The Weaponized Dollar

One more reason the US Dollar is losing market share to gold!

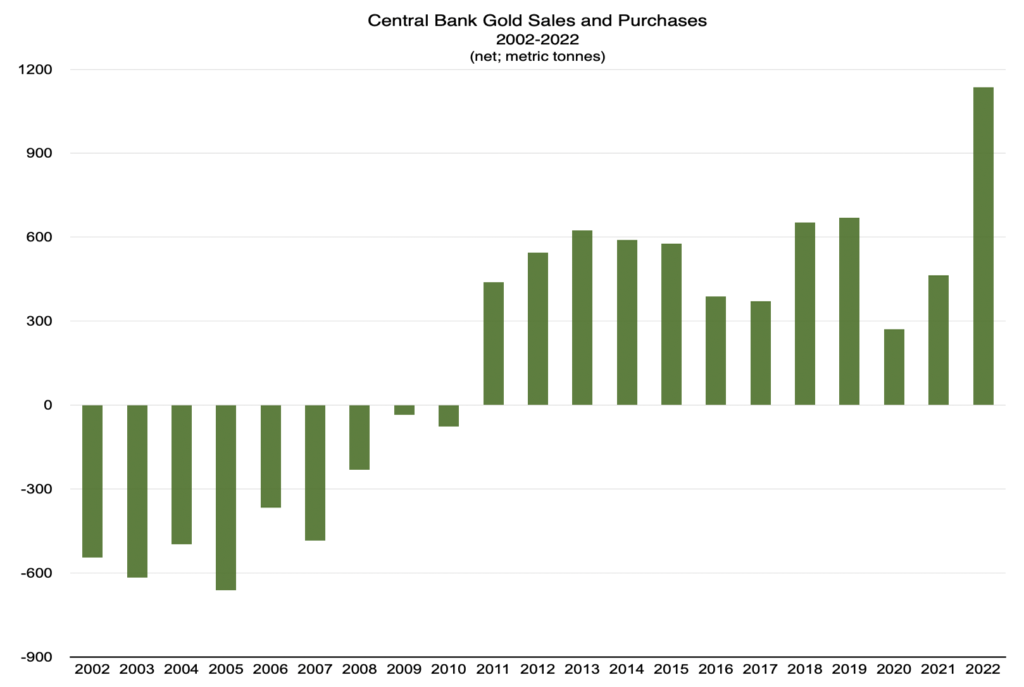

In the three months to the end of March, central banks added 228 tons to global reserves, the highest rate of purchases seen in a first quarter since the data series began in 2000.

CNBC, 5/5/23

How would you like to use a bank that makes you comply with policies that have nothing to do with banking? Maybe it is crazy woke. Or it decides to worship some weird made-up deity. Or maybe you have to agree with its political positions and vote for its candidates.

You would probably move your account somewhere else in a jiffy.

Of course, you would.

It is imperfect, but that is the best analogy we can come up with for the global role of the dollar. Instead of being a neutral currency without fear of favor, the White House gets to decide what foreign nations must do. And if they don’t comply, not only are they frozen out of the dollar economy and trade settlement systems that use the dollar, but sometimes their dollar-denominated assets are just taken from them.

Other countries, even long-standing allies, don’t like it very much. And that is why so many nations are moving central bank holdings out of US dollars and into gold.

That is one of the reasons that world-class billionaire hedge fund manager Stanley Druckenmiller says his only high-conviction trade is betting against the dollar.

It just makes sense. Nobody wants their assets held hostage. But the US dollar has been weaponized. Elon Musk explained it in one terse tweet:

Economist Peter Earle at the American Institute for Economic Research makes the same point: “by weaponizing dollar dominance and permitting expanding mandates to disorient US monetary policy, the dollar’s fate as the lingua franca of world commerce over the long haul may already be sealed.”

No wonder a Financial Times article reports that central banks are headed to gold now and in the future: “An annual poll of 83 central banks, which manage a combined $7 trillion in foreign exchange assets, found that more than two-thirds of respondents thought their peers would increase their gold holdings in 2023.”

It is a trend that is well underway as the following chart illustrates.

It is not good enough to try to reign supreme over other countries. Washington wants to wield the same power over you. Its forthcoming Central Bank Digital Currency is an attempt to have veto power over your personal choices.

Just as the weaponized dollar is driving people out of the dollar and to gold, the appetite of the Deep State Money Manipulators to surveille you should be enough to drive you to the privacy offered by gold.

Speak with a Republic Monetary Exchange gold and silver professional today. He will answer all your questions and help you make a sensible move to the enduring money of the ages.