Gold and Silver Roundup

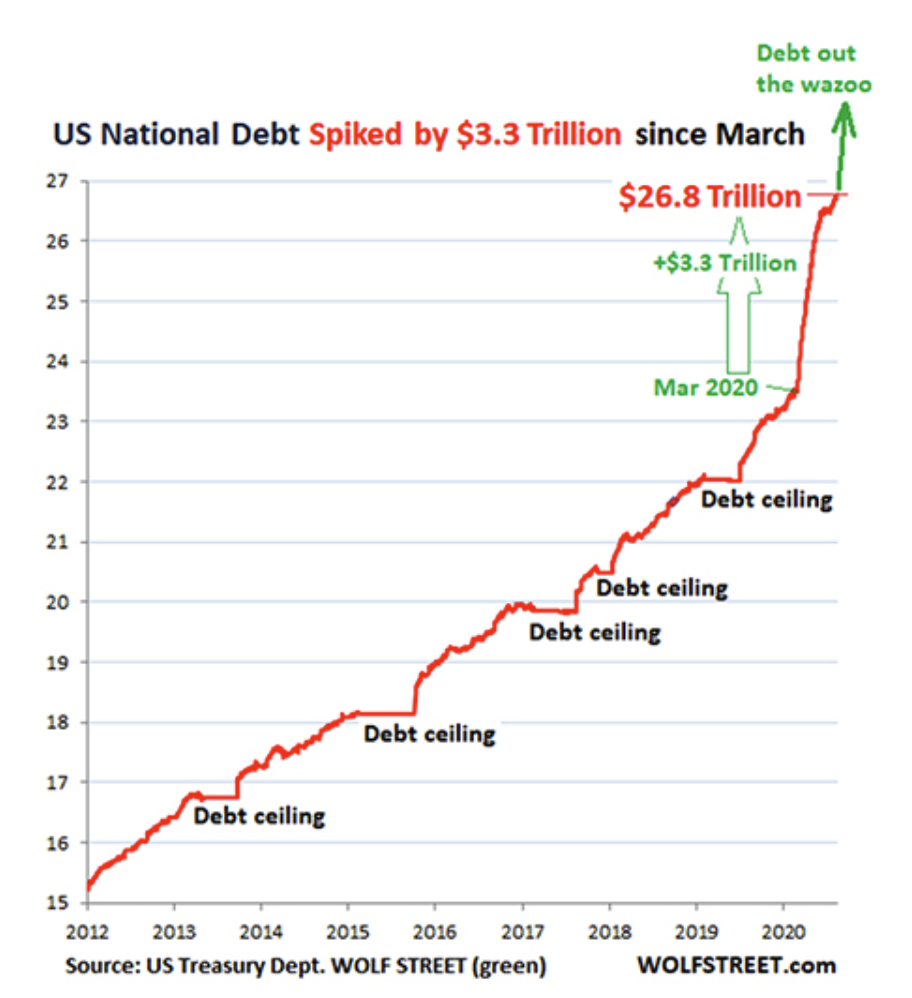

As we near the end of the year we’ve been watching price forecasts for gold in 2021. It is hard for anyone to overlook the fundamentals that we have been talking about: unpayable and still climbing national debt and unprecedented Federal Reserve money printing.

It is clear that these conditions are accelerating, so we expect accelerating bull market prices in 2021.

Citi analysts now have a call for $2,500 gold next year, with another possible target of $2,700. We recommend as well referring to our piece How High Silver?in which we wrote about Citi’s call for a silver to reach $40 next year, a 60 percent increase, “for starters,” they say.

The bank goes on to calls a forecast of $50 a “very realistic target,” and $100 an ounce “possible.” Bank of America also has a $50 “medium term” forecast for silver.

BofA is equally bullish on gold. Last April it published a forecast for gold to reach $3,000 over 18 months.

Inflation worries will fuel demand for gold in 2021, according to a recent note from Goldman Sachs. Goldman sees gold breaking out of its present consolidation range and climbing to new highs of $2,300.

A view of gold’s price future that spoke volumes about the future value of the dollar was offered by a Bloomberg commodities analyst that we reported in a piece we called Debt Out the Wazoo! That forecast gold to reach $7,000 by 2025.

The world’s major central banks intend to let inflation “run hot.” And you know that in January, if not before, Congress will pass another deficit-funded stimulus package.

As Bob Dylan sang in Subterranean Homesick Blues, “You don’t need a weatherman to know which way the wind blows.”

And you don’t need to be a bank analyst to see higher precious metals prices in our future.