A Simple Story: Gold and the Money Supply

Gold’s price trajectory is more reflective of the growing money supply than it is of the Consumer Price Index.

Although the CPI is widely reported by the popular news media, it is a lagging indicator. It purports to reflect price increases after they have occurred.

The money supply is generally considered a leading indicator.

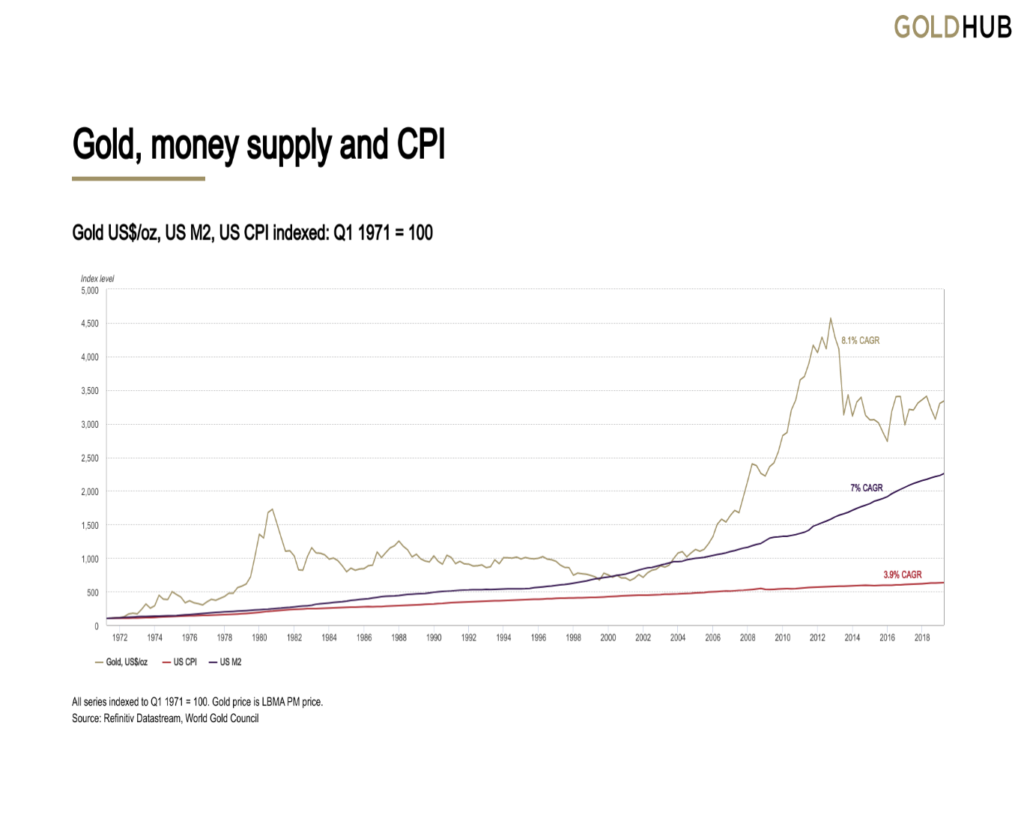

The World Gold Council recently provided the following chart to illustrate the relationship between money supply and gold.

The chart reaches back to 1971 when the US severed the last remaining link of the dollar to gold. Over that 50-plus year span, the CPI shows a compound annual growth rate of 3.9 percent. The money supply’s compound annual growth rate for the period (M2) is 7 percent.

Gold shows a compound annual growth rate over the half-century of 8.1 percent.

