Temporary Inflation

The Federal Reserve Board held its regular two-day monetary policy meeting this week (4/27-28), after which it issued its regular post-meeting statement:

“Inflation has risen,” it read, “largely reflecting transitory factors.”

Transitory? Where have we heard that before?

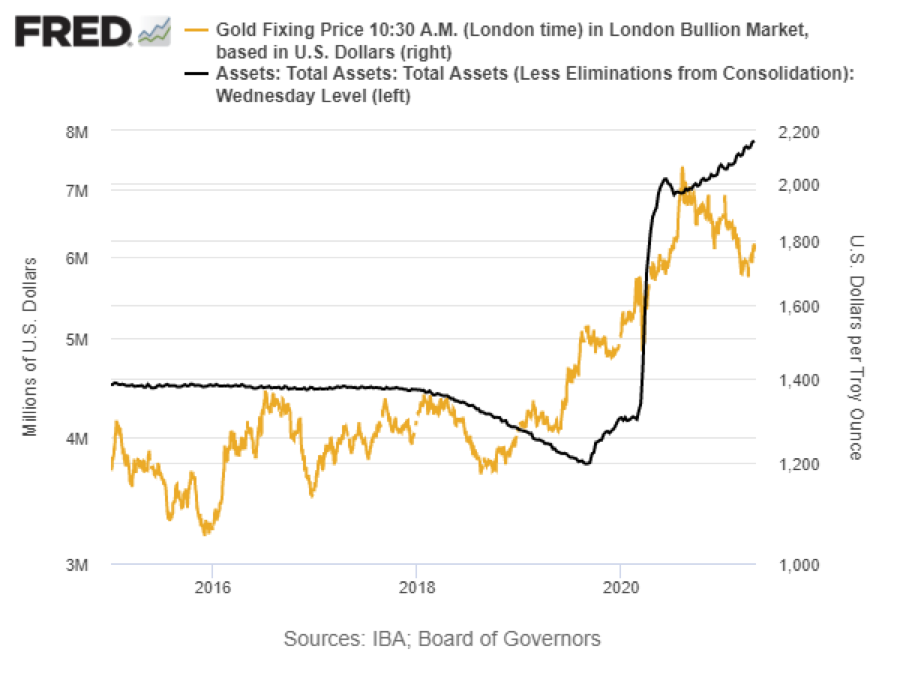

The Fed has created $3.6 trillion out of thin air since the January 2020. All that money must go somewhere. Monetarists like Milton Friedman have maintained that it could take many months for newly created money to work its way into prices in the consumer economy. Initially it was seen levitating stock prices and suppressing interest rates. Now we see it in the price of houses, groceries, and other commodities.

By what theory can this be called temporary? Typically, when consumer prices begin to rise, people and businesses begin to anticipate still higher prices ahead. They change their spending habits and pricing policies accordingly. Eventually prices begin to climb even faster than the rate of money printing.

The Fed decided to keep interest rates near zero. And to making the “transitory” talking point even more absurd, it announced that it will continue purchasing bonds at the current rate of $120 billion a month.

Chairman Jerome Powell held the regular post-meeting press conference during which he insisted that ““an episode of one-time price increases as the economy re-opens is not the same thing as, and is not likely to lead to, persistently higher year-over-year inflation.”

Okay. This is the Fed that misses all the big turns in the economy and does not ever seem to recognize the bubbles it has inflated itself – until it is too late, and the damage has been done.

Here, for example are quotes from interviews of former Fed Chairman Ben Bernanke. Bernanke demonstrates complete cluelessness when asked about the housing bubble the Fed created:

July 2005

BERNANKE: Well, I guess I don’t buy your premise. It’s a pretty unlikely possibility. We’ve never had a decline in house prices on a nationwide basis. So, what I think is more likely is that house prices will slow, maybe stabilize: might slow consumption spending a bit. I don’t think it’s going to drive the economy too far from its full employment path, though.

February 2007

BERNANKE: Our assessment is that there’s not much indication at this point that subprime mortgage issues have spread into the broader mortgage market, which still seems to be healthy. And the lending side of that still seems to be healthy

But here is Powell’s outlook, press conference remarks that may haunt him in the years to come:

April 2021

POWELL:

Asset valuations appear “frothy,” admitted Powell, but he did not see any risks that may hurt the financial system; and “Leveraging the financial system is not an issue.”

We shall see. In the meantime, a $4 trillion explosion in money created by the Fed out of thin air should be warning enough to fortify your gold and silver positions for the days ahead.

The Fed Open Market Committee’s statement winds up with this: “In assessing the appropriate stance of monetary policy, the Committee will continue to monitor the implications of incoming information for the economic outlook. The Committee would be prepared to adjust the stance of monetary policy as appropriate if risks emerge that could impede the attainment of the Committee’s goals.”

Yet inflation is not like a light switch that Fed officials can turn off with a flick of the wrist. After an unparalleled money-printing spree, consumer prices are only beginning to show the effects. Powell and Company have no idea what they have unleashed.

David Stockman reacted to the Fed and Powell this way: “These people are incorrigible. The Fed heads are driving the financial system to the very edge of monetary Terra Incognito, but they are still supremely sure that the inflation roaring up the supply chain is “transitory.”

Contact a Republic Monetary Exchange precious metals professional. Fortify your gold and silver positions.