I Wish I’d Said That, Part II

“WE’RE LIVING THROUGH THE GREATEST TRANSFER OF WEALTH FROM THE MIDDLE CLASS TO THE ELITES IN HISTORY!”

Just a few observations about money and the economy we’re been bookmarking lately, thinking that our readers will find them interesting.

Let’s start with Ayn Rand, The Ayn Rand Letter:

“Inflation is not caused by the actions of private citizens, but by the government: by an artificial expansion of the money supply required to support deficit spending. No private embezzlers or bank robbers in history have ever plundered people’s savings on a scale comparable to the plunder perpetrated by the fiscal policies of statist governments.”

TRANSITORY? ARE YOU KIDDING?

From Stephen Roach, Interest.co.nz.

The transitory inflation debate in the United States is over. The upsurge in US inflation has turned into something far worse than the Federal Reserve expected. Perpetually optimistic financial markets are taking this largely in stride. The Fed is widely presumed to have both the wisdom and the firepower to keep underlying inflation in check. That remains to be seen.

For its part, the Fed counsels patience. It is so convinced that its bad forecast will eventually turn out to be correct that it is content to wait…. In doing so, the Fed indicated that it was prepared to forgive above-target inflation to compensate for years of below-target inflation. Little did it know what it was getting into.

INFLATION MALARKEY!

From Jacob Hornberger, Future of Freedom Foundation.

Just recently I was thinking that at the very least, libertarians have made progress in causing people to see that inflation is caused by the government — specifically the Federal Reserve — and not by the private sector.

And then President Biden comes forward and damages my optimism!

According to an article in the Washington Post, Biden is “considering whether to escalate an attack on parts of corporate America over rising prices…. The administration would amplify criticisms of large firms in heavily concentrated industries for passing higher prices on to consumers as they benefit from high profits”…

All we need now are Richard Nixon-era wage and price controls and Gerald Ford-era “Whip Inflation Now” buttons and the inflation problem will be resolved. And just think — we can have those long lines at the gas stations all over again, just like in the 1970s.

THE STOCK MARKET BUBBLE!

From John Hussman, Ph.D., Hussman Funds

Market capitalization isn’t “wealth.” It’s the latest price, times shares outstanding. Blotches of ink on paper. Flashing pixels on a screen. If a dentist in Poughkeepsie buys a single share of Apple at a price that’s 10 cents higher than the previous trade, $1.6 billion in market capitalization emerges from thin air. If a single share trades 10 cents lower, $1.6 billion evaporates just as quickly. Whatever happens, every security in existence has to be held by someone until it is retired….

Ultimately, the wealth inherent in a security is the future stream of cash flows… Investors have never paid higher prices for those future cash flows or accepted prospective returns so low.

Put simply, the bubble hasn’t changed the wealth, and a collapse won’t change the wealth. What will change is the market cap. I suspect that the erasure of market cap in the coming years, and possibly the coming quarters, may be brutal.

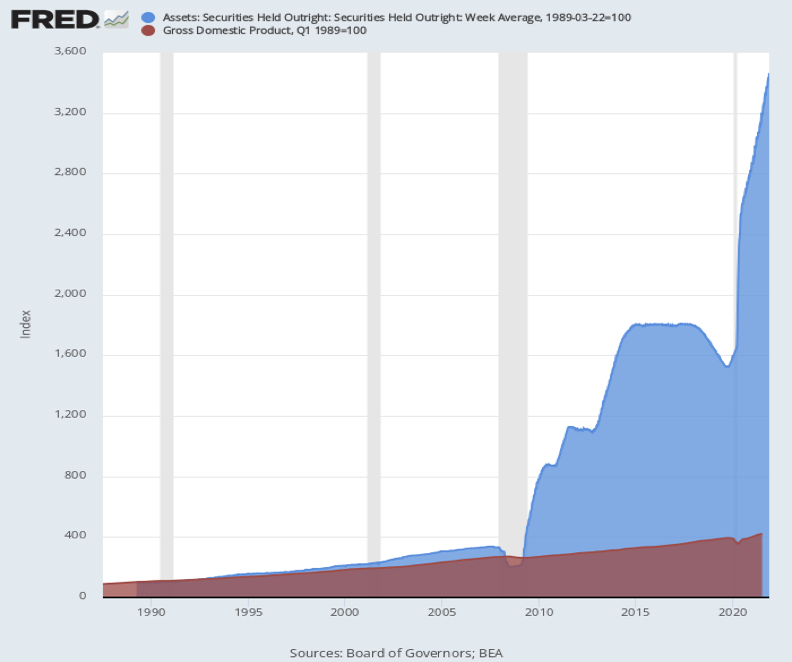

FED MONEY PRINTING FAR OUTPACES GROWTH OF THE ECONOMY!

From David Stockman, Contra Corner

The central banking Doomsday Machine will crank on until the level of financial asset inflation and manic speculative excess finally collapses on its own weight.

Fed Balance Sheet Versus Nominal GDP

And finally, this classic observation from Ludwig von Mises:

“The gold standard makes the determination of money’s purchasing power independent of the changing ambitions and doctrines of political parties and pressure groups. This is not a defect of the gold standard; it is its main excellence.”

If you would like to learn more about protecting yourself and your family with gold and silver, speak with a Republic Monetary Exchange precious metals professional today.