The Consumer’s Perfect Storm

The Perfect Storm: Incomes are Lower, Prices are Soaring, and Supply Chains are Fragile

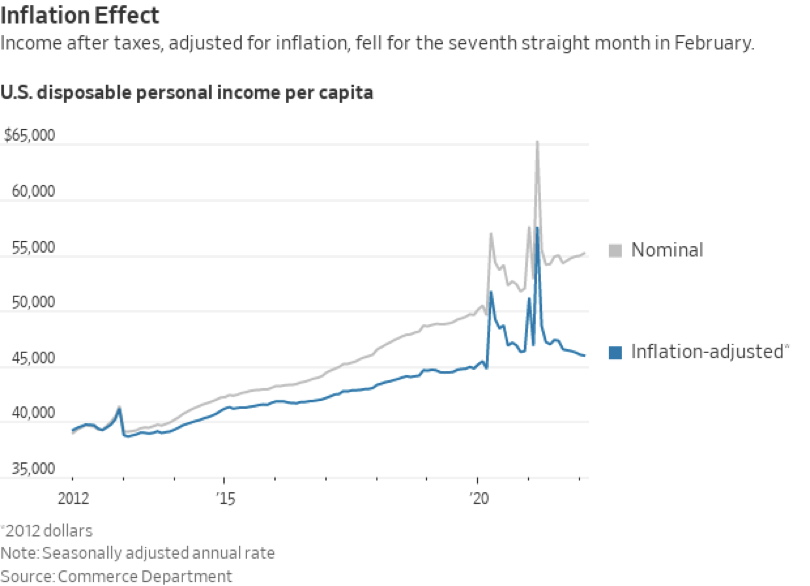

1. Accelerating Inflation Takes Its Toll as American Incomes Continue to Fall

The Wall Street Journal Says: Personal income increased by 0.5% in February over the prior month, a pickup after it was nearly flat in January, but inflation rose more quickly. Income after taxes, adjusted for inflation, fell for the seventh straight month in February to the lowest level since March 2020. The data add up to a picture of the economy growing as shoppers benefit from a strong labor market and rising wages, but see those gains eroded by rising inflation.

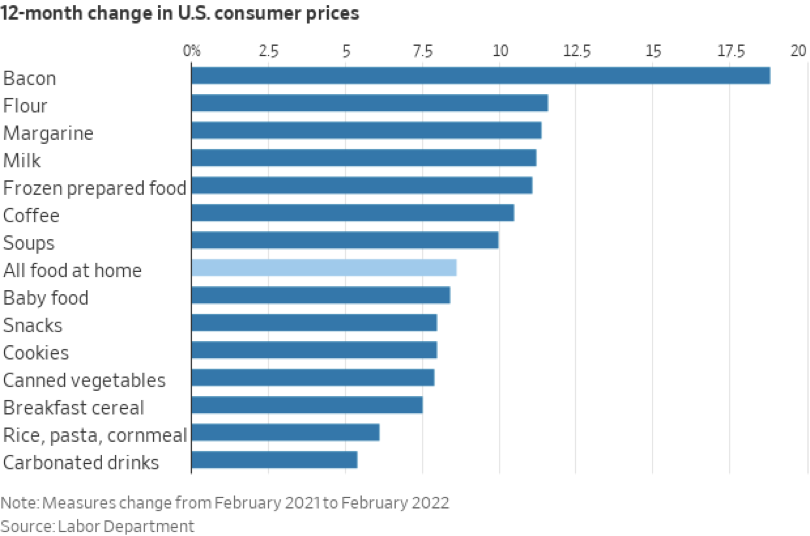

2. Americans Say They’re Feeling Inflation! You Don’t Suppose?

More than three out of four Americans say they have been impacted by inflation, according to a report published by CNBC. Of course, wages are failing to keep pace with rising consumer prices. Last year the survey found that 15 percent of employees regularly ran out of money between paychecks.

Now that number is almost 20 percent.

Gold is the currency of choice in times of inflation and crisis. Whether it is called a “flight to quality” or a “flight to safety,” gold is the world’s money of choice in times of trouble. That’s because of its superior qualities as money, qualities that have outlasted every conceivable type of government and countless paper money schemes, and survived world wars and global depressions.

3. Advice to “Entitled” Generation: Get Used to Shortages.

Are you a member of an entitled generation that has never had to sacrifice? Rob Kapito, the president of BlackRock, the world’s largest investment firm says, “For the first time, this generation is going to go into a store and not be able to get what they want.”

Buckle your seat belts, warns Kapito. “’We have a very entitled generation that has never had to sacrifice,” says the head of the $10 trillion dollar investment management company.

We will only note that a firm the size of Blackrock has had the political clout to object to the monetary policies that have brought us to today’s financial crisis. And one would think the firm had a moral obligation to resist the policies that have plundered their clients’ assets with double-digit inflation.