Victory Over Inflation?

Right! Wall Street Will Pretend Anything!

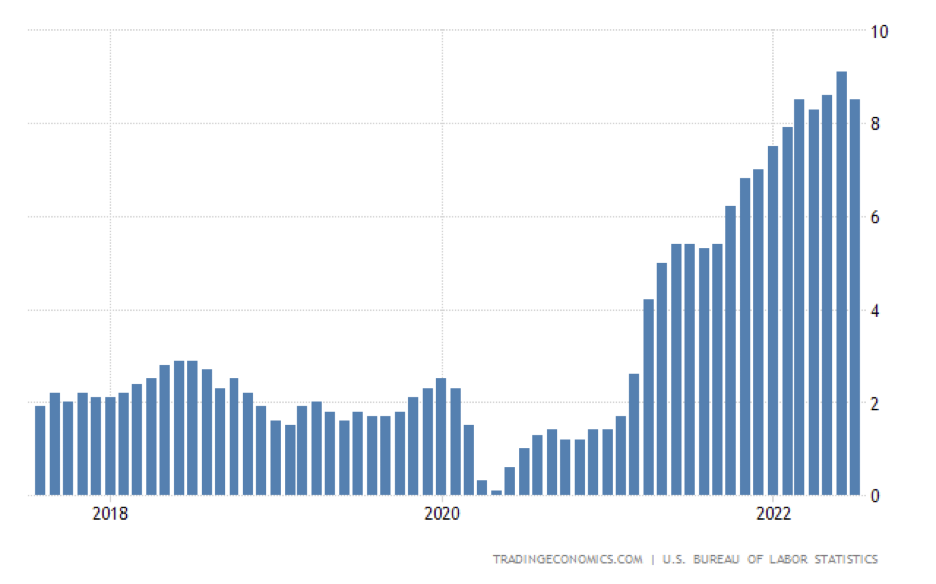

US inflation keeps running hot, with the headline Consumer Price Index for the 12 months ending in July up 8.5 percent.

Lower energy prices contributed to the index easing off from the 40-year high of 9.1 percent reported in June.

Lower energy prices factored into the modestly lower inflation numbers. Overall energy fell 4.6 percent led by gasoline which was down 7.7 percent.

Wall Street treated the lower CPI numbers like a long-term Federal Reserve victory over inflation. Stocks surged across the board. Never mind that an inflation rate of 8.5 percent would have been considered calamitous just six months ago. Indeed, it would have been thought an impossibility a year ago.

DOES THIS LOOK LIKE VICTORY OVER INFLATION TO YOU?

Wearing rose-colored glasses, Wall Street speculators leaped to the conclusion that with consumer prices coming in lower, the Federal Reserve will be less inclined to raise rates or to raise them as much at its September meeting.

More disciplined economic minds would not have reacted to the numbers with the same giddiness demonstrated by Wall Street traders. Defining inflation strictly as an increase in the supply of money and credit, they would not have overlooked the trillions of dollars the Fed stovepiped into the American economy over the last few years. They would have viewed the change in gasoline prices as simply a price change in one commodity, albeit an essential one. And in the absence of a change in monetary conditions, they would have noted that the additional money that consumers were forced to pay for gasoline would be offset by lower savings or reduced spending on other goods and services.

But it would not have changed their calculation of the inflationary shenanigans of the Deep State Money Manipulators. And that clear-eyed assessment of the cause of higher prices could have guided policy changes to corral inflation and return to normal.

Unfortunately, people like Jerome Powell and Janet Yellen are not among those disciplined economic minds of days gone by.

That is why they can’t fix our monetary problems and why you must buy gold and silver to protect yourself.