Stock Market Warning

Fed Policy Reversal May Pull the Plug

The Federal Reserve is starting to act like the pinball in an old-fashioned arcade game. It is bouncing off everything, reversing policies, and changing directions at a frenzied rate.

Ding! Ding! Ding!!!

Surprised and discredited by its own cluelessness about surging inflation, the Fed is now going to react with fresh interventions in the interest rate markets, interventions that promise vulnerability for stock markets.

The recent release of the minutes of its December policy meeting, the Wall Street Journal wrote, showed “officials believed that rising inflation and a very tight labor market could call for lifting short-term rates ‘sooner or at a faster pace than participants had earlier anticipated.’

Stock prices have been elevated to unsustainable levels by decades of Fed interest rates manipulation. So with the coming policy changes, we think it is time to issue a warning about stocks now trading at nosebleed altitudes.

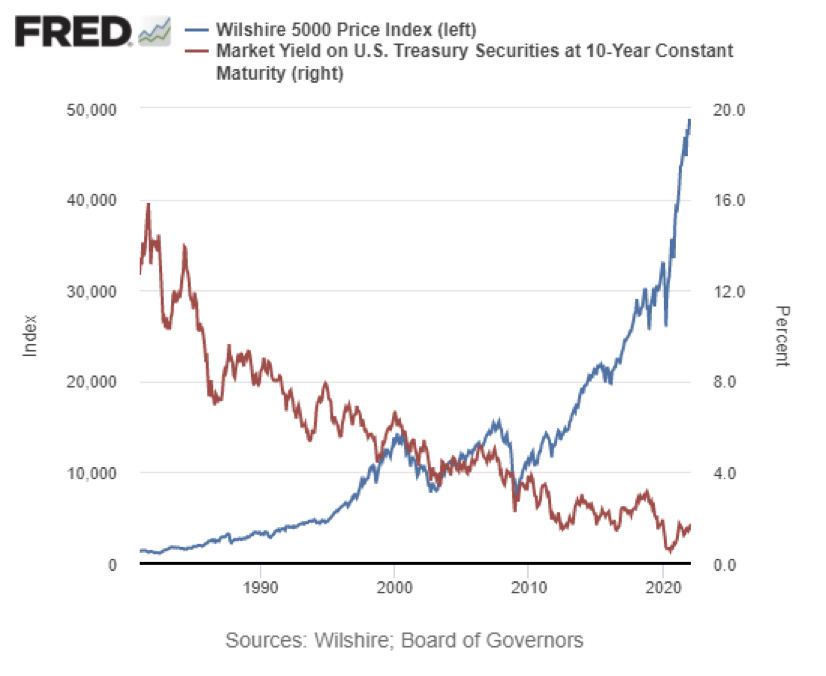

The following chart shows the yield (in red) on US 10-year Treasury notes since the double-digit interest rate levels in the early 1980s. The rise of the Wilshire 5000 stock index is shown in blue. It is not a mere coincidence that lower rates have enabled higher stock prices throughout the era.

But now the worm is about to turn. The Fed’s contrived interest rates are generating consumer price inflation – and bubbles just about everywhere, so the Fed has signaled a tighter monetary policy and higher rates beginning this year.

We believe it would be wise to take stock profits now and move to gold and silver as shelter from the financial storm to come from the policy changes.

We are not alone in spying storm clouds on the stock market horizon. Here is Bill Bonner, from the Bonner Private Wealth Substack newsletter:

Taken as a whole, if the stock market were to go back to normal range, about $20 -$30 trillion would go away. That’s based on the historic mean of Warren Buffett’s famous market-cap to-GDP indicator, which is 86%. In other words, with GDP around $23.2 trillion today, stocks would be worth around $29 trillion. The total market cap of the Wilshire 5,000—the broadest measure of US stocks—hit $48.7 trillion earlier this week.

You do the math. Or we’ll do it for you. Stocks would lose around $28.8 trillion if they declined from 211% of GDP to 86% of GDP. Give or take a couple of trillion, given how markets tend to overcorrect.

How much liquidity would you have then?

Not much.

Bill Bonner

Watch for gold to be the beneficiary of a scramble for real liquidity when the stock market begins to crack. That’s because it will take a lot of unsound financial institutions down with it. And speaking of Warren Buffett, we never tire of repeating his observation that you don’t know who has been swimming naked until the tide goes out!

Speak with a Republic Monetary Exchange gold and silver specialist today.