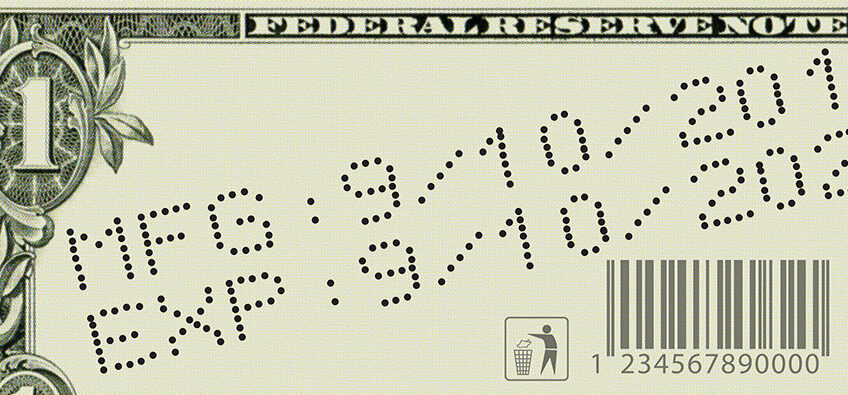

The Dollar’s ‘Sell By’ Date

“The dollar is doomed!”

So says bond market guru Jeffrey Gundlach.

Well, of course, it is.

Throughout history thousands of paper currencies and have come and gone, all failures eventually. It is the common fate of fiat money, money that is decreed to have value by the state, the king, the central bank, or some other institution.

Nobody ever has to decree that gold has value. Its value is intrinsic. That is why gold is the world’s go-to money in a crisis. Politicians come and go. Monetary bureaucrats change places. Governments rise and fall.

But the value of gold and silver endures.

As for the dollar’s long-term prospects, Gundlach, says “I don’t want to be overly dramatic, but I will use the word ‘doomed.’”

In a recent CNBC appearance, Gundlach pointed out that the Fed’s promise that inflation was only “transitory,” has been disproven. Originally, Fed officials suggested “transitory” meant one or two months. ‘Now,” says Gundlach, “transitory is six to nine months.”

“Jay Powell is still wishing, hoping, praying that this [inflation thing] goes way,” Gundlach said.

If Powell wants inflation to go away, all he has to do is stop the digital-dollar printing presses. Just stop inflating. But it still has the pedal to the metal. The Fed is currently printing $120 billion a month, more than $1.4 trillion a year.

Because the Fed doesn’t create any actual wealth – it doesn’t build any houses, bake any bread, or perform any labor – all the new dollars it creates can only take on value by depreciating the value of the dollars we have already. Dollars of less value mean higher prices.

And that, dear readers, is inflation.

Instead of wishing, hoping, and praying that inflation goes away, Chairman Powell should speak to us and learn how to protect himself and his wealth from the results of his own destructive policies.

Meanwhile, with every turn of the Fed’s printing press, the dollar gets closer to its sell-by date.