Notes and Nuggets About Gold, the Fed, and the Economy

Raising the gold price target, more debt, and a confused Fed!

Goldman Sachs:

“In our view, this combination of slower growth and higher inflation should generate investment demand for gold, which we consider to be a defensive inflation hedge. In addition, we expect continued growth in [emerging market] dollar-wealth and a rebound in consumer and central bank demand for gold. As such, we are raising our 12-month gold target to $2150 an ounce from $2000 an ounce.”

From CNS News:

When President Joe Biden was sworn in on Jan. 20, 2021, the federal government’s debt stood at $27,751,896,236,414.77.

When his first year in office ended on Jan. 20, 2022, it stood at $29,867,021,509,573.92.

That means that during Biden’s first 12 months in office, the federal debt grew by more than $2 trillion — or $2,115,125,273,159.15 to be exact.

US Mint 2021 Annual Report:

Demand for gold bullion ounces remained strong in FY 2021 compared to FY 2020. Sales increased by 580.0 thousand ounces (67.4 percent) to 1,440.0 thousand ounces, with a 70.5 percent increase in American Eagle gold bullion coin ounces sold and a 57.1 percent increase in American Buffalo gold bullion coin ounces sold…

Silver bullion ounces sold increased 12,202.0 thousand ounces (51.3 percent) to 35,999.0 thousand ounces in FY 2021, with a 62.4 percent increase in American Eagle silver bullion coin ounces sold….

Steven Roach, Australian Financial Review:

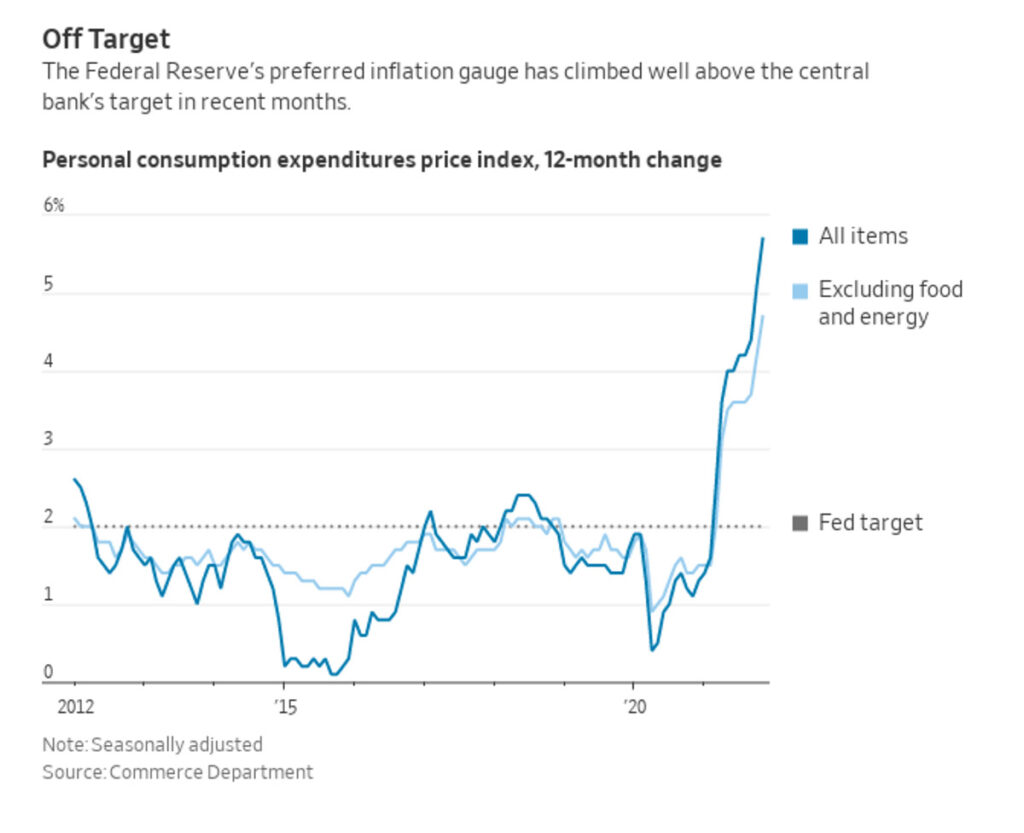

The current upsurge in inflation is not transitory or to be dismissed as an outgrowth of idiosyncratic COVID-19-related developments. It is widespread, persistent, and reinforced by wage pressures stemming from an unprecedentedly sharp tightening of the US labor market.

By now, it is passé to warn that the Fed is “behind the curve.”

In fact, the Fed is so far behind that it can’t even see the curve…

In the meantime, financial markets are in for a very rude awakening.

The Wall Street Journal:

Reuters:

China’s 2021 gold consumption rose by over a third from the previous year, as its economy rebounded from the coronavirus impact, the China Gold Association said on Thursday. [Led by gold jewelry, 2021 gold consumption rose to 1,120.9 tons versus 820.9 tons in 2020.]

Michael Shedlock:

Jerome Powell and the Fed are delusional. To state that asset bubbles are only “somewhat elevated” shows the degree of delusion.

This is undoubtedly the biggest financial bubble in history. Consumers appear to be in good shape only because of the asset bubbles