Money Printers Gone Wild!

The Federal Reserve has quietly launched a massive new round of money printing.

We hope you will take time with this very important piece. It should be shared widely. It describes a new phase of Fed monetary management, a turning point that people will look back on as a crucial moment in the US economy, and one that will drive gold to new heights.

The Fed has quietly launched a new round of Quantitative Easing (QE), the most outrageous monetary experiment in American history. QE began in 2008 with the Fed’s frenzied purchase of US treasury bonds and toxic mortgage and other troubled bonds. (It was mostly another example of crony capitalism; the Fed bought worthless mortgage paper from the banks, taking it off their books, and putting it on the books of the American people.)

The spree lasted until 2014, by which time the Fed had acquired about $4 trillion in assets.

Where did the Fed get $4 trillion to buy all those bonds? It just made it all up. We call it money printing, but that is an old-fashioned term. It’s mostly just made-up digital money. Bookkeeping entries.

There were three rounds of QE, known as QEI, QEII, and QEIII. The madness more or less came to an end in 2014. But all that made-up money is still out there. It represents a sort of Sword of Damocles hanging over the US economy.

Recognizing the danger that all that made-up money would find its way from the Fed’s balance sheet into the hands of the commercial banks, setting off a nightmare rise in consumer prices, the Fed tried to mop up some of this crazed money with a program called Quantitative Tightening. That necessarily involved higher interest rates, but when the stock market had a tantrum, the Fed apologized and stopped at once.

So, most of that QE funny money is still out there, an unresolved problem that can drive consumer prices (and gold) to the moon when it leaks out into the banking system and the general economy.

That’s all history, and it is bad enough. But now the Fed has begun a new round of money printing. They don’t like to call it Quantitative Easing, but it is.

Fed Boosts Amount of Liquidity Offered to Financial System

Besides bailing out crony institutions, flooding the overnight markets with Fed money, these “liquidity operations” in all their variety are aimed at driving down interest rates and keeping the stock market artificially high. To that end, Fed Chairman Powell recently announced a new program to buy $60 billion of Treasury bills each month through the end of the second quarter of 2020.

Powell objected to calling it what it is, but we’re more direct. Welcome to QE IV!

A couple of paragraphs ago I said that made-up Fed money seriously threatens the consumer economy with higher prices when it leaks out of the Fed’s hands and into the general economy. That’s when the money supply starts growing. And gold starts to take off.

And that is just what is now happening.

The peerless Doug Noland, who blogs at Credit Market Bulletin, observed recently that US money supply is at last beginning to explode.

Noland writes, “Let’s focus on the extraordinary $575 billion M2 expansion over the past 22 weeks (that receives zero attention). This was the second strongest (22-week) monetary expansion in U.S. history, trailing only 2011’s “QE2” period (Fed expanded holdings by $600 billion) where M2 expanded as much as $616 billion over 22 weeks. M2 growth peaked at $530 billion (over 22 weeks) in February 2009 during the Federal Reserve’s inaugural QE operation.”

Factoring in other money fund liquidity growth, Noland discovers that we are experiencing “a blistering 11.9% annualized growth rate” in the money supply. This is monetary inflation such as we haven’t seen for a very long time.

And it is very bullish for gold.

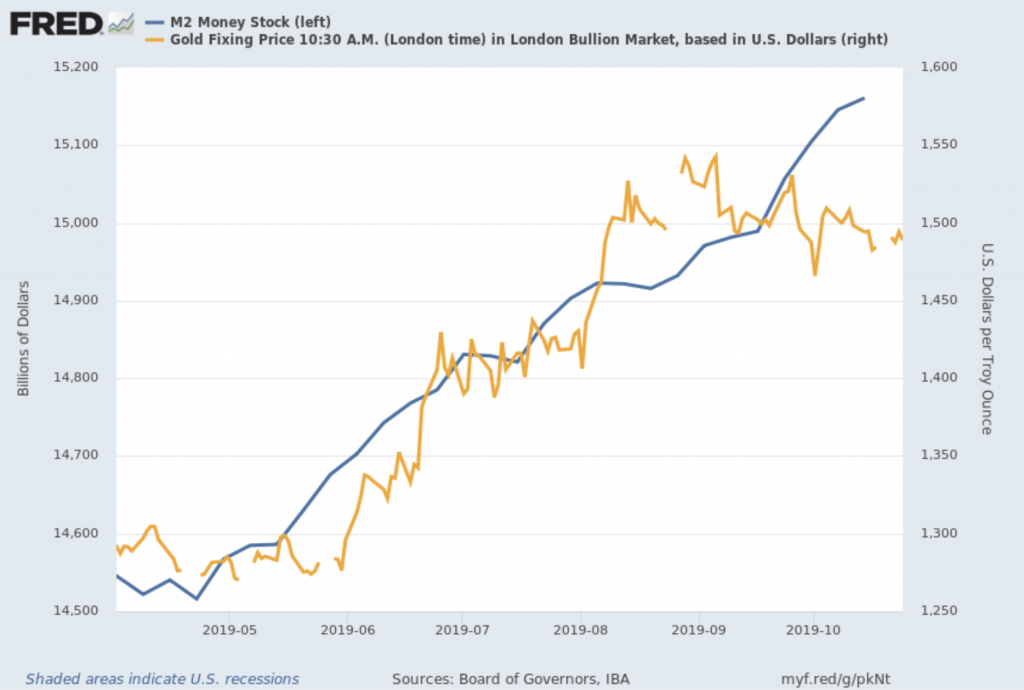

We admit that all this is a little wonkish for some of our readers, so we have prepared a chart using Fed data that illustrates what we are talking about.

It shows money supply growth (M2 – a measure of cash and cash-like liquidity such as checking deposits, savings accounts, and money market funds) taking off earlier this year. And just as you would expect, gold responded, surging powerfully throughout the summer. Please note that while gold has been consolidating its gains around $1,500 an ounce, the money supply (the blue line) continues to climb.

Here’s the way the Wall Street Journal headlined a story about the Fed’s new policies on Friday, 10/25:

This money supply growth and the new QE is a policy error that must result in serious consequences for the general economy, as well as much higher gold prices.

The Fed can create more dollars with a computer keystroke, but it can’t print more gold.

That’s why gold goes up.

It’s vital that you find out more. Call or stop by and visit with an RME Gold professional. Because this is a pivotal moment in monetary policy, feel free to share this post with family, friends, and colleagues.

They may appreciate learning that the Fed’s money printing has gone wild. They must not wait before protecting themselves and their families with the safety of gold, because the Fed is finally letting the much-feared inflation genie out of the bottle.