When Gold and the Dollar Parted Ways, Part II

Looking for Part I? Click Here.

It was a fateful decision fifty years ago today, one that spelled a slow unwinding of the US dollar’s value and undermined America’s unique financial position in the affairs of the world.

That it has taken fifty years is a testament to the might that America’s free economy had achieved on an honest monetary standard. But as we have pointed out, America’s productive engine has slowed and almost stalled since the dollar parted ways with gold on August 15, 1971. To be specific, for the two decades prior to Nixon’s severing the last link of the dollar to gold, US productivity was growing at an average of 3.72 percent a year.

Now, in the binge money printing era of 2007 – 2020, growth has slowed to only about a third that rate, to a mere 1.28 percent per year.

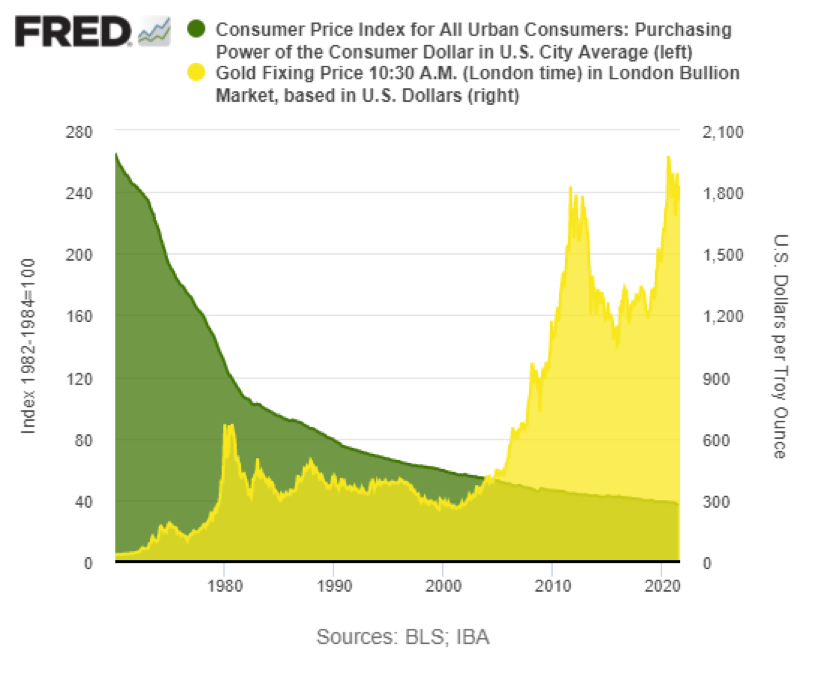

This chart further illustrates the damage done by abandoning gold. It shows fifty years of the collapsing purchasing power of the dollar and 50 years of rising gold prices.

We think the day deserves to be marked as a black-letter day in America. Here are some other observations about this date fifty years ago today.

Thorsten Polleit, the Degussa Report:

The monetary system in the world was fundamentally changed in one fell swoop. In fact, all currencies became non-redeemable paper money, or: “fiat money,” money that can be increased in any amount deemed politically desirable at any moment in time. The preferred method of producing new fiat money is through credit expansion on the part of central banks and commercial banks. Unsurprisingly, chronic inflation came with fiat money: the phenomenon that the prices of goods and services keep rising over time.

What is more, the issuing of fiat money through bank lending causes recurring waves of speculation, bubbles, and financial and economic crises. Most notorious are the so-called “boom and bust cycles.”

David Stockman, Stockman’s Contra Corner:

It is perhaps fitting that on the 50th anniversary of Richard Nixon’s dirty deed in August 1971, the US Senate saw fit to pass a budget resolution that will add $3.5 trillion of additional girth to the nation’s already bloated and unaffordable Welfare State.

William L. Anderson, The Mises Institute:

The collapse of the monetary order in 1971 reflected the massive dislocations and malinvestment of resources that ultimately turned the decade into one crisis after another, and the current economy is facing risks of even greater magnitude. Unfortunately, Keynesians rule the day, just as they did fifty years ago. As Charles-Maurice de Talleyrand wrote of the Bourbons in the years after the French Revolution, “They learned nothing, and they forgot nothing.” One can say the same for the Keynesians. A half-century after The Crisis, Keynesians seem hellbent on creating new crises and printing money to “fix” them.

Steven Forbes, The New York Sun:

We are still suffering today from the baleful consequences of August 15, 1971, when President Nixon ended the convertibility of United States dollars into gold.

If after that fateful day the United States had maintained the average rate of economic growth that it had achieved over the previous 180 years, when it operated under a gold standard, the economy would be at least 50% larger than it is today.

Ponder that for a moment. The median, pre-pandemic American household income in 2019 would have been $100,000, not the actual $66,000.