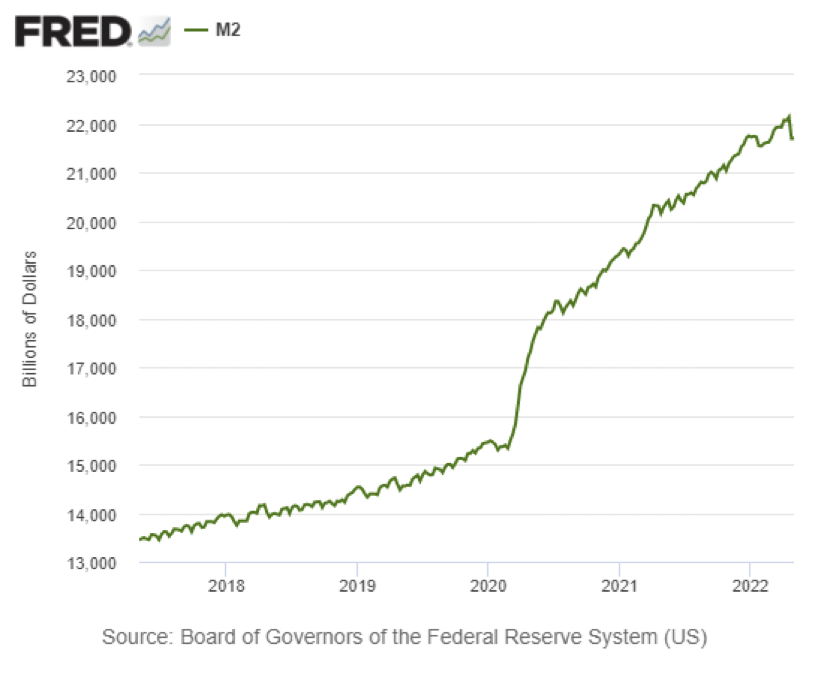

Accordingly, we present a five-year chart of the growth of the M2 money supply, a broad measure of liquidity consisting of currency and coins, checkable deposits, travelers’ checks, and savings and money market deposits.

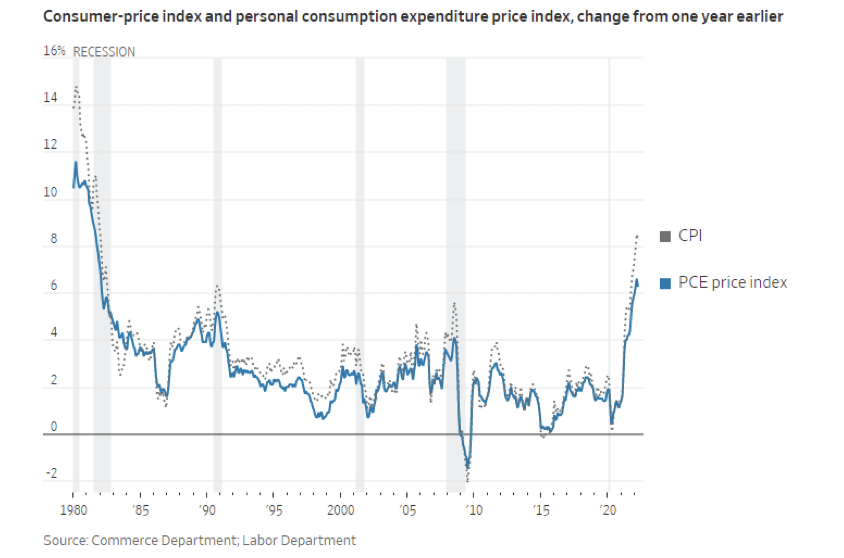

Meanwhile, the Commerce Department’s personal consumption expenditures price index, the inflation index the Fed prefers to follow, dipped in April, rising 6.3 percent, off slightly from its 6.6 pace from the annual rate ending in March.

As you would expect, the PCE and the CPI track one another fairly closely as this chart illustrates.

The Fed prefers to use the PCE barometer of prices, in part because it allows for consumers to switch spending patterns to buy lower price alternatives to those food items that have risen the most. As a consequence, it is accused of soft-pedaling the real impact of price hikes.

By any measure, government price statistics can ebb and flow from month to month. It is more important to be aware that the dollar’s purchasing power is continually eroding over time than it is to assume that a monetary crisis means that each month’s inflation figure needs to be higher than the month before.