That’s A Lot of Debt!

When the government’s debt is unsustainable, buy gold!

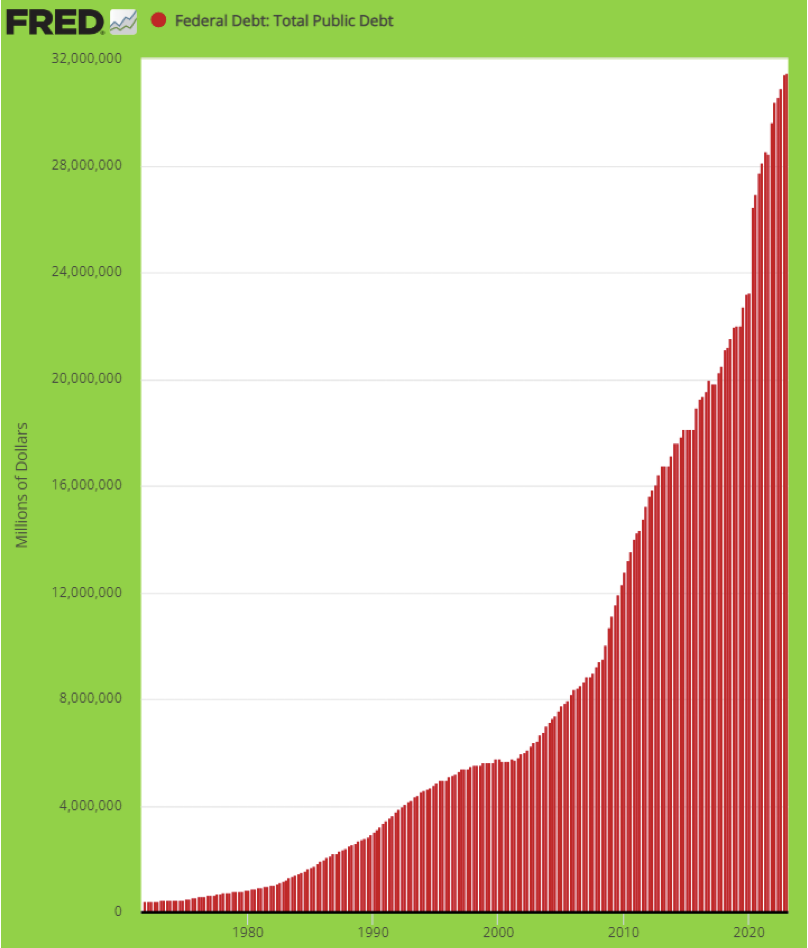

Without the slightest regard for how the Washington debt ceiling debate has evolved by the time this commentary is published, we’d like to put the current size and scope of federal debt front and center.

That is because it is huge. And it cannot be retired by normal, straightforward, and honest means. It can only be contained by the expedient of inflation. In other words, federal debt management will require a massive and ongoing devaluation of the dollar.

The US national debt clock, always worth a visit at usdebtclock.org, tracks the national debt at $31.818 trillion. That works out to $95,016 per citizen, or more than $380,000 for a family of four. Where are the people expected to get the money to pay that?

They are not expected to pay for it. It is unpayable.

The unfunded liabilities of the US government promises it has made to people that are not funded, things like Social Security, Medicare, and veterans’ benefits, amount to an additional $187.996 trillion. That is an additional $560,594 per citizen or $2,242,000 for a family of four. Where are the people expected to get the money to pay that?

They are not expected to pay for it. It is unpayable.

In other words, it doesn’t matter much what Mr. Biden, Mr. Schumer, Mr. McConnell, and Mr. McCarthy do. They won’t do what must be done.

Let us backtrack for a bit. We said the national debt cannot be retired by normal, straightforward, and honest means. We should have said by any such means that are politically feasible. On the other hand, Senator Rand Paul has proposed a solution that is straightforward but is not politically feasible. He proposes capping total spending, cutting 5 percent of the total budget every year.

From The Hill:

Under his [Paul’s] plan, if government spending continues at its current rate, an automatic $302 billion cut would take effect in 2024 and another $241 billion cut would take effect in 2025 — amounting to a total of $545 billion in cuts over the next two years.

Paul says his proposal would balance the budget by fiscal 2028 if the government adhered to its caps.

It would also mandate that growth in federal outlays may at no point exceed the growth in revenue from the previous fiscal year.

Senator Paul’s plan is not the only one. There are other workable alternatives to bring spending into control. None of them has the slightest chance of being enacted. Yet if there are not real, substantial cuts in spending, the debt will have to be repudiated or inflated away.

The pain would be much less under Senator Paul’s plan. The inflation alternative is capable of destroying the Republic and ruining the culture, or such culture as we have left.

In either case, your dollars will become worth less and less until they become worthless.

But your gold and silver will become worth more and more. You might say that it will become priceless in terms of dollars.