The CPI Numbers Should be Even Worse

A few words about energy prices and gold!

Consumer Price increases reported through August were higher than most people on Wall Street seem to have anticipated. So, with the latest CPI report, the stock market broke and broke hard. The Dow Jones Industrials fell 1,276.37 points, or almost 4 percent on Tuesday (9/13).

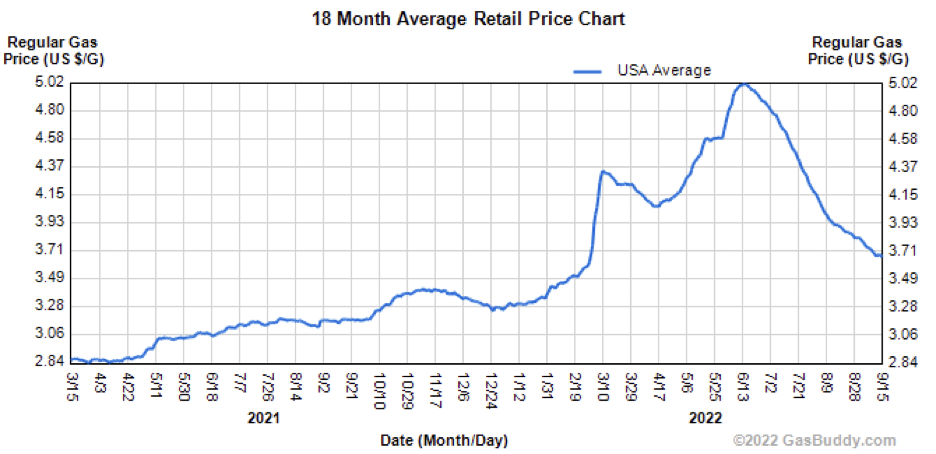

But the CPI numbers would have been much worse if it were not for the fact that gas prices, sky-high at around $5 a gallon last summer, have eased off.

Despite the recent dip, gas prices have spent the last six months much higher than they were for the year before. But even with gas prices falling more than 10 percent in August, and helping moderate overall consumer prices, the CPI was still up a red-hot 8.3 percent for the last 12 months (and in case you missed it, up 13 percent in Phoenix).

But does the fact that gas prices were lower mean that things are getting better on the energy front? We’re afraid not.

Gas prices are down in part because of weaker demand. Americans have meaningfully cut back on their driving, consolidating errands, foregoing trips, avoiding going into the office, and taking any other steps they can to cut down on trips to the gas pump. President Biden has been taking credit for lower gas prices in an unseemly way. If all commercial driving ground to a standstill, gas prices would fall even lower, but it would hardly be a sign of economic resilience.

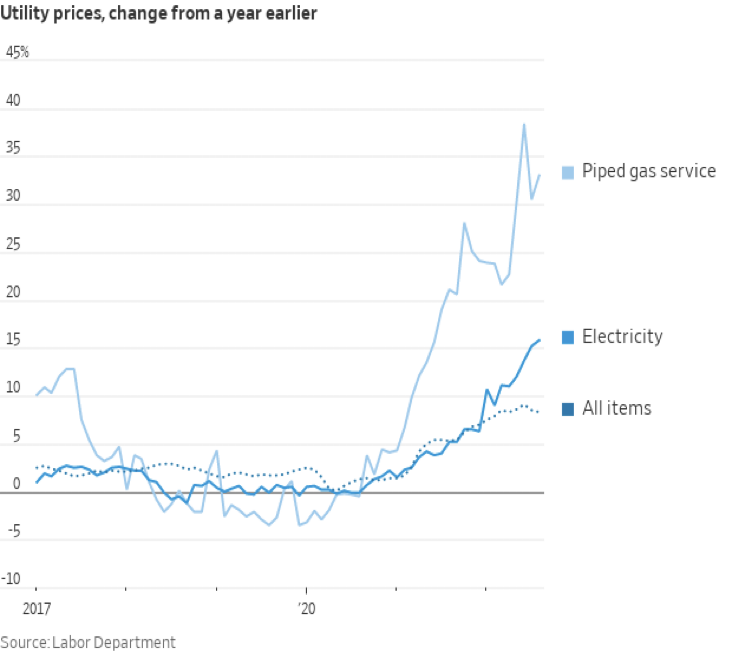

Other energy prices across the economy are still high and, like gas prices this summer, they are having a depressive effect on the economy. More and more Americans are having trouble keeping their energy bills paid.

From the Wall Street Journal:

Gasoline prices may be falling but other energy costs are rising, report Collin Eaton and Jennifer Hiller. Electricity costs rose 15.8% in August from a year ago, the biggest jump since 1981, driven by higher prices for natural gas. About one is six American families has fallen behind on energy bills and owe a collective $16 billion, roughly twice the amount in 2019. That number could rise this winter, a time when energy bills typically increase.

We call this to your attention not only because energy makes the world go around, but because this won’t be the first time that rising energy prices have driven precious metals prices higher. We cite the oil price shocks of 1973-74 beginning with the Arab oil embargo and the dramatic gold and silver bull markets of that decade.

In any case, rising oil prices act as a tax hike on the productive economy and threaten us with the stagflation that accompanied the 1970s.

High US inflation also causes foreign energy producers to resist selling their appreciating resources for a depreciating currency like the dollar. This in turn promises to accelerate the move by the central banks of the world out of the dollar and into gold reserves instead.