Revisiting the Dollar

It’s an ever-changing yardstick! Unlike gold!

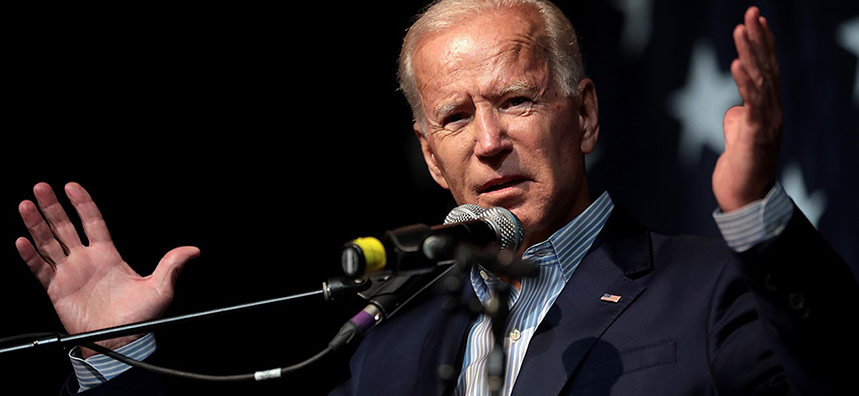

President Biden said something characteristically confused the other day when news came that the US economy is shrinking, down 1.4 percent in the January-February-March quarter.

A contracting economy is not good news. It’s even worse when you realize that consensus economists were expecting quarterly growth of 1.1. percent. So, the total swing from positive expectations to the negative reality was 2.5 percent.

Two consecutive quarters of contraction is the official definition these days of a recession.

Biden blurted out that he wasn’t that concerned about a recession. It’s hard to imagine that millions of American families would be so cavaliere about their future prospects.

But Biden quickly pivoted to the politically correct formulation. Actually, he said, “you’re always concerned about a recession… but the GDP, you know, fell to 1.4 percent.”

Actually, no. Biden clearly had no idea what was going on. The GDP did not fall “to” 1.4 percent, as though it had been slightly higher, but its growth had slowed to a mere 1.4 percent growth.

The US economy actually contracted – shrank – shriveled – by 1.4 percent.

Big difference.

Not to be outdone, at his long-anticipated May 4 press conference, the one in which he would describe how the Fed was going to tame inflation, Federal Reserve Chairman Jerome Powell was asked if the Fed had a credibility problem with the American people.

No, he answered. Never mind the Fed’s still shrouded in secrecy insider trading scandal. Forget a total misdiagnosis of inflation as transitory. No, he answered, the Fed has no credibility problem.

And with that, Powell was defending himself, the central bank, and the US dollar itself.

Job not well done. For the financial press and bubble vision TV may have been full of stories about how “strong” the dollar is. But the truth was quite different. Strong? When it continues to buy less and less?

John Tamny (@johntamny)at Real Clear Markets put it this way:

The dollar is “strong”? How? Why would money be anything but a constant measure of value?…

Indeed, while currencies no longer have a gold definition, gold still speaks through the markets. At present the “mighty” dollar is worth 1/1900th of a gold ounce. When the 21st century began a dollar purchased roughly 1/300th of a gold ounce.

The shame, as always, is that this is even being discussed. No one talks about a “strong” inch, foot, or minute. All three are quiet. As constant measures of length and time, they just facilitate the understanding of reality. Money is no different, or should be no different.

John Tamny

The New York Sun summed up this all-to-common confusion about dollar strength this way: “The dollar might well be king of today’s debased global currencies, but it wears a tin pot for a crown.”

We think this is a good time to keep a close watch on the monetary and fiscal authorities and what they say that is not actually so.

It is also a good time to speak with a Republic Monetary Exchange gold and silver professional about wealth preservation in an age of wealth destruction.