There is a Lot of Financial Risk Wrapped Up in That Evergrande Burrito!

In China, local government officials are buckling up for what could be a bumpy ride in Evergrande Group’s insolvency.

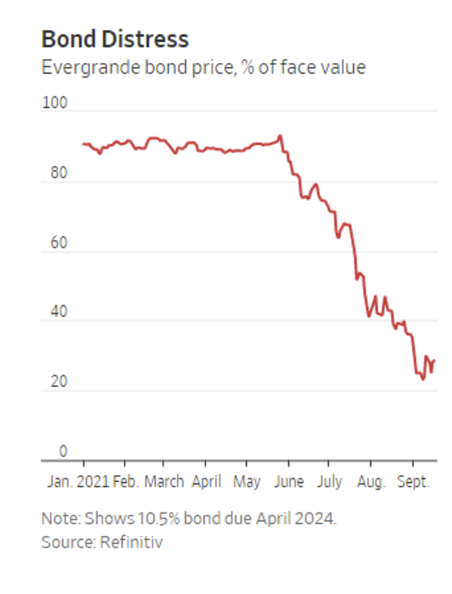

Evergrande is a Chinese real estate developer that, riding the country’s property bubble, has amassed $305 billion in outstanding debt that it is now unable to service.

A default of such a gargantuan borrower has the potential of spreading across the land and indeed beyond China. A substantial amount of the company’s debt is denominated in US dollars. The damage cascades far and wide when a debtor like Evergrande fails to pay its creditors, who then, in turn, are unable to meet their obligations to other companies, suppliers, and employees, who then fail to meet their own payments. The failure of Lehman Brothers figured prominently in the housing market collapse that cost millions of Americans their homes just over a decade ago.

The world’s financial markets are much more highly leveraged today than they were in 2008. And Evergrande is much bigger than.

China’s central party government is calling on local governments and state-owned agencies to be prepared to deal with the fallout from Evergrande’s expected collapse.

Whether such measures will be sufficient to contain the crisis or if it will spread like a Wuhan contagion remains to be seen. But already, the prospects of depressed real estate development in China have set the price of iron ore tumbling.

The crisis comes on the back of the existing Covid economic stress and the Fed’s new inflation burden.

A report from Reuters on Evergrande wraps up with a report from typical Chinese workers on its impact. “At an eerily quiet construction site in eastern China, worker Li Hongjun said Evergrande’s crisis meant he will soon run out of food while Christina Xie, who works in the southern city of Shenzhen, feared Evergrande had swallowed her savings.”

“‘It’s all my savings. I was planning to use it for me and my partner’s old age,’ said Xie. ‘Evergrande is one of China’s biggest real estate companies … my consultant told me the product was guaranteed.’”

Of course, he did.

The only global financial instrument that is not dependent on someone else’s promise or performance is gold. Physical gold that you own yourself has no counter-party risk.

Gold needs no guarantee. It guarantees itself. Speak with a Republic Monetary Exchange precious metals professional today.