I Wish I’d Said That!

“WE’RE LIVING THROUGH THE GREATEST TRANSFER OF WEALTH FROM THE MIDDLE CLASS TO THE ELITES IN HISTORY!”

Today we push back from the keyboard. Maybe we’ll go fishing. Or see a movie.

That’s because what we would like to have said about America’s historic wealth transfer and power concentration out of the hands of the middle class and into those with political power and connections has been written by someone else.

In fact, that very phrase, “the historic wealth transfer” are her words and not mine:

“When historians look back on the decisions made beginning in March 2020 and still going strong, this period will be remembered as the ‘Great Consolidation’—the acceleration of a historic wealth transfer and power concentration out of the hands of the middle class and into those with political power and connections.”

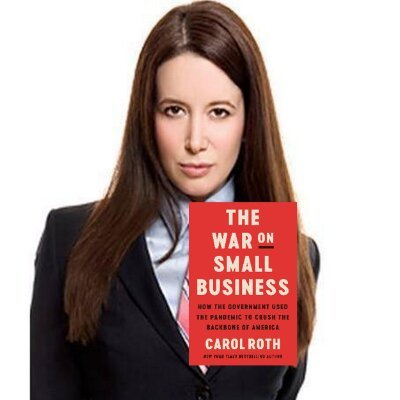

“Her” is Carol Roth, a former investment banker and author of the new book The War on Small Business. The piece we are citing appeared in Newsweek of all places. If you would like to know why you need to own gold and silver in an economy that is rigged against you, read it. Here’s a link.

We can’t just reproduce the whole article, but here are a few snippets to give you an idea of what is going on:

- Prior to COVID, more than 30 million small businesses accounted for about half the GDP and jobs in America; the other half of the economy was concentrated in 20,000 big companies. So you might have expected that small businesses would have had an equal amount of negotiating power when the pandemic hit as big companies. You would be wrong.

- As a result, big firms were deemed “essential” and allowed to stay open during the pandemic, while small businesses were subjected to punishing lockdown orders and forced to close, in part or completely. Many of the examples were doubly infuriating given the absurd hypocrisies they presented. For example, big box pet retailers like PetSmart that groomed pet hair and nails were deemed essential—while salons owned by small business owners that served humans were not. The LA-area Pineapple Hill Saloon and Grill was forced to close their outdoor dining—while a movie production not only operated but hosted a catering tent serving food to crew in the same parking lot that the restaurant had been forced to abandon.

- Meanwhile, the Federal Reserve was pumping trillions of dollars into the markets, helping to inflate stock valuations. Hundreds of thousands of small businesses were murdered in just a few short months—by government edict—while seven tech companies gained $3.4 trillion in market value….

- If you were able to access capital—which is code for already being big or wealthy, even if you weren’t in some cases financially sound—it was plentiful and, for debt capital, available at historically low interest rates. 2020 became a record year for IPOs and for other capital-raising vehicles like special purpose acquisition companies. And some of this capital was likely used to compete with your local small businesses.

We highly recommend this piece. Other than mentioning the Fed pumping money to its cronies, Roth doesn’t say much about monetary policy. But we cover all that in detail and we encourage you to share our blog posts with your friends and family members.

And if you have any questions or want to learn more about protecting yourself and your family with gold and silver, speak with one of our precious metals professionals today.