Wall Street, Bloody Wall Street!

How bad has it been? Pretty bad!

Fed Chairman Jerome Powell says that restoring price stability is “nonnegotiable.”

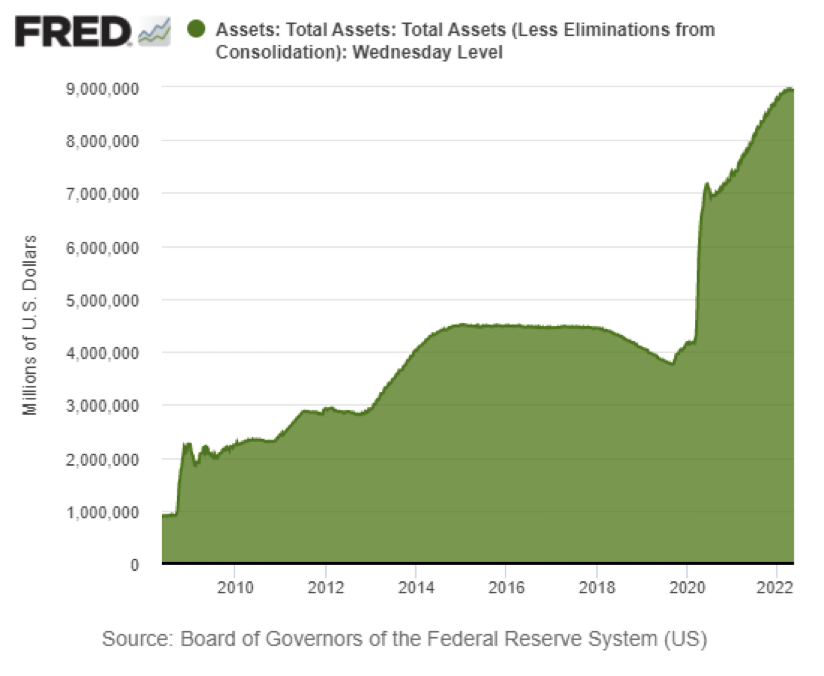

If price stability is so important, why did the Fed blow up the stock and bond markets in the first place? Did they really not realize that the creation of $8 trillion dollars over the last 14 years (shown below) would lead to price instability?

If the Fed has been willing to negotiate away price stability with banana republic-style money printing in the past, why are we being asked to believe that the future of price stability is now nonnegotiable?

We predict that “nonnegotiable” will come back to haunt the Fed the same way “transitory,” its prognosis for inflation has haunted it for over a year.

Can Mr. Powell envision no event, crisis, political uproar, or market calamity that would induce him or his successors at the Fed to once again eagerly sacrifice price stability with printing press money?

We can imagine many such developments. Here’s a shortlist based on the Fed’s history: War, recession, a political or electoral outcome Fed officials desire, stagflation, a pandemic, or a depression. And blood flowing on Wall Street. After all, it was Wall Street money power that created the Fed in the first place to serve their interests.

Already with the blood flowing on Wall Street over the last couple of weeks, we trust the phone lines and text messages from the influential are flying to Washington and to Fed officials screaming the outrage of the Fed’s cronies.

And that’s before this sell-off has even gotten serious.

We’ll just share some news snippets we have collected recently about how bloody it has been:

Yahoo Finance: The S&P 500 slid by 4% on its worst day since June 2020, closing at 3,923.68. The Nasdaq Composite dropped 4.7% to settle at 11,418.15, while the Dow fell by more than 1,100 points or 3.6%….

Ryan Detrick, LPL Financial Chief Market Strategist, told Yahoo Finance Live on Tuesday… that the S&P 500 has fallen for six consecutive weeks heading into this week. “It hasn’t been down seven weeks in a row for 20 years…

Wall Street Journal: Dow Drops More Than 1,100 Points on Recession Fears. Blue chips have the worst day since 2020 as S&P, and Nasdaq loses over 4%.

Wolf Street: Housing Bubble Getting Ready to Pop: Mortgage Applications Plunge amid Holy-Moly Mortgage Rates, Croaking Stocks…

And then there is this list of percentage market losses of well-known stocks from their highs provided by David Stockman. Please note that this list is from May 13 when there was still much more bloodletting ahead:

- Carvana: -90%

- Vroom: -98%

- Rivian: -85%

- Snap: -70%

- Pinterest: -76%

- Netflix: -73%

- Wayfair: -84%

- Chewy: -78%

- Shopify: -77%

- Teladoc: -89%

- Lyft: -77%

- Zoom: -79%

- Palantir: -81%

- GameStop: -80%

- AMC: -84%

- Coinbase: -83%

- Zillow: -81%

- Redfin: -88%

- Compass: -75%

- Opendoor: -82%

- MicroStrategy: -85%

- Robinhood: -87%

- Moderna: -72%

- Beyond Meat: -87%

- Peloton: -90%

- DoorDash: -72%

We recommend you avoid any further risk on Wall Street and move to the safe haven of gold before it gets any worse.

Speak to a Republic Monetary Exchange gold and silver professional today!