Huge Jump in Credit Card Debt

Another Financial Crisis Showing Up Soon!

Americans have burned through most of the “stymie” money they got from the government now. But as Milton Friedman once said, “There’s no such thing as a free lunch.” So thanks to those very government giveaways – and more like them – prices of everything have been rising relentlessly.

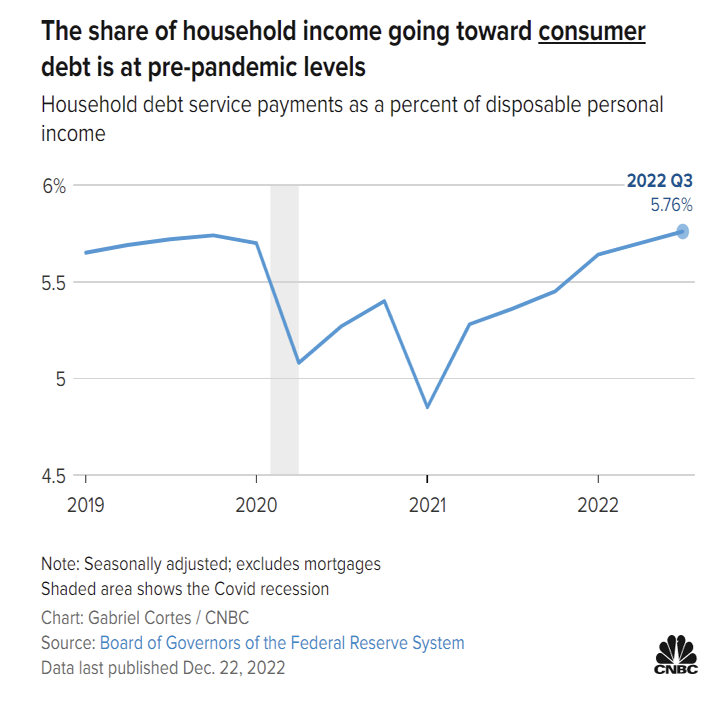

Now Americans are increasingly turning to their credit cards to pay for things like food!

Consumer credit card debt has spiked 18.5 percent over this time last year.

Oh, and the average credit card interest rate is now almost 20 percent and is poised to move even higher.

As gold expert John Rubino says, “the epicenter of the coming quake is plastic.”

The average consumer balance is $5,805. Bankrate calculates that at today’s average interest rate of nearly 20 percent, those making minimum payments would spend 17 years paying off their credit card debt.

Meanwhile, more new credit card holders are subprime customers, and delinquencies are rising. At the same time, Lending Club reports that 64 percent of Americans are living paycheck to paycheck.

With the stars continuing to line up for a recession, Rubino says, “If you own bank, auto, housing, or credit card company shares they’re vulnerable to a consumer-driven bear market.”

We suggest a timely move to gold and silver. Speak with a Republic Monetary Exchange precious metals expert today.