Serious Inflation

It was only a year ago that the Federal Reserve was insisting that inflation was a transitory malady. Yet it is still with us. Big time!

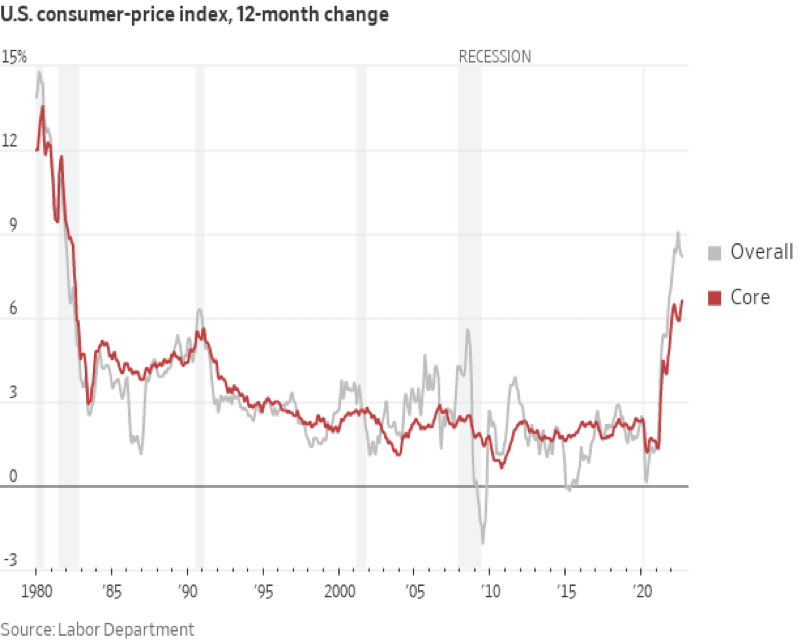

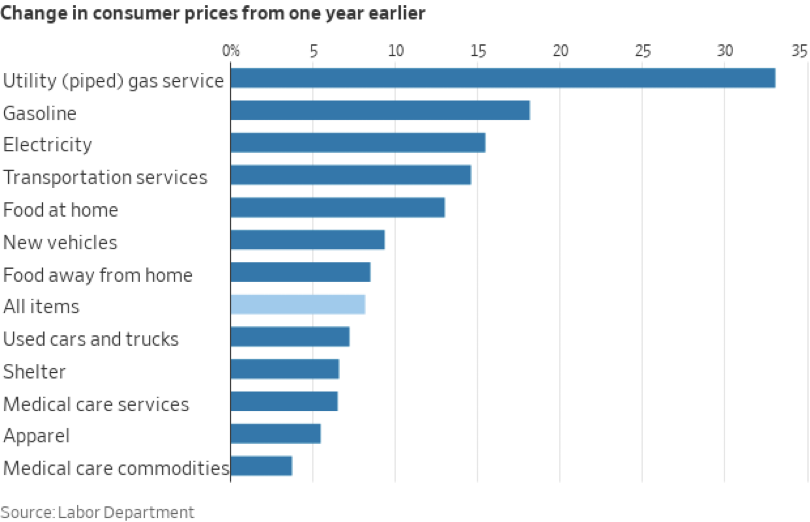

The government likes to refer to so-called “core inflation” which excludes food and energy prices. (Like who would need either food or energy?) The core inflation rate for the 12 months through September is up 6.6 percent. That is the biggest increase in more than 40 years.

So, the Fed hasn’t made a dent in inflation. As David Stockman observes, “the Fed has raised interest rate by 300 basis points in the last six months, yet the upstream inflationary pressures embodied in the producer price index have not even budged.”

As for the overall consumer price index, it was up 8.2 percent for the 12 months through September. That is seven months in a row that prices have risen at a rate of 8 percent or more. Wage earners find their hourly earnings up 4.92 percent which means that with prices rising faster – 8.2 percent – they simply aren’t able to keep up.

When the hot inflation reading came in, San Francisco Fed President Mary Daly said, “ “It does show the data not cooperating.”

Right! That darn data!

Have you spoken with a Republic Monetary Exchange gold and silver specialist to find out how precious metals can protect you from reckless governments, their unhinged spending, and their monetary folly?

Call today and make a no-obligation appointment!