine, imprisonment, or both.

On April 18, Roosevelt halted the export of gold. A farm relief bill passed on May 12 included an amendment that allowed the president to change the dollar-gold price.

Congress got into the act on June 5 with a resolution that abrogated both government and private gold contacts. It is worth lingering on this for a moment because the move was a frontal assault on the right to contract. Seeking to protect themselves from a long history of governmental monetary usurpations and abuse, many citizens sought the assurance of entering contracts that specified the party’s obligations in terms of specified weights of gold instead of just dollar amounts. As long as $20.67 remained the gold price, contracts could still be settled in the convenience of dollars without one party being fleeced by receiving payment in dollars of reduced value. But the new measure nullified those agreements, allowing debtors including the federal government to ignore the obligations, and pay creditors in cheaper, devalued dollars only. It was a windfall not just for private debtors, but for the federal government. The result was that creditors who had gold contracts were swindled by $3 billion, about $78.5 billion in today’s dollars. Conscientious individuals who had taken measures that were both prudent and common at the time were forced to accept payment in the new and capriciously established value of the dollar.

The dollar has never been the same since. And if you think that was a calamitous day for American freedom and prosperity, wait until Washington rolls out its new Central Bank Digital Currency.

That is coming. Protect yourself while you can with gold and silver.

REAL MONEY FOR FREE PEOPLE tells the entire American gold story in a clear and easy-to-understand way! And because it is information you need for the challenging times coming our way, we want you to have a copy absolutely free!

Just stop by Republic Monetary Exchange and let us give you a copy of REAL MONEY FOR FREE PEOPLE!

No cost. No obligation.