Global Demand for Gold Coins and Bars Continues to Grow

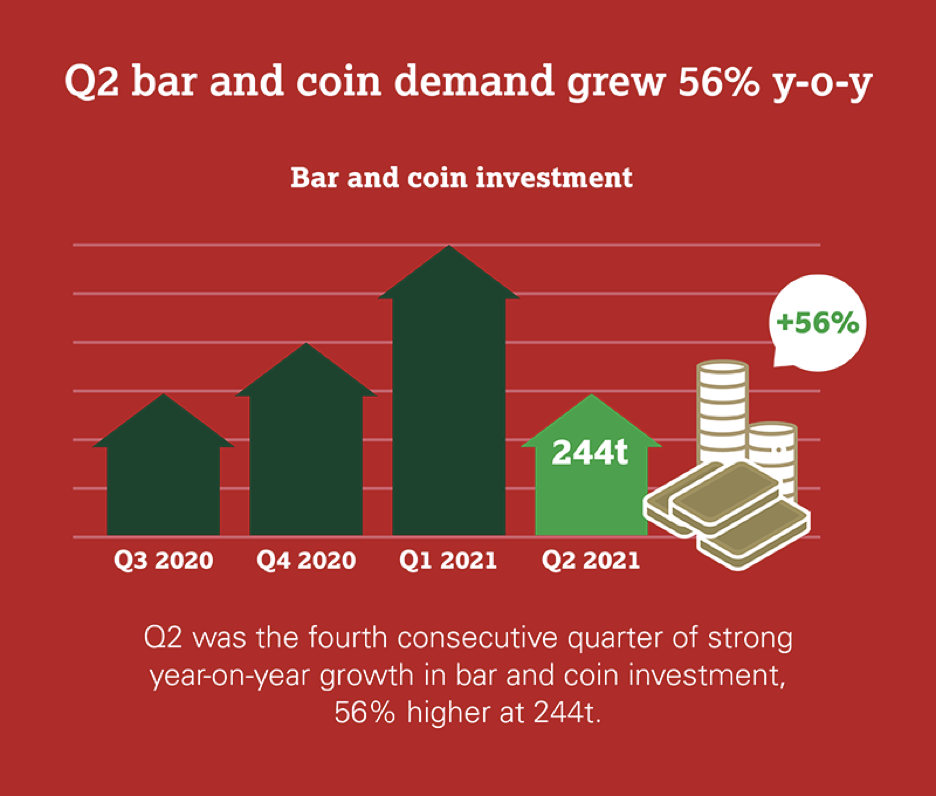

The World Gold Council reports that gold bar and coin demand for the 2021 April-May-June quarter grew by 56 percent over the same quarter a year earlier.

For the quarter demand measured 243.8 tons.

Altogether bar and coin demand in the first half of this year was the strongest since 2013, at 594 tons. In terms of total dollar value, it is the highest gold demand total since 2013.

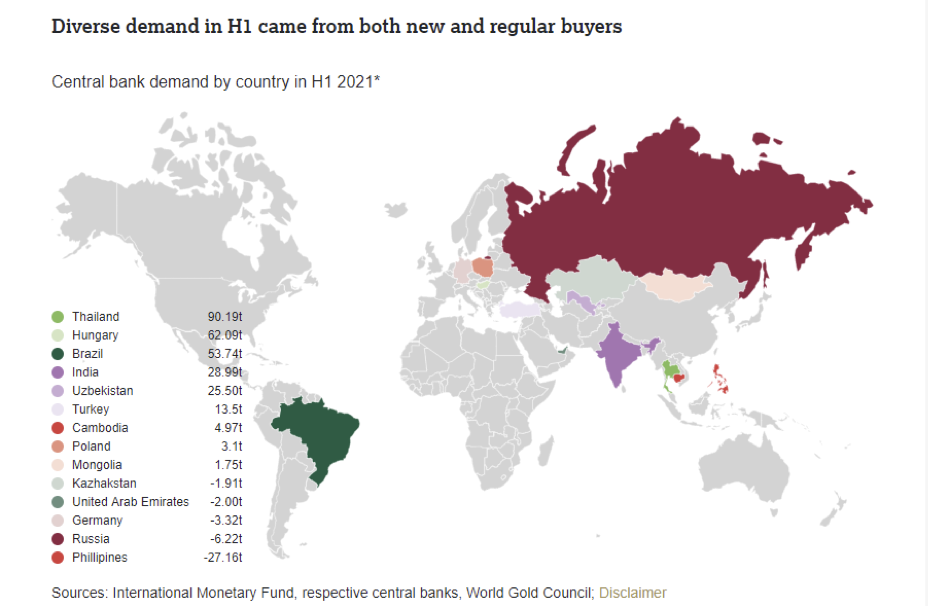

The second quarter saw gold demand from central banks reach 200 tons. WGC cites large-scale purchases by Hungary, Thailand, and Brazil. For the first half of 2021, central bank gold buying was 39 percent higher than the five-year average for the years’ first half and 29 percent higher than the ten-year first-half average.

Gold demand for both jewelry and technological applications continues to recover from slower COVID lockdown levels. For the second quarter, WGC reports:

Jewelry demand (390.7t) continued to rebound from 2020’s COVID-hit weakness, although remained well below typical pre-pandemic levels, partly due to weaker Indian demand growth. Demand for H1, at 873.7 tons, was 17 percent below the 2015-2019 average…

Gold used in technology continued to recover from the 2020 lows: Q2 demand was 18 percent higher y-o-y at 80 tons – in line with average Q2 demand from 2015-2019 of 81.8 tons. H1 demand (161t) was fractionally above that of H1 2019 (160.6 tons).

Gold outflows ETFs from the prior two quarters reversed to show modest inflows in the second quarter. The price of gold ended the second quarter of this year higher than its January 2020 price in the dollar, euro, yen, yuan, and rupee.