Gold vs. US Debt

We have written a lot about the US national debt lately, in part because of the debate about, and the suspension of, the debt ceiling.

Our rising debt is part of a well-worn cycle of currency destruction, one that has been enacted so many times that one would think that people would learn from it. But they never really do.

It generally works something like this: the government spends money it doesn’t have. It borrows more than it can afford, more than it can pay back, and finally turns to inflation – legal counterfeiting – to pretend to meet its obligations.

Because they can’t print gold, gold goes up while the value of the currency goes down.

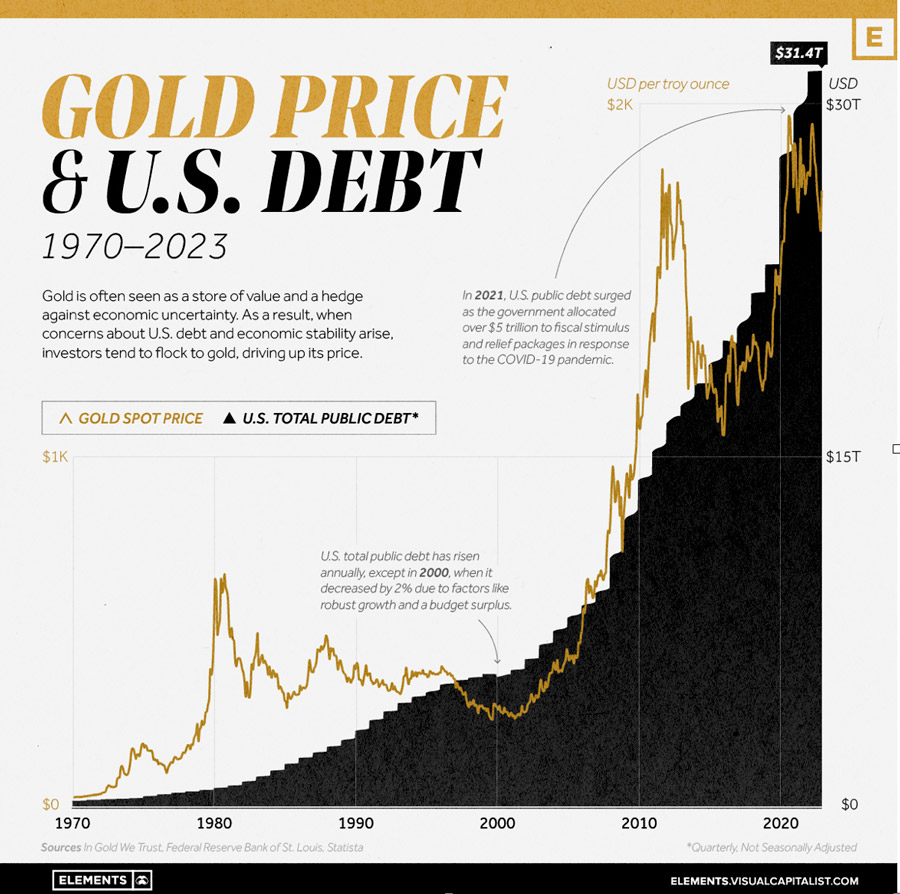

This chart, courtesy of Visual Capitalist, is a graphic portrayal of the growth of US debt and the gold price from 1970 to 2033.

We think you can see where this is headed!