Stocks Coming Unglued

Protect Profits with Gold!

Are you paying attention to stock market values decaying right in front of our eyes?

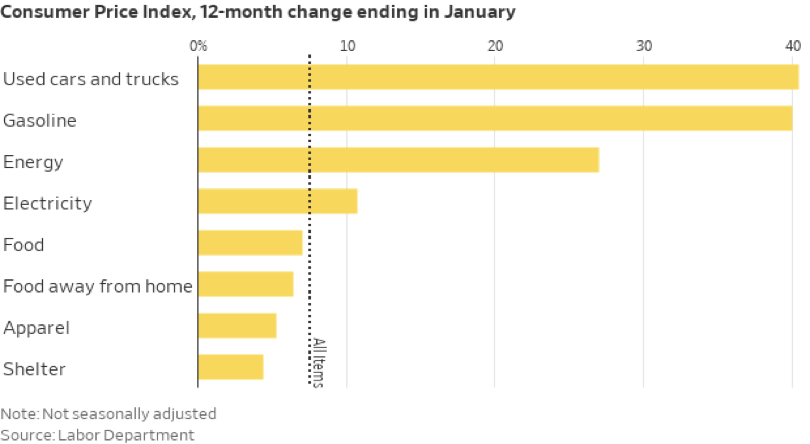

For those of you who have had a good ride in the stock market during the period that it was levitated by the Federal Reserve’s pumphouse of liquidity, we want to recommend that you prepare for the stagflation developing now and lock in your profits by moving them to gold.

Here is a sample of informed commentary about the way the stock market’s overextension is playing out.

The title of today’s piece comes from Wolf Richter at WolfStreet.com: “What we’re looking at is how the greatest stock market bubble ever is coming unglued stock by stock, rather than all at once.”

“All these stocks that spiked by 200% or 500% or 1,000% were hyped out the wazoo, often in the social media, and their prices spiked in the shortest time, often multiplying in days. This craze started in March 2020, and peaked in February 2021, and then came unglued.”

Stocks are clearly moving into bear market territory. Bank of America’s Michael Harnett points out that three out of four Nasdaq stocks and more than half of S&P 500 stocks are already at least 20 percent lower than their 52-week highs.

“Instead of buying the dips, investors should be selling the rips in the stock market as the Federal Reserve begins to raise interest rates into a bear market. We believe [the] bull era of central bank excess, Wall Street inflation, [and] globalization [is] ending, and [a] bear era of government intervention, social and political polarization, Main Street inflation, and geopolitical isolationism [is] starting,”

He adds that the bearish fundamentals are exacerbated by the war in Ukraine and the prospect of commodity price inflation. Another red flag is the likelihood of a Fed policy error. We hardly need to chime in ourselves that Fed policy mistakes are a way of life these days.

And a fundamental reminder from Bill Bonner, Bonner Private Research:

“The problem with just staying ‘in the market,’ may leave you with a losing position for decades. In the US, after the crash of ’29, it took 26 years for stocks to recover, in inflation-adjusted terms. And in Japan, stocks crashed in 1989; they still have not recovered.”

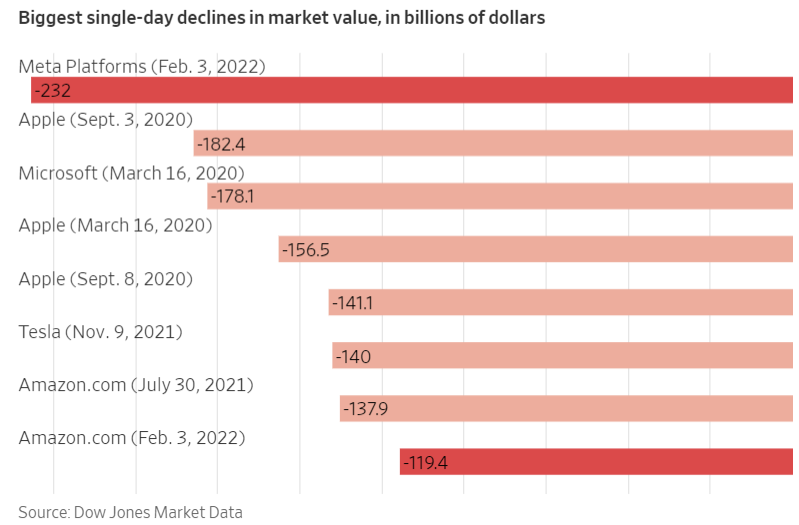

In that context, we thought we should re-publish this Wall Street Journal chart from a month ago when Meta (Facebook) lost more than $230 billion in market value.

In one day.

The chart details similar share price collapses over the last two years.

Take steps now to lock in stock market profits and breathe easier during the stagflation years ahead. Speak with a Republic Monetary Exchange specialist about wealth preservation with gold, the world’s enduring money of choice.