The Inflation Story Behind the Story

Near Double-Digit Inflation in Phoenix Metro!

If inflation is surprising on the downside, why does gold just keep marching higher?

Could it be there is more to this story than meets the eye?

As usual, the answer is yes.

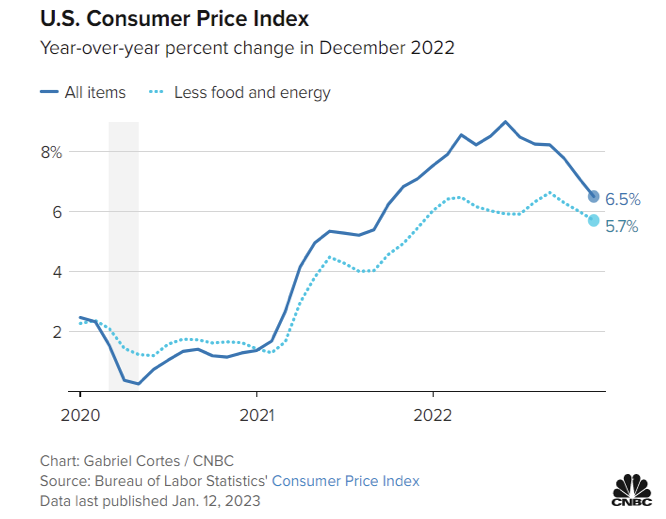

The Consumer price index through December shows prices up 6.5 percent over the past 12 months.

Lower gasoline prices helped keep the overall CPI number from registering higher. The gas component of the CPI for the month of December was down 9.4 percent from the November level. Nevertheless, overall energy costs climbed 7.3 percent over the 12 months.

Food prices registered an increase of 10.4 percent over the year. The shelter index was up 7.5 percent.

Most alarming may be the increase in services, which accounts for two-thirds of consumer spending. The services price index rose 7.5 percent, the most in 40 years.

Lower gas prices are a function of lower crude oil prices globally. Reduced crude demand may be signaling a gathering recession, although China’s reopening of its economy can be expected to push up gas prices higher.

Consumer prices continue to rise at near double-digit rates in the Phoenix metropolitan area. The Phoenix CPI is up 9.5 over the past 12 months.

In the meantime, real average weekly earning for American workers have now trended lower for 21 consecutive months.

Many analysts and Wall Streeters are calling for the Fed to slow or stop hiking interest rates in response to the lower CPI report. The next Fed meeting is at the end of January.

Just as it has been climbing fast since the beginning of November, the gold market greeted the CPI news on Thursday (1/12) by racing ahead $20, sharing the expectation that the Fed will pivot to a policy of reduced rate increases and ultimately higher inflation.